| Catch this rare earths story at exactly the right time | | | Please find below a special message from our advertising sponsor, Defense Metals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

The Right Resource

At The Right Time | |

Timing is everything in investment, and the stars are aligning perfectly for Defense Metals (DEFN.V; DFMTF.OTC).

Geopolitical and economic trends are driving demand for rare earth elements, just as Defense Metals is steadily advancing its

world-class Wicheeda rare earths project toward production.

| | |

There’s a scramble going on for some of the world’s most critical metals.

|

Demand for rare earth elements — driven by two powerful macro trends — is creating an ideal investment window for those looking to capitalize on these trends.

Rare earths are critical to both the ongoing electric vehicle boom and many military applications that major economies (and particularly the U.S.) deem crucial for national defense.

|

It’s an environment tailor-made for Defense Metals (DEFN.V; DFMTF.OTC) and its Wicheeda rare earths project in British Columbia.

|

Located in an uber-safe mining jurisdiction, Wicheeda’s world class rare earth element (REE) resource is road-accessible and, as you’ll soon see, open to significant growth via the drill bit.

With China supplying fully 95% of the world’s REEs...U.S.-China tensions continuing to escalate...and the EV revolution taking hold the world over...Defense Metals unquestionably holds the right resource at the right time.

|

Macro Trend #1:

An EV Boom In Full Swing

|

That EV revolution is very real, with car companies expanding their lines of EVs at a rapid rate and U.S. EV brand leader Tesla seeing its cars popping up all over the nation’s roads.

The International Energy Agency projects that the EV market will grow from just over 10 million EVs on the road in 2020 to 145 million by 2030.

Why is that important for Defense Metals? Only this…

The permanent magnets that power these vehicles require rare earths for their production.

| | |

Even better, Wicheeda’s most valuable metals are neodymium and praseodymium — the two light rare earth elements that are key inputs for those permanent magnets.

The metals also have other commercial applications like medical imaging equipment, rechargeable batteries, wind energy and camera lens coatings.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Macro Trend # 2:

A Looming U.S.-China Cold War

|

Adding to the allure of this deposit is its location in British Columbia, which makes it a North American deposit that could capture the attention of the U.S., now that decreasing dependence on China has become a major foreign policy and economic goal.

The Senate just passed the Innovation and Competition Act on a bipartisan basis, demonstrating that politicians across the U.S. political spectrum see a looming Cold War with China.

And with key military applications like guidance systems, jamming devices and laser targeting absolutely dependent on REEs for their production, Wicheeda is likely going to be on the United States’ radar.

|  |

Given the tensions with China, the U.S. would almost certainly prefer to source its REEs from North America rather than the Middle Kingdom.

|

Road-Accessible BC Resource

Positions Defense Metals For Leverage

|

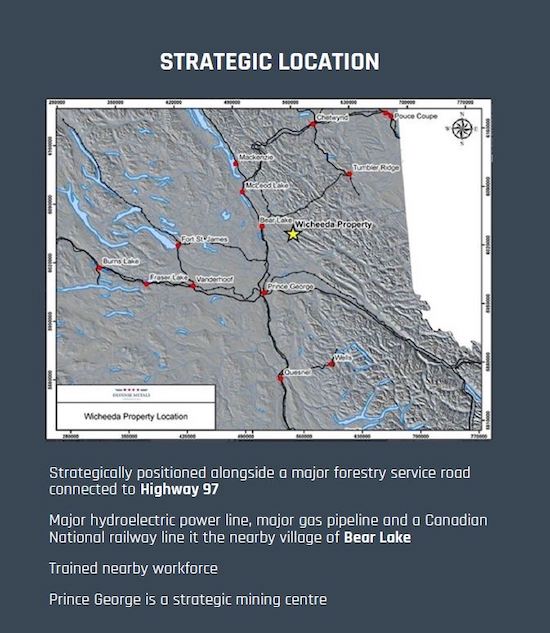

As you can see from the map below, Wicheeda is completely road-accessible and near key mining infrastructure.

|  |

That’s a big advantage in a segment of mining where REE resources tend to reside in far-flung locales.

Importantly, the company has a resource that’s capable of generating strong recoveries, so much so that Defense Metals has already received evaluation sample requests from multiple potential offtake partners.

|

Wicheeda is also open to expansion via the drill bit — in fact, a resource definition and expansion program is set to begin soon.

|

The last time Defense drilled the project, it was able to use just 2,000 meters of drilling to dramatically increase the size of the project’s REE resources.

Management is enthused about this program’s potential to grow Wicheeda even more in the days ahead.

|

Catalysts Just Around The Corner

|

Timing is always a key question with any investment — and given the favorable macro environment and the near-term catalysts Defense Metals has on the horizon, the timing to build a position in the company could hardly be better.

Consider that in the next 12 months, Defense Metals is working to:

|

• Grow and increase the resource confidence of Wicheeda via drilling

• Put out an updated resource estimate for the project based on this work

• Produce a PEA on the project, so that analysts and investors will be able to quantify the economics of the deposit

• Continue to provide samples and advance discussions within potential offtake partners

|

It’s an impressive number of potential catalysts. Together, they make Defense Metals one of the very few REE plays that’s actively advancing a resource toward production.

Given all this activity and its current trading levels, Defense Metals is providing you the chance to own one of the most intriguing names in the space…at bargain prices.

| | | | Scientific and Technical Information

The scientific and technical information contained in this document has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a director of Defense Metals and a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Technical Report

National Instrument 43-101 Technical Report on the Wicheeda Property, British Columbia, effective June 27, 2020 and prepared by APEX Geoscience Ltd. (Steven J. Nicholls, B.A. Sc., MAIG and Kristopher J. Raffle, B.Sc., P.Geo) is available under Defense Metals’ profile on SEDAR (www.sedar.com).

Forward-Looking Information

This document includes certain statements that constitute “forward-looking information or statements” within the meaning of applicable securities law, including without limitation, Defense Metals’ expectations for its deposit, plans for its project, as well as other statements relating to the technical, financial and business prospects of Defense Metals and other matters. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance

on forward-looking statements due to the inherent uncertainty of such statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Forward-looking statements are subject to a variety of risks and uncertainties, which could cause actual events,

level of activity, performance or results to differ materially from those reflected in the forward-looking statements, including, without limitation: (i) risks related to rare earth elements, and other commodity price fluctuations; (ii) risks and uncertainties relating to the interpretation of exploration results; (iii) risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; (iv) that resource exploration and development is a speculative business;

(v) that Defense Metals may lose or abandon its property interests or may fail to receive necessary licences and permits; (vi) that environmental laws and regulations may become more onerous; (vii) that Defense Metals may not be able to raise additional funds when necessary; (viii) the possibility that future exploration, development or mining results will not be consistent with Defense Metals expectations; (ix) exploration and development risks, including risks related to

accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration and development; (x) competition; (xi) the potential for delays in exploration or development activities or the completion of geologic reports or studies; (xii) the uncertainty of profitability based upon Defense Metals history of losses; (xiii) risks related to environmental regulation and liability; (xiv) risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to

as “social licence”), including local First Nations; (xv) risks relating to obtaining and maintaining all necessary government permits, approvals and authorizations relating to the continued exploration and development of Defense Metals projects; (xvi) risks related to the outcome of legal actions; (xvii) political and regulatory risks associated with mining and exploration; (xix) risks related to current global financial conditions; and (xx) other risks and uncertainties related to Defense Metals prospects, properties

and business strategy. These risks, as well as others, could cause actual results and events to vary significantly. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, the loss of key directors, employees, advisors or consultants, adverse weather conditions, increase in costs, equipment failures, government regulations and

policies, litigation, decrease in the price of REE, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, failure of counterparties to perform their contractual obligations and fees charged by service providers. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements.

Sources:

· www.sedar.com

· www.defensemetals.com

| |

© Golden Opportunities, 2012 - 2021

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |