| A new indicator points to a surprise for gold... |

|

| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

Key technical indicators confirm a huge shift for gold into a major bull market.

...But another indicator is now pointing toward a major, unexpected change in the metal’s relationship with the bond market.

By Omar Ayales

|

Chief Strategist & Editor

GOLDCHARTSRUS.NET

A division of The Aden Research Group

|

|

Editor’s Note: I read everything I can from nearly every analyst in the gold market and a tremendous number of broader-market commentators. So it’s been a great pleasure to watch Omar Ayales, son of my dear friend Pamela Aden, develop into one of the most accurate market analysts out there.

Raised from the crib as both a gold bug and a technical analyst, Omar brings something to the table that I and many of us gold nuts struggle with: A dispassionate view of the metals and mining shares.

The result has been not only an ability to trade these assets in both up and down trends, but to do so with incredibly profitable outcomes. I can’t recommend Omar and his service more highly, and I’m truly grateful to him for sharing some of his latest thoughts with us here.

— BL | | |

|

The gold price, the U.S. dollar and bonds have risen in lockstep for several years on safe haven demand.

|

|

Fear and uncertainty were brewing.

Tension from a trade war between the U.S. and China was reaching its peak. Concerns over disrupted supply chains were casting doubt and fear of a deflationary crisis.

Back then, liquidity once again became the safe haven of choice, fueling a bull market in the U.S. dollar that has lasted nearly three years.

My name is Omar Ayales, chief strategist of Gold Charts R Us, a weekly trading service looking to gain by trading commodities, stocks and bonds.

Before the fundamental reasons explaining a particular price behavior become obvious, our indicators allow a glimpse so that investors can position themselves before the moves actually occur.

In short, technical analysis — properly done — is prescient.

And in today’s noisy world, analysis of price action is the only real and unbiased form of analysis.

|

In this regard, I’m about to show you a key shift in investor sentiment as it pertains to gold that should allow for a more informed decision when positioning and timing your portfolio.

|

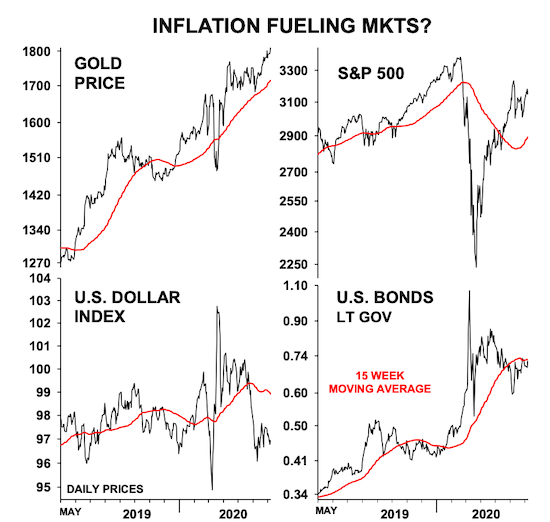

Consider that the U.S. Dollar Index’s (DXY) three-year bull market rise coincided with bull markets in the gold price and U.S. government bonds as the need for safe havens grew.

An interesting move for gold, since it historically tends to move opposite to the dollar.

|

|

Uncertainty started peaking at the onset of 2020. The killing of an Iranian general was the catalyst then. Soon after, Covid-19 broke out pushing the world into unprecedented lockdowns.

The dollar, gold and bonds all rose to new highs then.

The global economy was shut down.

Global supply chains have been decimated. Entire industries that were once the bedrock of the economy are being forced to reinvent themselves.

Zero demand at the start of the lockdowns pushed all assets down, including gold and bonds. Safe havens fell less than risk assets, naturally. But they all fell.

Governments and central banks across the board, led by the U.S. Federal Reserve, pledged liquidity to infinity. From sending checks to people, to processing thousands of loans to businesses...the system was doing all that it could to stay alive.

Then, something interesting happened.

As the world started moving out of lockdowns, opening communities back up, the organic rate of demand for all goods and services came back, leaving economists and investors baffled.

Stocks surged. The tech-heavy NASDAQ actually went on to reach new highs!

The need for safe havens changed radically as animal spirits and risk appetite started to pick up.

The dollar and U.S. government bonds started to decline. They’re now threatening to break below intermediate support levels.

But gold held its own.

It decoupled from the dollar and bonds after trading together for over two years!

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

The dynamic fueling gold’s bull market shifted from fear...to greed.

|

Gold went from being traded as a safe haven, to being traded as a hedge against inflation expectations, given the loose monetary policy being promoted.

This dynamic gives the gold universe renewed strength to rise to new all-time highs.

Gold’s break above $1,800 is very telling. And even more telling are the surging gold shares.

The HUI gold share index broke to new highs and it’s looking hungry for more.

And because gold’s main catalyst now is related to runaway inflation, it’s likely we’ll see surges in risk appetite and resources.

This combination could also be a strong catalyst for silver. One only needs to look at the steady rise in copper since the March lows to get a feeling of this.

Thus far silver has been a laggard. It’s been stuck within a tight trading range between $17 and $19. It’s testing $19 as this goes to press....

Don’t be fooled. Silver is a sleeper — and when it wakes up, there’s no stopping it.

|

A clear break above $19 will be the technical catalyst that could push silver up much higher.

|

|

Not only will it trigger a strong buy for silver, it will also reconfirm strength within the gold universe’s coordinated up-move.

Gold’s breakout rise above $1,800 is a buy signal in itself that will likely bring in lots of new buyers. And contrary to what has been the case over the past couple of years, greed and inflationary expectations is what will continue fueling gold.

As part of this, the relationship between gold and the dollar is poised to go back to its traditional role.

My line in the sand on the U.S. dollar index in 96. It’s a three-year-long bull market support! A break below this level will show structural weakness in the dollar that could catapult gold higher.

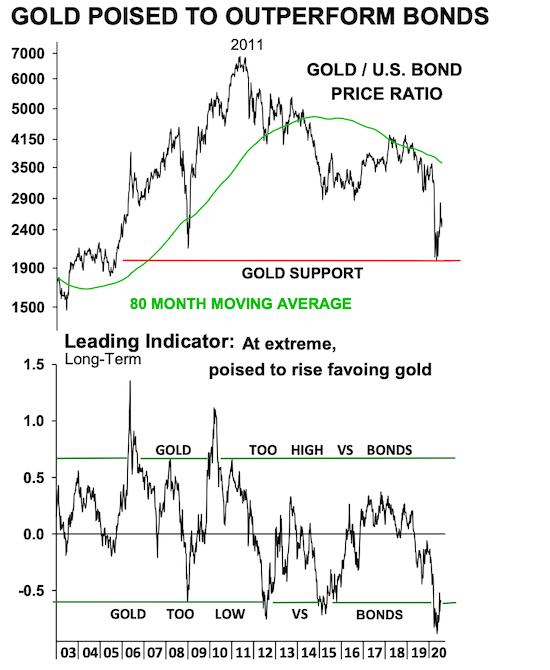

But what about bonds? Look at this next chart.

It’s a gold to bond ratio. It tells us which of the two are being favored.

Notice the ratio had fallen in favor of bonds. The indicator below suggests the relationship is at an extreme and it could now bounce back to favor gold.

|

|

This tells us gold could be favored over bonds in the foreseeable future.

This is yet another confirmation that, over the past month or so, the narrative fueling gold’s rise has shifted.

|

Don’t be surprised if gold now starts moving with long-term government bond yields. And note that this is a completely unexpected development at this point — few, if any, analysts or investors are factoring this into their decisions.

|

The lesson here is that temporary weakness in gold may develop, and if so it will be an ideal time to build your position. Be sure to do your homework in selecting what to buy and when.

And remember that the primary trend has been confirmed. Like Seth Klarman would say, “The single greatest edge an investor can have is long-term orientation.”

Good luck and good trading!

Note: If you would like to try out our service, CLICK HERE for a special introductory rate exclusive to readers of Golden Opportunities.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |