|

| These are heady times for silver bugs. |

| The precious metal is trading at levels not seen since 2011 — and apparently headed much higher — yet the small universe of silver equities has yet to fully come along for the ride.

The window is closing, but there’s still time to get in on good silver stories before they start delivering serious leverage on the uptrend for silver. |

| Clearly one of the most exciting ones that’s emerging from the pack is Silver47 Exploration (AGA.V; AAGAF.OTC). |

| Silver47 is about to close on a merger of equals with junior silver darling Summa Silver...and that transaction will instantly create a U.S.-focused, development-stage silver company with a massive 245-million-ounce silver-equivalent resource spread over three projects. |

| Best of all, recent trading levels suggest an enterprise value per silver ounce for the merged company of just US$0.32 per in situ ounce! |

| With the transaction set to wrap up within days, silver investors will want to have Silver47 Exploration on their radars as we move into the busy fall season for the metals. |

| Merged Company Will Boast A

Massive Silver-Equivalent Resource |

| Again, the new Silver47 will have a global, U.S.-focused resource of 245 million silver-equivalent ounces spread across three projects in Alaska, Nevada and New Mexico.

Those are the key projects in what will be a six-project portfolio for the company. Their combined resources will consist of 236 million ounces of inferred silver-equivalent at an average grade of 334 g/t and 10 million ounces of indicated silver-equivalent at an average grade of 333 g/t.

So this portfolio boasts not only size, but grade as well. But in addition to the enhanced capital markets profile and liquidity this newco will offer, its three core projects all offer significant expansion potential via the drill bit. Between this possibility for organic growth and management’s intention to stay active on the acquisition front, Silver47 has a real chance to hit its goal of hosting a billion ounces silver-equivalent in this upcycle for silver. |

| Red Mountain:

Obvious Room To Grow |

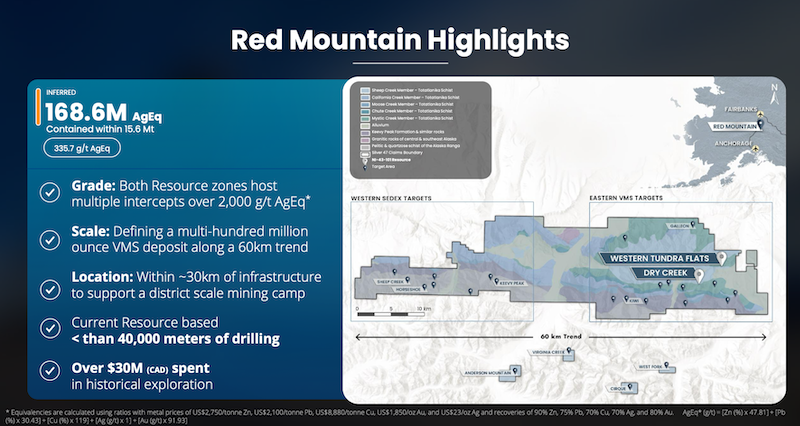

| The lion’s share of Silver47’s global silver-equivalent resource comes from its Red Mountain volcanic massive sulphide (VMS) project in Alaska. The current resource for Red Mountain is based on less than 40,000 meters of drilling and hosts 168.6 million ounces of inferred silver-equivalent resources at 336 g/t AgEq. |

| Again — we see that this project offers size, high-grades and tremendous potential for growth. |

| Consider that the resource lies within just two zones so far in a project that encompasses an extensive 60-kilometer trend...and each of these zones have generated multiple intercepts grading more than 2,000 g/t silver-equivalent. |

|

| Click image to enlarge

The polymetallic resource at Silver47’s Red Mountain project contains 168.6 million tonnes of inferred silver-equivalent resources, with great potential to grow much larger. |

| Plus, there’s a critical metals component to the Red Mountain story: Its polymetallic resource hosts five of the most domestically scarce minerals in the U.S., including zinc, antimony and gallium.

Management’s goal is to increase the project’s 15.6-million-tonne resource to 18 million tonnes, with an upside of up to 20 million tonnes. Drilling will begin soon to test this potential. |

| Hughes:

An Historic

Nevada Silver District |

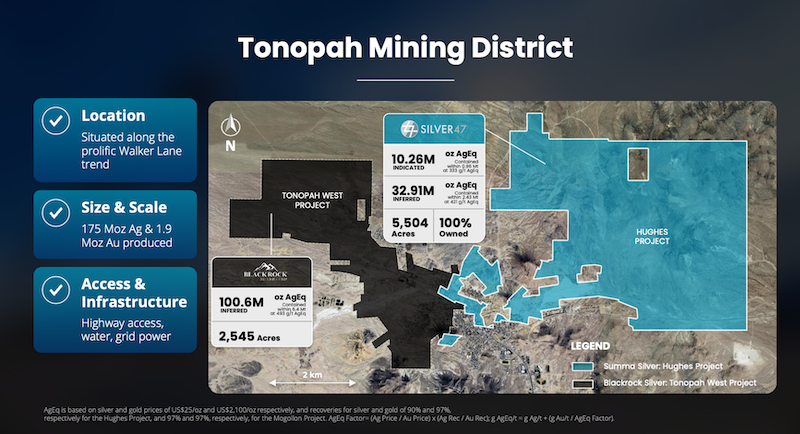

| Adding to Silver47’s allure is the Hughes project in Tonopah, Nevada that the company will inherit from Summa Silver.

The Tonopah silver district is the state’s second most prolific silver district after the Comstock Lode, having produced more than 175 million ounces of silver and 1.9 million ounces of gold. |

|

| Click image to enlarge

The Hughes project lies on the east side of Nevada’s historic Tonopah Mining District and hosts a large, high-grade silver-equivalent resource. |

| Hughes contains 10.3 million indicated silver-equivalent ounces and 32.1 million inferred silver-equivalent ounces. Inferred tailings contain an additional 2.74 million inferred silver-equivalent ounces. |

| The project has outstanding access to infrastructure and assays pending that could significantly expand the existing, high-grade silver-equivalent resource. |

| More drilling at Hughes is planned for early 2026. |

| A Mexico-Like Epithermal Silver Vein Field

In New Mexico, USA |

| Last but not least, there’s the Mogollon project in New Mexico, which will also come over from Summa Silver. |

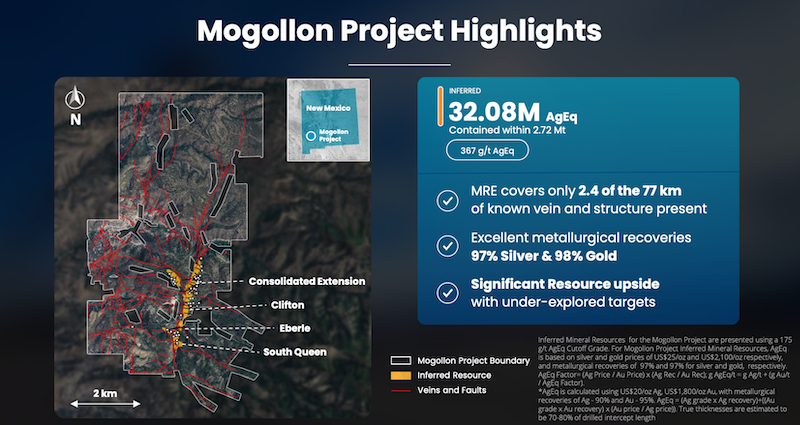

| Mogollon hosts 32.1 million ounces of inferred silver-equivalent and lies within what Silver47’s Galen McNamara considers “one of the great remaining vein fields still left in the United States.” |

| As the myriad red lines in the map of Mogollon below make clear, this project hosts a robust, epithermal vein field similar to the legendary silver vein systems of Mexico. |

|

| Click image to enlarge

The 32.1-milion-ounce inferred silver-equivalent resource at Mogollon covers just 2.4 km of a 77 km vein field. |

| The current resource estimate for Mogollon covers just 2.4 kilometers of 77 kilometers of known veins and structures there, so the expansion potential here is obvious.

Silver47 will follow up on that potential with a drill program planned for the fall. |

| Significant Re-Rate Potential Just Ahead |

| You’re reading that right, the new Silver47 exploration will conduct drilling programs on all three of its flagship projects over the next nine months. |

| Those programs will give the company the opportunity to stay top-of-mind with investors and to demonstrate the growth potential of Red Mountain, Hughes and Mogollon...all while the price of silver could continue to soar. |

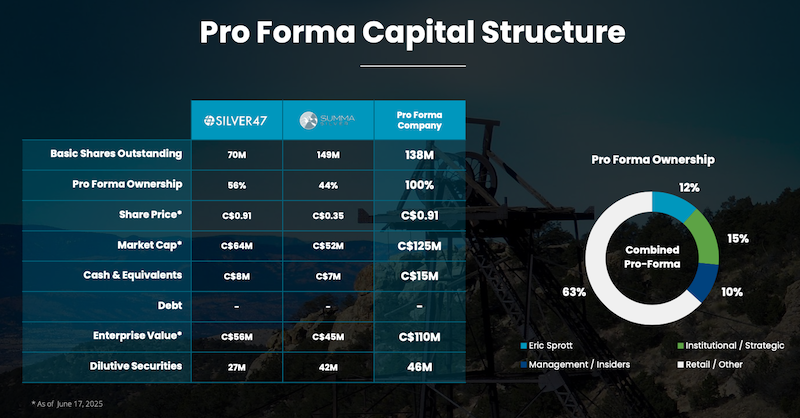

| As the pro forma capital structure below indicates, the new Silver47 will have a market cap of roughly C$125 million and a hefty cash position of C$15 million. |

|

| Click image to enlarge

The merged Silver47 Exploration will have a market cap of roughly C$125 million and a cash position of C$15 million. |

| Backed by institutional and strategic investors including the inimitable Eric Sprott, Silver47 Exploration is about to emerge from the merger as an undervalued (and rare) U.S.-focused silver play, one valued at US$0.32/oz. of silver equivalent in the ground.

Given the bullish environment the silver market will likely provide in the coming months, you’ll want to begin conducting your due diligence on Silver47 now. |

| CLICK HERE

To Learn More about Silver47 Exploration Corp. |