| Is this today’s last undiscovered discovery play? |

|

| Please find below a special message from our advertising sponsor, Thunderstruck Resources. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

On the island of Fiji, Thunderstruck Resources (AWE.V; THURF.OTC) controls four distinct discoveries — in gold, silver, copper and zinc — that have been frozen in time for over four decades.

This may be the last undiscovered discovery play in today’s red-hot mining market.

But now, with drill programs about to begin on two of its projects, the window to beat the market into this story is closing fast.

|

|

Recent share price reactions to good drill results (and even to the mere anticipation of good results) prove we’ve officially entered a secular bull market for gold.

|

Consider just three recent examples of this trend:

|

• A development-stage junior in Ontario rises 33% in two trading days on news of high-grade results from drilling to expand its existing underground resource

• A silver-gold explorer drilling an historic Mexican silver district wows the market with uber-high-grade assays and spikes 240% over the next two trading days

• A gold explorer in southeast Alaska with a just-started drill program announces a financial injection from a high-profile investor, and sees its shares jump more than 75% in less than a week

|

Such are the gains that are possible when the drills begin to turn on high-potential projects in a gold bull market.

But, as you can tell from the speed of the market reaction, the gains in this environment go to the swift…and to the prescient.

That said, there are still opportunities to stake positions in undervalued drill-hole speculations — if you know where to look.

And while much investor attention has been focused on high-profile jurisdictions like Mexico and British Columbia, Thunderstruck Resources (AWE.V; THURF.OTC) has quietly built an impressive precious and base metal portfolio on the island nation of Fiji.

Now, thanks to a successful financing and a financial commitment from a key joint venture partner, Thunderstruck is about to begin drill programs on two of its four projects in the country.

The program on its gold project, in particular, has the potential to be a game-changer for the company, while the program on its joint-ventured base metal project provides a key valuation backstop.

|

Simply put, this company offers investors a drill-hole play that the market, to date, has overlooked.

|

But given the recent profits that similar drill programs have generated, odds are very good that investors will find their way to Thunderstruck sooner rather than later.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A “New” Metals District Emerges

|

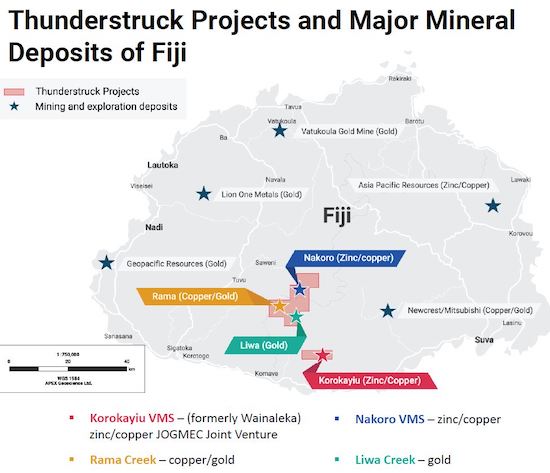

Located along the Pacific “Ring of Fire” that is home to many of the world’s most largest gold and copper deposits, Fiji has a long history of mining.

Its Vatukoula mine on the north end of Viti Levu, the country’s main island, has produced more than 7 million ounces of gold over an 80-year mine life. And it’s still going strong.

Meanwhile, the Namosi project on the southeast end of Viti Levu is home to one of the world’s largest undeveloped copper-gold resources (52 million ounces gold-equivalent).

|

|

Within this metals-rich region, Thunderstruck has managed to consolidate a land-package that includes the Korokayiu (zinc-copper), Liwa (gold), Rama (copper-gold) and Nakoro (zinc-copper) projects.

This collection of projects was originally discovered in the 1970s by mining major Anglo Pacific.

|

Now, after 40 years that saw mostly sporadic, small-scale exploration by subsequent operators, these projects are exploding onto the scene in the midst of an emerging, red-hot metals and mining market.

|

In short, with two separate drill programs poised to begin, Thunderstruck stands as one of the last “undiscovered discovery” stories just as the gold bull market kicks into high gear.

|

High-Grade Zinc-Copper Joint Venture Backstops The Value

|

Thanks to Thunderstruck’s joint venture with Japanese major JOGMEC, the Korokayiu project provides a key backstop to the gold upside that its nearby Liwa project offers.

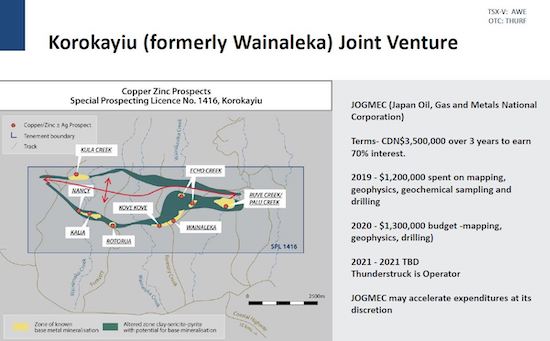

Anglo originally discovered the high-grade volcanic massive sulphide (“VMS”) zinc-copper mineralization in 1977, outlining a small high-grade resource in 1980.

But then Anglo simply left! Back then, porphyry projects were all the rage and even high-grade VMS projects didn’t get any respect. (Only later did subsequent discoveries prove how valuable VMS deposits could be.)

So for over four decades, this discovery was left virtually ignored.

But here’s the deal: The near-surface deposit remains open along strike and at depth, and the vast majority of the currently known mineralization lies within 100 meters of surface.

|

|

As you can see on the map above, prior work on Korokayiu has outlined more than 15 kilometers of potential strike on the property, over no less than eight distinct targets, so far.

Thunderstruck optioned the project in 2019 in a deal that will allow JOGMEC to earn a 70% interest in exchange for C$3.5 million in expenditures.

The major spent C$1.2 million last year on a program that included drilling and has committed to spending another C$1.3 million in 2020, a budget that will also fund another round of follow-up drilling at Korokayiu.

|

And consider what that program will be following up on: Last year’s drilling was highlighted by Hole 17, which cut 13.8% zinc, 2.94% copper, 114 g/t silver, and 1.08 g/t gold over 11 meters!

|

This year’s program will consist of a minimum of 1,500 meters and will attempt to expand the known high-grade mineralization on the Wainaleka target and test for extensions toward the Echo Creek and Kove Kove targets.

This program, funded fully by its joint-venture partner, has the chance to provide important results of its own for Thunderstruck.

| |

With Thunderstruck’s current value fully supported by its JOGMEC JV at Korokayiu, investors who buy AWE in advance of its upcoming drill program at Liwa will essentially get its substantial gold exploration upside for “free.”

Past surface work has generated four high-profile targets on Liwa, extending over more than three kilometers in strike and open in all directions. Those targets — Jensen’s, Liwa Ridge, Lower Vatuvatulevu and Gun — have been clearly outlined by soil surveys, sampling and trenching.

| |

| | Key targets for Thunderstruck’s drill program on its Liwa gold project |

Highlights from the work on these targets include 15 meters of 1.9 g/t gold and 5.5 meters of 2.0 g/t from a 1989 trenching effort. High-grade samples include 55 g/t gold (Jensen’s), 11.1 g/t gold (Liwa Ridge) and 44.1 g/t/ gold and 1,205 g/t silver (Lower Vatuvatulevu).

Clearly, there’s a lot of smoke at surface on Liwa. But that’s not all: A geophysical survey conducted last year confirmed significant anomalies to 300 meters depth below all four targets.

In short, the targets are well-defined and the depth potential on them is significant.

If the upcoming 2,200-meter drill program confirms that these high grades extend at depth, Thunderstruck could make big headlines in this red-hot junior mining market.

|

A Rapidly Closing Window Of Opportunity

| Again, because of their reputation for delivering quick profits in the current environment, undervalued drill-hole speculations like this are hard to come by.

|

With the drills at Liwa expected to start turning in August and the program at Korokayiu providing that all-important backstop, Thunderstruck offers a compelling risk-reward profile, and an equally compelling entry price.

|

|

Given the massive numbers of generalist investors that are now rotating into the gold space, the company offers a bargain that likely won’t last for long.

Simply put, Thunderstruck’s drilling program at Liwa is a downside-protected opportunity — a “golden ticket,” if you will — that could see good news from the drill bit turn into instant profits.

But your window of opportunity is closing fast. If you want to participate in the upside here, you’ll want to own Thunderstruck before the drills start turning in the days ahead.

|

|

CLICK HERE

To Learn More about Thunderstruck Resources

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |