| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The Fed insists that higher inflation rates are merely transitory. The latest CPI and PPI numbers argue to the contrary, as do latest public polling data.

What this all means for gold in the near term, however, remains to be seen.

| |

The Fed is as much a public relations organization as it is a central bank.

|

Thus, part of its job is to manage public expectations as to its monetary policy, the results and repercussions thereof and its plans for the future.

|

In regard to all of this, its efforts can be politely described as “messaging”...and more accurately as propaganda with a peppering of outright lies.

|

As the CNBC broadcast of Fed Chairman Powell’s testimony before Congress plays over my shoulder, I’m reminded of the most infuriating aspect of the Fed’s public relations program — its serious concern over income inequality in the U.S. and its on-going fight to rectify these inequities.

Of course, anyone with any knowledge of financial history knows that the Fed is the leading cause of income inequality, as its blank-check monetary policies primarily benefit those who already own the assets that are appreciating as the dollar’s value depreciates.

Moreover, it has encouraged unprecedented levels of peacetime debt creation, both public and private, to the degree that it must promote much higher levels of inflation to depreciate the value of those debts.

And inflation doesn’t bother the rich man much. It is the lower to middle class that suffers, as they can’t avoid the effects of a rising cost of living.

Only those who actually lived through the rampaging inflation of the 1970s have any experience or respect for the damage that can be wrought when the genie is released from the bottle — and there are relatively few of those left alive and operating in today’s markets.

For its part, the Fed believes it can let the genie out of the bottle just a bit, and then stuff it back in whenever they wish.

The fact that this feat has never been accomplished before in monetary history doesn’t dent their hubris.

But facts and data are hard for even Powell & Co. to ignore...and the latest inflation numbers show that the inflation genie may have already escaped.

| | Golden Opportunities continues below... | | SPONSOR:

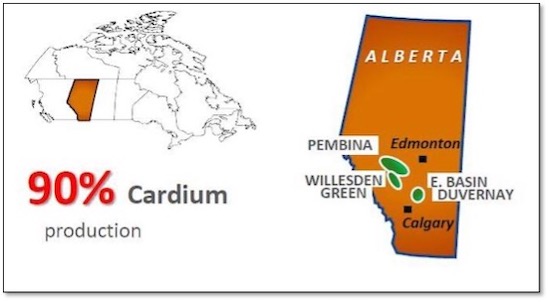

InPlay Oil (IPO.TO; IPOOF.OTCQX) | | Oil Leverage Unlocked | | Investors looking for a way to maximize their torque on oil’s resurgence are eagerly awaiting evaluation expansion as a major value-unlocking event for InPlay Oil (IPO.TO; IPOOF.OTCQX). | | Because — at the end of JUNE — oil-price hedges that InPlay put in place to weather the depressed oil environment and pandemic fell off. | | It’s a value-creating event that…combined with reserve growth and operational efficiencies generated in the Year of Covid…promises to light a fire under InPlay Oil’s share price | | Timing is everything with investment opportunities. | If you can jump on board a company just before key catalysts remind the market of its value proposition...that’s a recipe to make money.

Such an opportunity is developing with InPlay Oil (IPO.TO; IPOOF.OTCQX) a Calgary-focused oil and gas producer that has used the year lost to Covid to retool and gear up for the post-Covid surge that seems directly ahead. |  | | InPlay is focused, with 90% of its light oil production from the Cardium Formation in western Alberta providing top decile returns | | InPlay is on the cusp of record production and cash flows, and yet it’s still trading at a steep, pandemic-induced discount. Watch for the next potential move known as “funds flow multiple expansion.” | CLICK HERE

To Learn More About InPlay Oil

And Its Upcoming Value-Unlocking Event | |

Stunning Inflation Reports

|

Rumors were running rampant in the days leading up to the June Consumer Price Index report that we were about to see a “double digit” number.

Yesterday’s release of the report revealed that rumor was incorrect...but it wasn’t far off.

|

The numbers were, to be frank, shocking — with every iteration coming in about twice expectations.

|

The headline CPI showed a 0.9% gain month-over-month, against expectations of 0.5%. The core rate also rose 0.9%, more than double the 0.4% prediction.

The year-over-year numbers were equally disturbing, with the headline CPI coming in at 5.4% and the core rate at 4.5% annually. Again, far above expectations, and the biggest gains since 2008.

With numbers like these, there’s little doubt that the Fed will begin tapering its asset purchases sometime this fall. And perhaps that’s why, despite these remarkably hot inflation numbers, gold lost its early gains and ended up slightly down for the day.

As far as the Fed’s public stance that this inflation spike will be transitory, I have to grant that supply-chain issues played a big part in some of the price gains. For example, used car prices gained an amazing 10.5% in June alone, thanks to the shortage of computer chips that has been restraining new car production.

But much of these cost pressures are decidedly not temporary, including rents and other services prices.

And today, we received news that there are additional price spikes in the pipeline, as the Producer Price Index provided another round of shock and awe on the inflation front.

Once again, the numbers came in at double expectations, with both the headline and core PPI running at 1.0% gains month-over-month.

More bad news for the Fed: Inflation expectations are becoming “unanchored,” in their phraseology, as recent polls show that the public is expecting higher prices in the future. Central bankers fear this phenomenon, as consumers begin buying more quickly to avoid future price hikes, thereby exacerbating the inflationary trend.

The good news for gold bugs is that the yellow metal is responding today, gaining over $20 immediately after the PPI report was released, then suffering through the expected bear attack later in the morning, before recovering as Powell reiterated his dovish stance before Congress.

As I write, it’s up over $18, about 1%, and is just a few dollars from surmounting the key 200-day moving average. It’s important to also note that the 50-day moving average rose decisively through the 200 DMA over the past few sessions, achieving the “golden cross” that many traders pay close attention to.

|

Remain Cautious — And Vigilant

|

Today’s response in gold is encouraging, but I remain cautious in our approach. While the golden cross is helpful, it would be better if both the 50 DMA and the 200 DMA were both rising. As it stands, only the 50-day is on an upward trajectory.

|

And from a fundamental standpoint, it seems that the Fed will be forced, figuratively kicking and screaming, to begin tapering at some point over the next few months.

|

How the market will view gold during this transition in policy is uncertain, but the chances are very good that it will provide an opening for the bears.

Longer term, the evidence continues to build that significantly higher price inflation will be more permanent. And as we’ve argued many times, it will actually be necessary to depreciate away the value of today’s towering debts.

In that environment, short-term wiggles notwithstanding, the prices of gold and silver will be on upward paths.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. Another factor favoring gold and silver will be seasonality, as the fall typically brings higher prices for the metals and mining shares.

Once again, you should consider attending this year’s blockbuster, in-person New Orleans Investment Conference. We have dozens upon dozens of the world’s top experts in geopolitics, economics and every asset class presenting, and I expect attendance for this return to face-to-face events to be a complete sell-out.

If you’re a serious investor, I urge you to CLICK HERE to see our amazing speaker line-up and to register now.

| | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |