|

Dear Fellow Investor,

Whether you’re a true believer or a skeptic, you can’t get out of the way of climate change.

Governments and industries are figuratively moving mountains — and literally moving markets — to address the issue of global warming.

And regardless of where they may stand on the subject, the smart money is focused on profiting from one of the biggest trends of the modern age.

Because companies and investors well positioned in the sustainability space are already doing well...very well...by doing good.

Providing undeniable proof of that fact is SusGlobal Energy (SNRG.OTCQB), a global renewable energy and regenerative products company focused on monetizing its proprietary, game-changing technologies in the space.

Simply put, SusGlobal is a company that has jumped all over the sustainability sector and developed a five-year plan that will see its revenues and earnings soar.

Consider the reasons why....

So Many Ways To Win

SusGlobal’s primary projects use anaerobic digestors to divert organic waste from landfills.

The process itself is sustainable (and profitable) because the process of treating the waste also generates valuable biogas and heat that can be used to produce electricity and regenerative products contributing to the Circular Economy.

Better still, the end products of the process are an eco-friendly compost and a liquid fertilizer that the agriculture sector is increasingly looking to as a replacement for chemical-based fertilizers.

The market for the dry form and the liquid form of SusGlobal’s end product are both high-growth, with the dry-form market expected to grow by 8.5% a year to $2.7 billion by 2023 and the liquid-form market expected to grow 9.8% annually to $1.9 billion by 2023.

Between the biogas and electricity production from its projects and its “SusGro” liquid fertilizer and “Earth’s Journey Compost,” SusGlobal has access to a number of revenue streams with its projects.

Add in the tipping fees the company receives from governments for processing organic waste... and potential revenue from cap and trade programs on greenhouse gas emissions...and you have a business model tailor-made for the “Green Revolution.”

Key Projects In Canada And The U.S.

SusGlobal has four core projects so far, three in Canada and one in Florida.

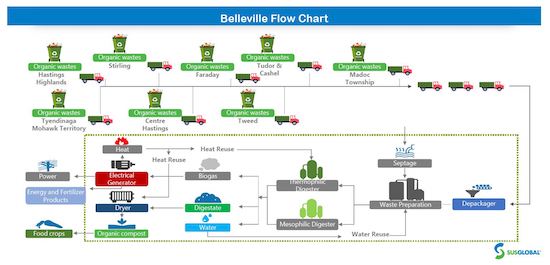

The company’s Belleville project in Belleville, Ontario uses anaerobic bio-digesters in its organics processing plant. The site has approval for up to 120,000 tonnes/year of organics processing and produces the company’s Earth’s Journey Compost product.

SusGlobal will also have an organic waste processing concession in Hamilton, Ontario and the use of three idle digesters at the Hamilton Wastewater Treatment Plant. Like the Belleville operation, Hamilton will produce electricity and waste heat from processing this material. The end product of the digestate is the SusGro liquid fertilizer.

The Kincardine-Walkerton project is located in Kincardine, Ontario and will process organic waste separated from green bin organics from nearby municipalities. Its end products will be excess electricity from the process and a solid fertilizer.

Finally, in the U.S., SusGlobal has an interesting opportunity to generate Earth’s Journey Compost from organic wastes in Fort Myers, Florida. It’s a perfect setting for SusGlobal, as recent hurricanes in the area have created a large supply of organic waste. Plus, thanks to its large agricultural sector, Florida has a ready-made market for SusGlobal’s end product.

Net Income Is Forecast To Quadruple

How lucrative is this opportunity? SusGlobal is forecasting sales in 2020 of C$25 million, predicated largely on the sale of its SusGro liquid fertilizer product. With post-tax net income of C$7 million, the company should have a solid base of earnings to work from.

Over the next five years, as the projects in its portfolio come online, SusGlobal expects revenues to grow over C$80 million by 2024 and for net income to quadruple to C$28 million.

Those are ambitious goals to be sure — but consider that SusGlobal already has the available capacity to make them a reality.

Better still, it boasts a tight share structure. That means success on the development front (and potential new project acquisitions) have the potential to make its share price really pop.

And when you consider all that’s working its favor, that pop seems both inevitable and imminent:

• Sustainability — perhaps the most powerful trend in today’s world — putting the wind at your back. Plus...

• ...An innovative, proprietary technology that...

• ...Earns revenue to address a major environmental problem in waste treatment...

• ...And produces valuable end-products for very significant, additional revenue streams...

• ...All adding up to projections of near-term, rapidly growing earnings.

What more could an investor ask for?

As the company gears up for rapid growth, the window is open to get in on SusGlobal Energy now, before the rest of the market catches up to this ripe opportunity.

Bottom line: Investors looking to cash in on the Green Revolution need to take a serious look at this innovative, rapidly growing company.

CLICK HERE

To Learn More about SusGlobal Energy

|