|

Dear Fellow Investor,

Well, this is interesting. In a “we’re on the precipice of a complete global economic reset” kind of way.

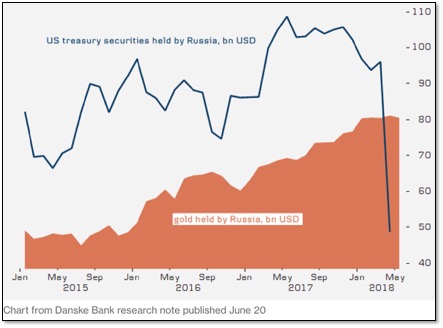

As you can see from the accompanying chart, Russia just dumped half of its U.S. Treasury holdings.

...And at the same time, Russia’s central bank continued its steady purchases of gold for its official reserves.

Sources: U.S. Treasury Dept., Bloomberg, Macroband Financial, Danske Bank

It’s well-known that Russia has been buying gold, heavily and consistently, for years. The Russian central bank began buying the metal heavily after the 2008 financial crisis and their purchases have only increased over time.

That’s been an important factor in the gold market. But now the news that Russia is dumping its Treasurys could have major repercussions for the U.S. and the balance of global economic power.

Reports show that Russia sold $47.4 billion of its Treasury holdings in April, leaving it with just $48.7 billion, in response to the U.S. escalation of sanctions against Russian companies and individuals. That’s down from $176 billion in Treasurys held in 2010.

At this level, Russia’s gold reserves of 62 million ounces, valued at $80.5 billion, dwarf its U.S. dollar reserves!

In fact, for all we know, they may have sold off the rest of their dollar holdings in May and June.

If they did, it would be completely in line with their stated goals. As you probably know, both Russia and China have voiced their desire to free themselves from the global U.S. dollar hegemony.

Golden Opportunities continues below...

Their strategy is many-fold. Part of it revolves in shifting payments for oil to their native currencies, bypassing the dollar. If successful, this could collapse the massive petrodollar economy that has helped the U.S. float its ever-growing debts.

Another key part of the strategy: Building gold reserves to protect themselves from the inevitable depreciation of the U.S. dollar.

After years of steady purchases, Russia currently holds about 1,928 tonnes of gold. China’s official total is around 1,843 tonnes, but most experts (myself included), feel that their true holdings are double that level or more.

The real question now is whether China, perhaps further prompted by President Trump’s escalation of a trade conflict that’s currently limited to mere rhetoric, will follow Russia’s lead and begin tossing its U.S. dollar holdings over the gunwale.

Given that China holds about $1.18 trillion in U.S. Treasurys, there are doubts as to whether it could sell any significant amount without doing greater damage to itself due to the resulting decrease in the value of its holdings.

Still, if the political goals are important enough, China’s massive Treasury holdings represent a nuclear option — especially at a time when the U.S. is faced with having to finance growing U.S. deficits while the Fed removes itself from an already-saturated marketplace.

Even some half-way option — selling perhaps 20%-40% of their Treasurys — could crater the U.S. Treasury market and send the value of the dollar plummeting.

It may be a longshot, but it’s just one of many, many developments — some of them inevitable — that will push gold prices far higher.

Seems to me that we should all take the lead of Russia and China, and buy gold.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|