| Found: Overlooked leverage on rising gold prices |

|

| Please find below a special message from our advertising sponsor, African Gold Group. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

How To Leverage A

Gold Bull Market

|

|

The history of gold bull markets shows that companies with

“ounces in the ground” and near-term or ongoing production are often among the sector’s most popular stories.

Offering clear optionality and near-term production leverage,

African Gold Group (TSX-V: AGG; OTC: AGGFF) is a compelling bet on what promises to be a multi-year bull run for the yellow metal.

|

|

Want visual proof we’re in a gold bull market? Check out this five-year chart of the gold price.

|

|

After trading sideways for much of the 2010s, the yellow metal made a decided break upward in 2019.

It’s a trend that continued into March 2020, when the Covid lockdowns hit and cratered gold prices (along with the prices for just about every other asset out there).

Then the monetary and fiscal responses came online, pumping unprecedented amounts of liquidity into the financial markets and the broader economy.

All of a sudden, long-term trends of currency depreciation and negative interest rates were dramatically accelerated, ushering in a parabolic phase for gold prices.

As a result, gold bugs have seen their holdings in gold companies of all sorts deliver dramatic gains over the past few months.

|

But that doesn’t mean you can no longer find value in the market.

| That’s a point amply proved by African Gold Group (TSX-V: AGG; OTC: AGGFF), a company with a compelling, development-stage project in gold-rich West Africa that’s currently trading at a fraction of its inherent value.

|

Profitable Project With A Clear Path To Production

|

So far, the market has overlooked AGG and the potential of its Kobada project in Mali.

But as more generalist investors pour into this sector, that’s likely to change…and fast.

The reason is simple: These are the companies most likely to convert higher gold prices into cash flow and profits, making them a more risk-protected play than explorers.

A key factor in African Gold Group’s potential is the economics it's recently generated in an updated feasibility study on Kobada.

|

The numbers are remarkable. This construction-ready project boasts a post-tax IRR of 41.1% and a post-tax NPV, discounted at 5%, of US$226 million.

|

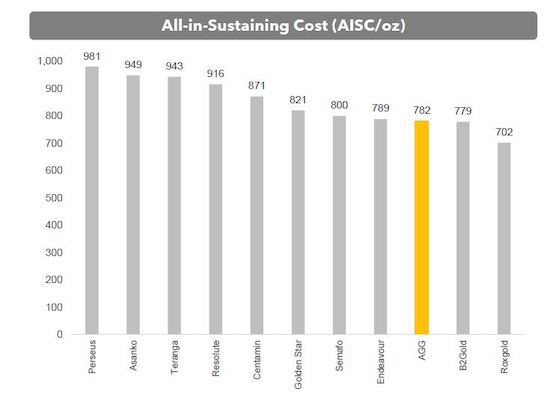

And, as the chart below indicates, the company’s operating costs would come in on the low end of West African gold projects, a fact which would make for a highly profitable operation under the current gold price regime.

|

| | AGG’s Kobada project would be one of West Africa’s lowest-cost gold mines |

Point of reference: African Gold Group’s current market cap is around C$30 million (US$22 million).

In the mining world, development-stage companies tend to see their market caps close the gap with the project’s valuation as it moves closer to a construction decision.

If fully realized, this trend would result in a 10-fold gain from AGG’s current valuation.

But even if the market only partially re-rates AGG in the short-term, a market cap two or three times current levels would not be surprising, especially in the current red-hot market environment.

Let’s take a look at how straight-forward this investment argument is….

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Lay-Up To Add Gold Ounces

|

If you’re looking for a simple and compelling path to far greater value, African Gold Group certainly fills the bill.

Consider that its Kobada project offers an opportunity to quickly boost project reserves (currently 754,000 ounces) with a straightforward drill program to prove up the inferred oxide resource outside of the pit boundary at Kobada.

This deposit’s global gold resource is well over two million ounces (1.2 million ounces measured and indicated and 1.1 million ounces inferred).

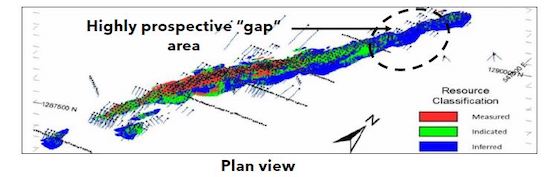

And just by drilling the blue area highlighted on the deposit map below, AGG could quickly add up to 575,000 ounces to the open-pittable oxide resources at Kobada.

|

| | Plan view of the deposit at Kobada |

These are shallow ounces that, if added to Kobada’s reserve base, could provide another short-term boost to AGG’s share price.

And that’s just the low-lying fruit at Kobada — there are many promising but less-explored targets on the 30 kilometers of shear zones identified on the project.

| |

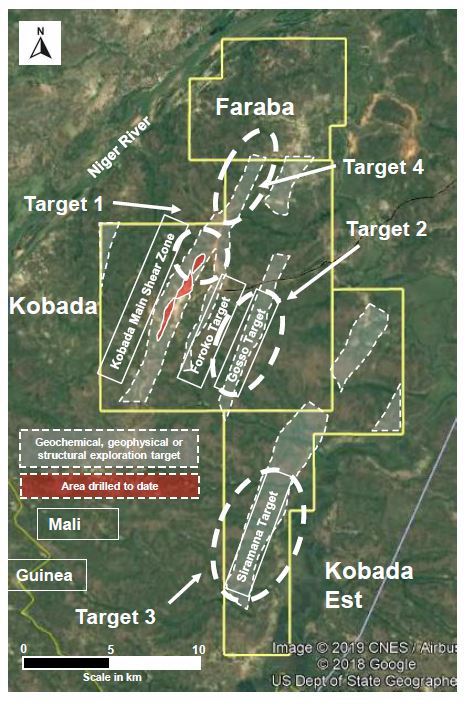

Surface work on the property package surrounding the deposit area at Kobada has identified at least five target areas with the potential to significantly grow the existing deposit’s resources.

Those targets are highlighted in the map below (the red area in the middle represents the deposit area, as currently defined).

|

| | AGG has outlined multiple exploration targets on Kobada |

As you can see, this deposit area lies along only part (four kilometers) of the Kobada Main Shear zone’s 12 kilometers of strike.

Indeed, the Target 1 area just northeast of the deposit provides a ready target for resource extension.

With the mineralization at Kobaba typically occurring near the surface, a drilling program could assess all these targets in fairly short order.

In short, given the prospectivity of West Africa for open-pittable gold, the odds are very good for more resource growth via the drill bit.

| |

Simply put, African Gold Group offers gold investors an overlooked gem that looks due for a substantial re-rating as the gold bull market advances.

The paths to share price growth are many:

|

• The generalist investors that the rising gold price will attract to this tiny sector could latch onto AGG’s near-term production story (the company could make a construction decision by the end of this year and begin pouring first gold by Q2 2022).

• Sustained higher gold prices could push the market to reassess Kobada’s economics based on the feasibility study’s $1,760/ounce case ($329 million NPV and 56% IRR, after-tax) as opposed to the current, $1,530/ounce base case.

• Optionality: Kobada boasts more than two million ounces of gold in the ground. In a gold bull market, the value the market assigns to those in situ ounces tends to go up…often quite dramatically.

• Exploration upside: Between the short-term potential to add significant oxide ounces to Kobada’s mine plan and the longer-term potential of its myriad exploration targets, large-scale resource growth via the drill bit is more than a possibility, it’s likely.

|

Again…so far…the market is not recognizing AGG’s potential.

But given gold’s bright prospects and the many ways to win this story offers investors, that oversight could get rectified any day now.

For those looking for a high-potential lever on the yellow metal, African Gold Group is a compelling opportunity at current levels.

|

|

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |