| Full faith and credit...in the Fed? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Gold Newsletter Preview: | | Full Faith And Credit | |

Today’s gold market is a battleground for two diametrically opposed belief systems — one believing in the Fed, and the other not so much.

The Fed followers have been winning until the last few days, begging the question: Have the tables suddenly turned in favor of gold?

| |

It’s been often said that gold is as much a religion as an investment.

|

That’s as true as it ever was these days, except that it seems it’s not the gold bulls, but rather the bears, who are demonstrating faith.

And that faith is rested in none other than the Federal Reserve.

If you aren’t buying gold right now, or are betting against it, you must believe the Fed’s contention that recent inflationary pressures are transitory, or at least that this august group of central planners will be able to nip it in the bud with the many tools they supposedly have at their disposal.

On the other side of the bet are those with a more cynical view, those who believe we cannot avoid serious repercussions from an unprecedented level of monetary accommodation and fiscal spending.

I won’t go into the evidence supporting the latter case. We’ve covered them many times in these pages, demonstrating that, at the very least, interest rates must now remain negative on a real basis going forward, and for as long as the current monetary regime remains in effect.

Otherwise, the federal budget will simply implode, with debt-service payments overwhelming all other spending.

So it can’t happen, and it won’t. The result will therefore be a very supportive environment for precious metals and all tangible assets, as interest rates remain well behind the inflationary curve and the dollar continues to lose value.

But all of that is beside the point at this moment, because the gold bears — the investors who are placing their full faith and credit in the Fed — have been winning.

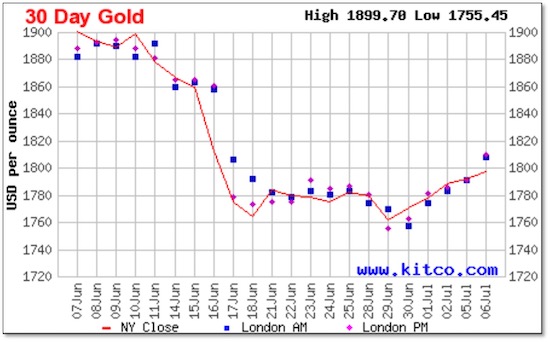

That may be changing as I write, however, as gold has put in a half dozen positive days. The chart below tells the tale:

|  |

The “rally” is continuing today, with gold gaining as much as $10.

But it’s hard to put too much faith in these gains, as they are coming amid some truly confusing signals in the markets:

|

• The Dollar Index has been rallying in recent days...

• Treasury yields have actually been dropping...and significantly...at the same time that the dollar has been strengthening...

• Gold has posted some impressive early gains (over $20 early in yesterday’s session, for example), before losing most of those gains as the shorts counter-attack...

• The Fed has been releasing trial balloons on QE tapering and rate hikes (they’re actually thinking about thinking about raising rates in a couple of years).

|

Amid all of this confusion, I’ve become a bit more cautious toward the metals and mining stocks, until we can get a clear trend in place. I explain this this stance in detail, and provide some compelling technical evidence, in our just-issued July edition of Gold Newsletter.

But here’s the most interesting part: Despite my general caution toward the sector, I managed to uncover two junior mining stories so compelling that I had to recommend them strongly for immediate acquisition:

|

• A spectacular new roll-up play in the world’s best mining jurisdiction. In fact, I think I’ve found the world’s next mid-tier gold producer...and it’s currently valued as a mere developer.

The team behind this new company has done it before and have both powerhouse financial backing and world-class assets already in the fold. And there are key catalysts in the near future the prompted me to recommend this company now.

• A high-grade drill-hole play with results coming any day. This company is following up on spectacular high-grade drill results from a previous operator in Nevada — drill results that the market has apparently completely forgotten about!

That’s why this micro-cap junior is still trading for mere pennies as the drills are turning and results are expected at any moment.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

You can get all the details on these new, red-hot stock picks by subscribing to Gold Newsletter now.

|

To get a full year of Gold Newsletter…and get immediate access to our exciting July issue packed with valuable investment intelligence and details on dozens of exciting junior mining plays…simply click on the link below.

|

I’m not recommending that anyone jump head-first into the metals and mining sector right now. So it says a lot when I’m recommending immediate purchase of these two extraordinary junior mining plays.

I strongly urge you to act now to discover these two new recommendations and get positioned.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

CLICK HERE

To Get The

July Issue Of

Gold Newsletter

| | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |