| Dear Fellow Investor,

|

| It was the warning shot in what promises to be a new escalation in the U.S.-China trade war.

|

| China announced at the beginning of July that it was restricting exports of gallium and germanium, two specialty metals on which it holds the lion’s share of global production.

And while those metals, used primarily in semiconductor manufacturing, have enough substitutes and non-China production for the West to weather the restrictions, the move may presage similar restrictions on rare earth elements (“REEs”).

You see, China controls virtually all of rare earth metal production, and rare earths play vital roles in U.S. defense equipment, the EV industry and other applications like wind turbines, optical-quality glass, smartphones and MRI scanners.

Understandably, that vulnerability has the U.S. scrambling to find rare earths from U.S. (or U.S.-friendly) sources.

|

| It’s a situation tailor-made for Defense Metals (DEFN.V; DFMTF.OTC), which controls what could eventually be the second largest REE mine in North America.

|

| With the U.S. Department of Defense on the verge of banning future supplies of REEs from China, Russia, Iran and North Korea, Defense Metals’ Wicheeda project in east-central British Columbia makes the company a prime candidate for a re-rating in the near future.

|

| Canada’s Mountain Pass?

|

| Right now, the only producing REE mine in North America is the Mountain Pass mine in California.

Mountain Pass produced a record 42,500 tonnes of rare earth oxide (“REO”) in concentrate during 2022 generating revenues of more than $525 million for MP Materials.

Why does that matter for Defense Metals?

|

| Because a preliminary economic assessment (PEA) for its Wicheeda project predicts that it could produce about 25,000 tonnes of REOs annually, about 60% of Mountain Pass’s 2022 production level.

|

| With a recent capital injection of C$12.5 million, Defense Metals is cashed up to produce a prefeasibility study on Wicheeda in H1 2024.

That would make Wicheeda one of the very few prefeasibility-stage rare earth projects in North America...and a prime candidate to be Canada’s version of Mountain Pass.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

| Strategic Location

|

| Unlike many REE deposits, Wicheeda is in a prime location, just 80 kilometers from the British Columbia city of Prince George.

|

| Prince George has a skilled work force to draw upon, and Wicheeda has power transmission, a gas pipeline and a major rail line nearby.

Better still, the deepwater port of Prince Rupert is just 500 kilometers away and accessible by rail and road.

|

| These infrastructure advantages are critical. Combined with the fact that Wicheeda will soon complete prefeasibility, they make Defense Metals an obvious choice to move forward with a bankable feasibility study, paving the way for it to potentially become North America’s next REE mine.

|

| A Superior REE Resource

|

| Wicheeda’s REE resources may allow for it to become only the second REE-producing mine in North America...perhaps accounting for about 10% of the world’s production.

Currently, the project’s indicated resource is 5.0 million tonnes of 2.95% total rare-earth oxide (“TREO”) and its inferred resource consists of another 29.5 million tonnes of 1.83% TREO.

|

| The company has conducted an additional 10,000 meters of drilling since that mineral resource estimate was announced in 2021 and an imminent resource update should put a large portion of that inferred resource into the indicated category.

|

| Not only is that additional resource confidence critical, as only resources with confidence levels of indicated or higher will be used in the company’s upcoming prefeasibility study, but pilot plant metallurgical testing has also shown that Wicheeda can produce a concentrate of greater than 40 percent TREO.

|

| Undervalued…For Now

|

| Despite its decided advantages, Defense Metals remains undervalued, both with respect to results from its 2021 PEA on Wicheeda and in comparison to its peers.

The project’s post-tax net present value (established in its 2021 PEA) implies the potential for an extremely lucrative re-rating as the company moves forward with prefeasibility and continues to de-risk Wicheeda.

|

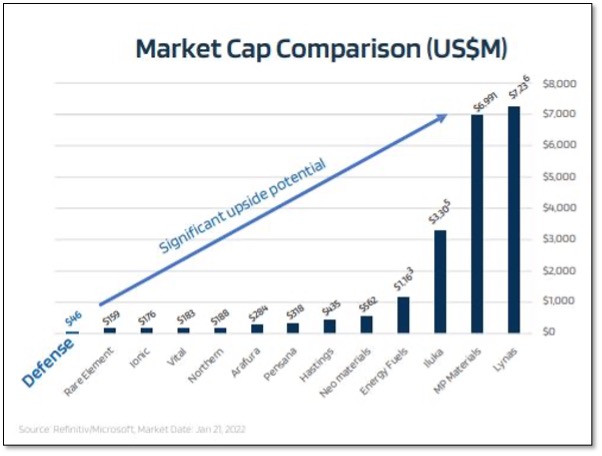

| And, as the graph below demonstrates, Defense Metals is woefully undervalued compared to its peers.

|

| Consider this: Although Wicheeda could produce approximately 10% of the world’s annual rare earths, Defense Metals currently has a market cap of only around US$50 million.

MP Materials produces about 16% of the world’s REEs and has a market value of about US$7 billion.

|

|

|

Companies with projects that are not nearly as advanced as Defense Metals are trading at multiples of Defense’s current market cap.

That undervaluation makes Defense a prime choice to re-rate as the U.S.-China trade war heats up.

|

| Great Timing

|

| To help it achieve that re-rating, Defense Metals recently became part of Discovery Group, a team responsible for some of the biggest winners in the recent past.

Discovery Group has raised over C$1 billion for its affiliated companies and has concluded more than C$2.6 billion in M&A since 2002, the most recent deal being the C$1.8 billion takeover of Great Bear Resources by Kinross Gold.

|

| Defense Metals’ addition to the Discovery Group fold gives it access to capital sources and expertise that should bode well for the company as it seeks a higher profile for Wicheeda.

|

| The upcoming resource update for this world-class rare earth resource could alone be a key catalyst to jump-start Defense Metal’s market valuation, along with the growing requirements for U.S.-friendly rare earth sourcing.

|

| But add in the geopolitics of China’s export restrictions on gallium and germanium as the first steps in a critical metals trade war, and this situation becomes urgent.

|

| In short, you’ll want to do your due diligence on Defense Metals now. Start by reviewing the technical reports filed on SEDAR and available on the company’s website.

|

| CLICK HERE

To Learn More about Defense Metals

|