| This could be the next silver elephant to hit the market... |

|

| Please find below a special message from our advertising sponsor, Silver Elephant Mining Corp. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

The Next Silver Elephant?

|

|

The record shows that some of the biggest winners in the junior mining market have been silver plays with big resources and a few other key ingredients.

So what’s the next big silver winner?

With a flagship project containing tens of millions of ounces of high-grade silver — and a new gold-silver project with 94-meter intercepts — the well-named Silver Elephant (ELEF.TO; SILEF.OTCQX) ticks all the boxes.

|

|

Gold futures just marked the highest quarterly close in history — yet another piece of evidence indicating a major new bull run in gold.

|

As exciting as that may be, experienced investors know that silver typically moves more than gold in a classic bull market, providing much more profit potential.

|

And with silver recently beginning to out-perform gold, it seems the long-awaited big move in the white metal is on.

|

But smart traders also know that high-quality silver stocks offer even more potential than silver itself.

And this is the key to doing just that: Finding a silver company that understands the leverage comes from expanding silver resources in the ground…and buying such a company at an early stage.

In that regard, it’s hard not to consider Silver Elephant Mining Corp (ELEF.TO; SILEF:OTCQX), which has not one but two quality silver projects under its belt.

And as you are about to see, even with two potential silver elephants already in the stable, the company is on the hunt for even more.

|

Flashback: Silver Standard Resources Of 2001

|

Many experienced junior mining investors fondly remember buying a silver company named Silver Standard (back then the symbol was SSRI, not the current SSRM) at C$1.50 a share in 2001. By June 2002, it had gone to $7.00…before hitting $15.00 in 2004 and $30.00 in 2007!

|

|

Get this: During the entire six-year, 2,000% run, SSRI had no silver production, no revenue, and no profit to speak of!

You see, investors were drawn to Silver Standard’s silver resources in the ground, which were ultimately estimated at around a billion ounces, from the various silver projects they acquired and expanded.

Their operating mindset at the time: Why mine silver at low prices in exchange for fiat money, when that silver could be kept safely in the ground in anticipation of much higher prices to come?

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Could This Silver Junior Be The New Silver Standard?

|

The management team at Silver Elephant is operating from the Silver Standard playbook by drilling to expand its flagship Pulacayo project and the newly acquired Triunfo project, while looking to further acquire pre-production-stage silver assets which may be slightly out of money at current silver prices.

As Joaquin Merino, Silver Elephant’s VP of South American operations, stated in the company’s recent Triunfo project acquisition announcement, “We want our shareholders to own as much silver in the ground as possible.”

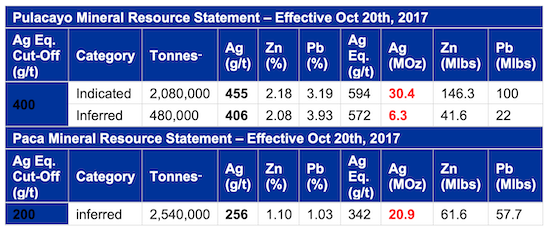

Mr. Merino, a professional geologist who started his career with Hecla, led a team that outlined, from scratch, 30.4 million ounces of Indicated silver and 27.2 million ounces of Inferred silver resources at the Pulacayo-Paca project before that project was acquired by Silver Elephant in 2015. Mr. Merino believes there’s a lot more silver at Pulacayo, as only 30% of the known mineralization had been drilled.

|

|

Mr. Merino joined Silver Elephant in 2019 and feels the newly acquired Triunfo project will be another a big success.

“Historic hole TR-001 returned 94.2 meters grading 0.39 g/t gold, 21.8 g/t silver, 0.65% lead, 0.39% zinc, (0.95 g/t gold-equivalent *) based on the prior operator’s SEC 10K fillings. Only 20% of the property was explored.”

Mineralization outcrops at the surface and continues for at least 750 meters, in three discrete blocks, in the east-west direction with widths varying from 20 meters to 150 meters. The deposit remains completely open at depth and to the east, where there are numerous artisanal gold workings. The Triunfo Project has access to power and water, and is accessible by road year-round.

|

A Deal Maker With Strong Financial Backers

|

Silver Elephant was founded by John Lee, CFA, who is the company’s chairman and known as a smart deal maker and prolific fundraiser. Lee is one of the well-positioned survivors coming out of the long metals bear market.

Sprott disclosed a 9% stake in Silver Elephant in late 2019, and the Nine Point gold fund is also a large shareholder.

A combination of two highly prospective silver projects, a proven exploration team and a deal maker backed by top-tier financiers is a powerful recipe for success.

|

Here’s The Opportunity...

|

Silver Elephant Mining Corp is currently trading around C$0.35, for a market capitalization of around C$45 million.

This is one-twentieth (1/20) of the value of its neighbor, New Pacific Metals, with its massive new Silver Sand discovery in Bolivia.

While you can’t compare the two companies at this point in terms of resources, the market value of New Pacific clearly demonstrates the value proposition of a growing silver resource in a country that is rapidly re-opening to foreign investment.

And there’s news to come: Gold and silver assay results expected late this month from two Pulacayo drill holes and several dozen chip samples taken from surface and the tunnels at Triunfo.

Considering a silver market that appears primed for substantial gains ahead — and the proven leverage of silver juniors with large, growing resources — smart investors will want to check out Silver Elephant Mining Corp before the rest of the herd discovers it.

|

|

CLICK HERE

To Learn More About Silver Elephant Mining Corp

And Its Growing Silver Resources

|

|

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |