| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

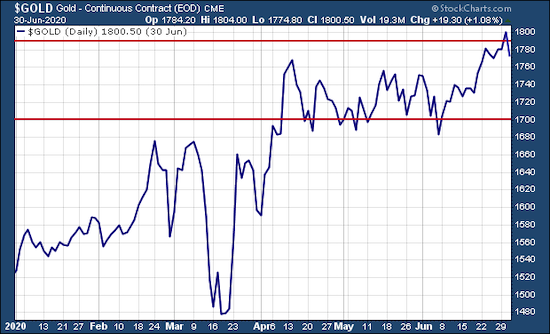

Gold continues to hesitate in taking its next big step higher. But once it does, look out.

|

|

A little over a week ago, I wrote that “It’s only a matter of time before gold breaks out to the upside. It could be just a few weeks, days, hours...or at this very moment.”

|

|

Let’s delete the part about hours or this very moment, and keep the weeks or days. Because gold’s been turned back once again from the key breakout levels.

|

To review, I had been writing about gold’s consolidation pattern since mid-April, and how it looked likely to break upwards and through that pattern at any time. That very day, the price was up $12 and challenging resistance.

It fell back from those gains, but keeps bouncing up against the ceiling. Heck, yesterday the near futures price made headlines when it poked above the “big number” of $1,800, before being driven back down in the aftermarket.

Today, good news on a potential Covid-19 vaccine sent spot gold down over $20 to the high $1,750s. It’s recovered a bit from those lows, to around $1,770, while the August futures price, which had closed just above $1,800 yesterday, is down to around $1,777.

Technically, gold broke through our key resistance levels yesterday, but was quickly driven back by the shorts and whatever other forces are fighting this rally.

So is our thesis incorrect?

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

My admittedly biased view is that this is yet another test of our will, the kind that gold’s famous for putting out there to shake out the weak hands.

I would’ve hoped, hell even expected, that a clearance of the key resistance around $1,790 would have lit a fire under the metal and taken it well above $1,800...and from there on to an assault on the nominal price record just above $1,900.

But then again, the record shows that it almost always takes a few tries for gold to get past the “big numbers” in a rally.

|

|

As you can see from this chart (which I’ve manually updated to reflect today’s action), it took gold about seven tries over the past few months to seemingly clear $1,700 for the final time.

Yesterday’s peak above $1,800 was just a tease...and today’s drop back below is a challenge.

So let’s not worry overmuch about today’s set back. Because gold will eventually make its next big move. And as the old saying goes, “The next step’s a doozy!”

|

Encouraging Action In The Juniors

|

We should also remember that gold has shown remarkable resiliency when faced with these “good news” sell-offs. The last time we had reports of a vaccine breakthrough, for example, the metal quickly traded down well over $20, only to recover most of those losses before the close.

We could see something similar today, as the price is already well off its lows for the session.

Regardless, the junior miners that we focus on in Gold Newsletter have been giving us everything we’d want and more.

Consider that the gold mining majors gained between 2%-3% yesterday, but have given all of those gains back today. The juniors, however, not only flew higher yesterday, many are continuing to rocket higher today.

|

As a couple of examples, the two stocks that I’ve been featuring in our “Top Two” report are up tremendously since we first published that report. One has more than tripled and the other has more than quadrupled.

And those pale in comparison to Great Bear Resources (GBR.V) which, after its recent run higher, is up a mind-boggling 58 times in value since we debuted that recommendation in a Gold Newsletter Alert.

|

|

The point is, the speculative money is now pouring into the junior mining sector, and these investors aren’t flinching at gold’s daily fluctuations.

They know full well that this is a bull market for the ages, thanks to the unprecedented creation of currency and debt ongoing at this historic moment in history.

So stay the course...and get involved while you can.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. Of course, the best way to get involved is to subscribe to Gold Newsletter or our Gold Newsletter Alert, where I continue to unveil the hottest new opportunities in the junior mining sector.

To get onboard with these publications, simply CLICK HERE.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |