|

Dear Fellow Investor,

I’ve known Dana Samuelson since my first day in the gold industry.

When I joined Jim Blanchard’s organization as a junior copywriter in 1985, Dana was already well-established as the head trader in what was already the largest coin and bullion dealer in the U.S.

I had a lot to learn about the business on that first day, but Dana already knew it like the back of his hand.

These days, Dana runs American Gold Exchange and is one of the most respected experts in the metals business, most recently serving as president of the prestigious Professional Numismatists Guild. I heartily recommend his company to my friends and family.

I also recommend that any serious investor read Dana’s periodic analyses of the metals market. He’s in the trenches every day, but also has the ability to put things in a longer-term perspective.

I thought his latest commentary was particularly spot-on, and wanted to share it with you and the rest of our Golden Opportunity readers today.

— BL

A stronger U.S. dollar pressured gold and silver to 2018 lows in late June, creating an exceptionally good buying opportunity in all precious metals this summer.

After a sleepy first quarter, the U.S. economy accelerated during Q2 as recent tax cuts took effect, and spending and job growth picked up. At the same time, the Eurozone decelerated in Q2, weakening the euro and boosting the dollar to the highest level in six months.

But this momentum may prove transitory as newly-enacted trade tariffs, which are effectively new taxes, weigh on businesses and consumers. If growth stalls, so will the dollar, setting the stage for a dramatic rebound in the gold price in the second half of the year.

Gold's Solid Fundamentals

Gold is fairly valued in our opinion between $1,275 and $1,325 an ounce and is now oversold. None of the fundamentals that drove gold to $1,350 earlier this year have materially changed. In fact, reasons for gold to rebound from this selloff are increasing.

The U.S. economy has hit a sweet spot in Q2 of this year with 3.9% estimated growth. But we enjoyed even stronger growth in Q2 (4.6%) and Q3 (5.2%) of 2014, only to see it fade. Pundits have been saying for months now the longest and weakest economic expansion in U.S. history is due for a correction. As the economy corrects, so will the stock markets, sending money in search of safe havens like gold.

In today's global economy, economic weakness in Europe and Asia can easily become economic contagion in the U.S. But looming much larger, the future of the euro itself is becoming increasingly uncertain, with recent populist votes in Italy and Germany threatening to undermine its fundamental existence. The Chinese economy has hit a soft spot as well, with growth slowing and debt rising. It’s difficult to see how the U.S. will avoid being pulled lower if this weakness in Europe and Asia persists.

While tensions with North Korea have eased with the nuclear agreement, their behavior so far has not really changed. They did destroy their testing facility, but the site itself had become unstable, and they already demonstrated that their nukes work. Based on Secretary of State Pompeo’s recent trip to North Korea, the disarmament negotiation will be a long, hard slog. New threats of annihilation could come from Kim Jong-un at any time.

And while we applaud President Trump’s desire to right past economic wrongs by pressuring trading partners through new tariffs, and we understand that he is playing “the long game” of renegotiation, strange things can and will happen. If protectionism turns into trade wars, the global economy will surely suffer in the short term before a fairer equilibrium is established.

And finally, debt worldwide is at historic, never-before-seen levels. The U.S. national debt now stands at $21 trillion and growing. Nothing is being done about it and no one seems to care, but these debt levels will have dire long-term consequences for the economy and the dollar.

It only makes sense to be prepared. Gold has a long history of providing valuable portfolio insurance in times of political and financial uncertainty like these. Looking forward, we think this summer may well provide the best buying opportunity of the year — perhaps for several years — for long-term investors.

The Latest Charts

The U.S. Dollar

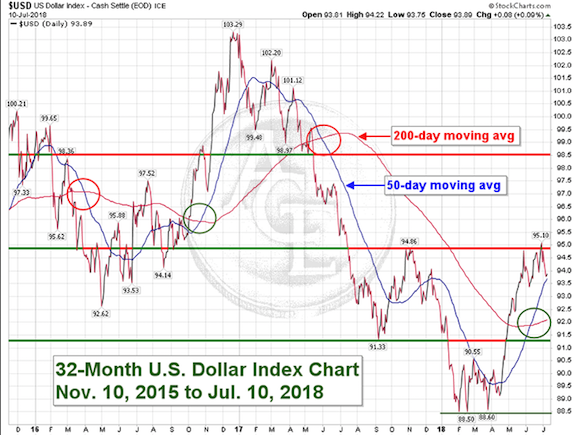

As you can see on the chart above, the dollar strengthened between mid-April and the end of May. Part of this boost can be attributed to the economy picking up steam, but much of it was due to increased international turmoil.

The U.S. exited the Iranian agreement on May 8, further troubling a troubled region. Then Italy’s new Euroskeptic government took office in May, threatening to boost spending and lower taxes, potentially lowering Italy’s credit rating. Italy holds the largest debt in the Eurozone. Were it to default or leave the EU, it would create much larger financial issues than the Greek debt crisis of a few years ago.

Also supporting the dollar was the increase in U.S. GDP. During Q1, growth was 2% and the U.S. economy underperformed the Eurozone, which grew at 2.5%. While the euro strengthened, the dollar weakened, hitting a four-year low of 88.50 to 88.60 repeatedly on the U.S. dollar index.

In Q2, however, the trends have reversed. The U.S. economy is projected to have grown 3.9% while the Eurozone has fallen to projected growth of 2.1%. The euro has weakened as a result while the dollar has rallied, pressuring gold lower. As you know, a stronger dollar weighs on gold by making it more expensive overseas.

The Fed has not helped. With job creation at a steady pace and the economy picking up, financial markets fully expected the Fed to raise interest rates by a quarter-point at the June meeting, which it did. What the markets didn’t expect, however, was the central bank signaling a possible fourth hike this year. Eight Fed officials now project a fourth hike while seven project three, a change in one voter. If this holds true, the divergence between U.S. and Eurozone rates is likely to increase, which would support the dollar.

Given its weakness from the December 2016 high to the Spring 2018 lows, the dollar was due for a rebound. But that momentum is stalling. As we go to press the dollar is trading at just over 94 on U.S. dollar index chart.

The question now is whether the dollar can extend its rally and break above 95, its next major upside resistance level. A stronger dollar will pressure gold lower while a weaker dollar will buoy gold higher.

The wild card is trade. The escalation of protectionist trade policies by the U.S., China, and Europe in recent weeks is pushing the global economy toward uncharted territory. If brinksmanship blossoms into a full-scale trade war, the result is likely to be sharply higher inflation and slower growth.

Should this scenario play out, the Fed will be in a bind. Do they raise interest rates to get ahead of inflation, or let inflation run hot to boost growth? More than likely, given the long climb out of the Great Recession, they'll support economic growth and let inflation run hot. Under these circumstances, gold will become the asset of choice to preserve purchasing power.

Gold Gold

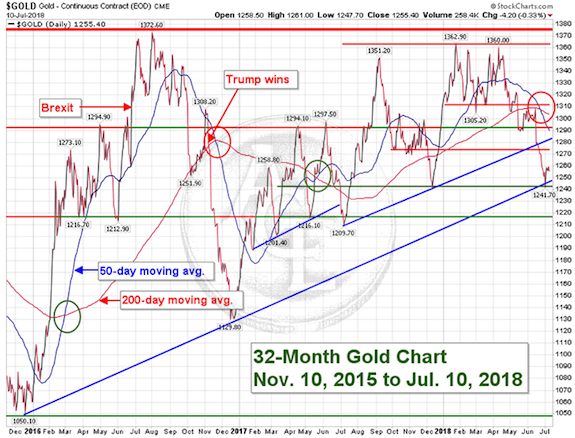

Gold broke lower in price in mid-June following four major events that occurred during the week of June 11. First, the Fed signaled four rate hikes in 2018 instead of the three previously announced. Second, the ECB confirmed they would continue quantitative easing through the end of 2018 and keep interest rates at record lows well into 2019. Third, peace broke out on the Korean peninsula following the historic summit between President Trump and North Korean Dictator Kim Jong-un. And finally, the first round of tariffs against China were announced.

As you can see on the chart above, that week is precisely when gold began to falter in earnest, breaking short-term support at $1,290 and falling to the major support trend line at $1,245. Going into this time frame, gold was already in a corrective phase after twice testing, but failing to break, major resistance at $1,360.

When selling pressure ramped up in mid-June, gold, silver, and platinum all corrected down to summer 2018 lows. All four precious metals, including palladium, have effectively gone on sale due to this selloff. But sentiment can change quickly, especially in the trade-war environment that we are now entering.

The key for gold going forward is the strength or weakness of the U.S. dollar. Unless the dollar rallies further, gold will continue to find support around the $1,250 level. So far, it is holding major support at $1,245 and has enjoyed a modest rebound now that thin trading volumes of the July 4th week have passed.

Technically, gold has undergone what traders call the death cross, when the 50-day moving average moves under the 200-day moving average, indicated by the red circle on the chart. However, the fact that gold held support at $1,245 is a good sign. It’s entirely possible that gold has already hit its 2018 low, and the dollar its 2018 high. The dollar's inability to push above 95 on the index chart is beneficial for gold.

Summer months are typically soft for precious metals, so it’s not unusual to see price-weakness. In fact, this recent selloff is reminiscent of July 2015, when gold broke support at $1,140 and fell to a $1,084 low. Summer trading volume was thin and sentiment at the time was negative. But it proved to be a good buying opportunity, with gold popping back over $1,150 within three weeks. Remember, precious metals markets are much smaller than bond, currency and equity markets. They can be bullied, and sometimes are, but they soon return to their natural points of equilibrium.

We see short-term support for gold at $1,245 with secondary support at $1,215. But we believe the bottom is already in place at $1,241.70. Upside resistance will be found at $1,275 and again at $1,295. As you can see on the chart, in the past 18 months sell offs have been bought back up quickly, creating five V-shaped bottoms since December 2016. We believe this sell off will result in a similar V-shaped rebound.

Silver Silver

Like gold, silver sold off to new 2018 lows during June’s correction, creating an unusually good buying opportunity. As we said earlier this year, silver under $16.35 looks cheap to us. Its brief foray below $16 was bought up quickly.

As you can see on the chart, silver’s trading range continues to tighten. The wider price swings over the last 18 to 24 months have diminished considerably. Over the last five months, absent several spikey highs and lows, silver's trading range has narrowed to between $16.25 and $16.80 per ounce, creating well-defined support and resistance levels. A consolidation phase like this means a larger price move is coming, and we believe it will be to the upside.

Over the last two years, silver's price movements have been more commodity-driven and less like an inflation-hedge or currency of last resort. However, its two recent spikes up to $17.25 were reactions to inflationary factors—rising interest rates on the 10-year Treasury notes and higher oil prices. This tells us silver's traditional role as an inflation hedge is very much alive, if latent, and it remains bullishly sensitive to even minor changes in inflationary forces going forward. As was we mentioned above, tariffs are inflationary.

Gold And Silver Specials

Classic U.S. gold coins remain extremely inexpensive in the current market, but we are seeing supplies tighten quickly. Premiums above gold content for many coins are hovering near historic lows, but it's only a matter of time until they rise back toward their 5-year averages. Now is the time to pick up Pre-1933 U.S. gold coins on the cheap!

Recently, newsletters like The Aden Forecast and Weber Global Opportunities Report have recognized just how undervalued these coins truly are today. Both recommend trading modern gold bullion coins, if you own them, for $10 and $20 U.S. gold coins minted pre-1933, given how inexpensive these classic coins are today relative to gold bullion. We agree completely!

While prices and premiums are still near record lows, they are firming up faster than we expected. There are still great bargains to be had, but the ability to pick and choose is diminishing. That’s why we are extremely pleased to offer the following:

$10 Liberty gold coin, MS64 – Only $1,045 each

We love the $10 Liberty in Mint State 64 in the current market. Of the four major $20 and $10 gold coins, these are the scarcest in MS64 grade, with a known survival rate of under 25,000 for the whole series. That's real scarcity! Plus, they enjoy the lowest price of four types today.

These coins have a tremendous track record of gains when the market is hot. They have traded for $2,950 twice in the past 10 years. Yet they are priced at just $1,045 today, little more than a third of their price peak. $10 Liberty MS64 coins are absolutely one of the best values in the entire U.S. gold coin market for scarcity, price and previous track record. They should not be missed.

Swiss 20 Francs, BU – $5 off per coin

We have a small cache of Switzerland 20 Franc gold coins in Brilliant Uncirculated grade at the lowest premium we’ve ever offered! For bulk-gold buyers who want privacy and internationally-recognized, trading-sized coins, you can’t beat Swiss 20 Francs at today’s prices.

Morgan Silver Dollar 10-Coin Set, MS65

If you are a history buff or simply like silver coins, there isn’t a better value or a more interesting offer than our 10-coin Morgan Dollar sets in MS65 condition. These big, hefty silver dollars dated 1878-1904 were the trading coins of commerce that built the American expansion west of the Mississippi.

In our 10-coin instant collection you, get 10 different date and mint-mark coins from the three primary mints at the time, Philadelphia, New Orleans and San Francisco. These coins are trading today at the lowest price we have offered them at in over 10-years.

Once again, we believe the summer dip has created a golden opportunity to add to your holdings at what may prove to be the lowest gold prices of the year. If you have any questions, our market experts are happy to assist you. Just give us a call at 1-800-613-9323.

Dana Samuelson

President

American Gold Exchange

|