| This indicator is signaling a gold breakout...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | From Bold To Boring

| | | After a rollicking spring rally, gold has settled into a trading range that seems typical for a summertime slowdown.

One indicator is now pointing toward a big surprise soon, however.

| |

July 1, 2024

Dear Fellow Investor, | | It’s a new day, a new week and a new month...and if we pause a moment to look back at what gold did over the last four weeks, we see that it went a long way to go nowhere.

| | Remember the big story at the beginning of June? Back then, we were talking about the newfound volatility that gold and silver was experiencing. After a nearly unbroken string of new highs over the first six weeks of the spring rally, the metals had settled into a more normal pattern of peaks and valleys.

| | The good news, I noted then, was that gold was setting higher highs and higher lows, and thus the bull market thesis was intact.

| | Unfortunately, that pattern soon changed as well.

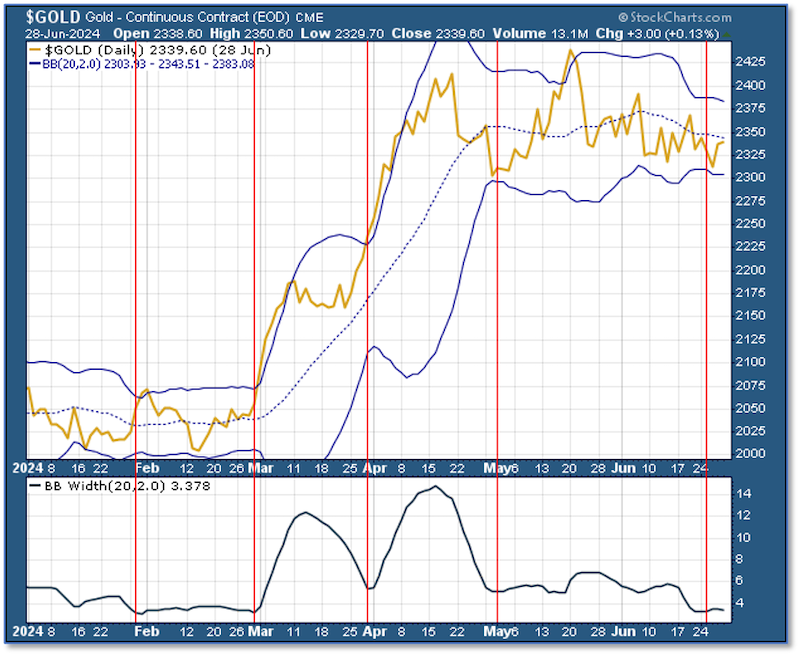

Since then, as you can see from the five-month price chart below, the price failed to set those higher highs and lows, and has now settled into the kind of sideways trading pattern characteristic of the usual summer doldrums.

|  | | At the same time, a number of analysts/pundits have been predicting a major sell-off in gold — the typical “one more dive lower before the next big move higher” predictions.

As I’ve said before, these kinds of statements are common at market junctures like these (and actually often come right before a major price breakout). It's more a rhetorical safety net than a prediction — you could be 100% right, but you can never be 100% wrong.

All this said, the odds appear to favor a summertime slowdown for the next month or two, with gold remaining in a trading range.

However, one interesting indicator is now flashing a signal for a potential price breakout at any time....

| | Falling Volatility Can Lead To Rising Prices

| | The Bollinger Bands volatility gauge has been a fairly reliable technical indicator for asset prices in general and gold specifically. As long-time readers know, I track gold’s Bollinger Bands because when they narrow (indicating falling volatility), that event often presages a breakout in either direction.

| | Importantly, if the price is in an uptrend, this breakout is usually to the upside. And gold, as we know, has been in quite an uptrend.

| | Consider the accompanying chart, on which I’ve marked occasions when the Bollinger bands have “pinched,” as shown by their width in the bottom panel.

|  | | As you can see, every time the band width has bottomed while gold has been in an uptrend, we’ve seen a quick, subsequent move higher. The bottom in the band width that occurred in late January came before gold had begun its rally, and in any case didn’t mark a significant fall from higher levels.

So has the Bollinger-band width bottomed and is this predicting an imminent price breakout?

We’ll soon find out.

Regardless, the fundamental picture is still arguing for a renewed move higher at some point over the next couple of months. If we’re in a typical summer doldrums kind of market, the record shows that the price of gold will bottom sometime between mid-July and mid-August.

In addition, I believe the markets are going to begin pricing in a Fed rate cut by next month.

| | Bottom line: Even if we don’t get a breakout soon as predicted by the pinching Bollinger bands, we seem likely to see a renewed bull run within the next month or two.

| | My advice is to use this quiet period to get positioned in the best junior mining stocks while bargains remain on offer.

To help you get a head start on your due diligence, consider the array of interviews with top junior mining executives that we feature on the Gold Newsletter YouTube page. A few of our most recent interviews are highlighted for your convenience below.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. I’m packing my bags for this year’s tremendous Rule Natural Resource Symposium, being held next week in Boca Raton. I urge you to click here to see about attending in person, or via their easy streaming option. Hope to see you there!

| | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |