The Right Discovery Story At The Right Time

Allegiant Gold (AUAU.V) (AUXXF. OTCQX) was already one of the most highly regarded, long-term exploration plays in Nevada.

But when Goldcorp wrote a big check to back the company just a few days ago, savvy investors are now wondering if they should position themselves for the short term as well.

Dear Fellow Investor,

Nothing in the junior exploration game pays like discovery.

Companies that find new gold deposits usually see their share price multiply several times over.

But discovery is inherently risky. So, what can a company do to increase the odds in its favor while hedging against the possibility of a few drill-hole misses?

Well, if you were going to put together a plan to maximize the chances of discovery, while protecting investors downside, you’d follow ALLEGIANT’s game plan.

This company has checked all the boxes when it comes to building a discovery story:

• Backing from smart money players, including a gold industry major?

Check: ALLEGIANT is raising C$4.9 million to explore for gold on its Nevada projects. That total includes a C$2.1 million equity stake from Goldcorp, one of the largest and savviest players in the gold mining industry.

• Looking for gold in a fertile jurisdiction for multi-million-ounce deposits?

Check: Long-time investors know there’s no better jurisdiction for gold exploration and production in the world. According to the Nevada Bureau of Mines & Geology, Nevada’s historical gold production was 222.7 million ounces through 2016, leading most nations by a large margin.

• Led by a “been-there, done-that” management team?

Check: ALLEGIANT’s CEO Andy Wallace is also the principal of Cordex, a company founded by John Livermore, who discovered the Carlin Mine and helped put Nevada on the map as a gold district. Simply put, Wallace is one of the most successful and highly regarded gold explorers in Nevada history.

• Downside protection from advanced stage projects?

Check: ALLEGIANT’s Eastside project in Nevada has almost one million ounces of NI-43-101 compliant and historic gold resources.

• Discovery “bets” spread across multiple projects with solid news flow?

Check: ALLEGIANT is drilling no less than six different, high-potential projects in a major gold exploration program that starts next month!

Follow The Smart Money

When it comes to gold exploration stories, you want to follow the smart money whenever you can, and you have that opportunity with ALLEGIANT.

The company is not only raising close to C$5 million in a private placement, but roughly C$2.1 million of that investment is coming from Goldcorp. Goldcorp does not make thoughtless bets on exploration.

When Goldcorp is involved, you can be sure that they performed detailed due diligence on ALLEGIANT’s projects and management team.

In a sign of how interested majors are in this part of the world — and ALLEGIANT in particular — Goldcorp is taking close to a 10% equity stake in ALLEGIANT.

That money will fund exploration drilling on at least six of ALLEGIANT’s projects, of which Goldcorp will have right of first refusal on North Brown, Red Hills, Monitor Hills and Hughes Canyon projects.

Widely Regarded As The

World’s Greatest Gold District

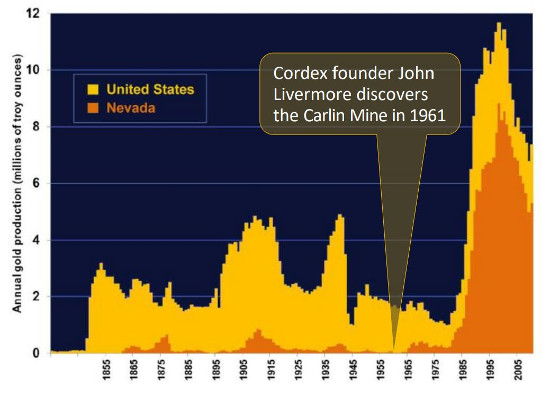

Take a look at this graphic of gold production in the U.S. and Nevada.

It tells you everything you need to know about the importance of Nevada to the United States’ (and the world’s) gold production.

Not only that, it clearly shows the importance of Cordex to Nevada and U.S. gold production.

Consider that it was John Livermore’s discovery of the Carlin Mine in 1961 that thrust the state to the pinnacle of U.S. gold production. In 2016, the U.S. was the fourth largest gold production nation in the world and nearly 75% of it came from Nevada.

At 4.55 million ounces, Nevada’s production alone accounted for 5.0% of total world mine output in 2016.

Combine that productivity with a mining-friendly environment that recently enacted streamlined permitting, and you have the makings of one of the world’s greatest gold mining districts...

...And the perfect place to make a new blockbuster gold find.

A Track Record of Multi-Million-Ounce Discoveries

Of course, it doesn’t hurt, when looking for gold in a district like Nevada, to have a management team that has had a hand in some of the state’s biggest gold discoveries. And that’s certainly the case with ALLEGIANT.

ALLEGIANT has a long-standing exclusive relationship with Cordex, a private company that is credited with eight gold discoveries in Nevada. Five of those happened under CEO Andy Wallace’s management, including the five-million-ounce Marigold Mine, the 12-million-ounce Stonehouse/Lone Tree Mine and the Daisy Mine.

Major Cordex Discoveries in Nevada

Wallace has assembled a team that knows Nevada geology and knows how to pick projects with the most potential to host significant discoveries.

Now, with the Goldcorp-infused private placement under its belt, ALLEGIANT will have the chance to get out there and make a new Nevada gold discovery!

Free Discoveries

When you’re in discovery mode, it never hurts to have an established deposit to cover your company’s current market cap. And at the Eastside gold project, ALLEGIANT certainly has that.

The Original Zone at Eastside hosts an NI-43-101 compliant resource of 721,000 gold equivalent ounces. That deposit, combined with a number of other targets on Eastside’s district-scale property, gives Allegiant a solid base to fall back on.

Some might argue that ALLEGIANT’s C$20 million market cap only takes into consideration the compliant resources at Eastside, with no value being given to discovery upside. Essentially, new ALLEGIANT investors get all that discovery upside for free (and paid for, in part, by Goldcorp).

Bet With The Proven Winners

The cash infusion from Goldcorp and other well-heeled investors will fund a 10-month drill program on six of ALLEGIANT’s projects, beginning in August.

Goldcorp and ALLEGIANT are using a “bet on black” strategy with this program, spreading their bets over North Brown, Red Hills, Monitor Hills, Hughes Canyon, Adularia Hill and Silver Dome projects.

Plus, ALLEGIANT will continue to drill projects outside of the Goldcorp alliance.

With the drills set to produce a steady flow of results, now might be the time to align yourself with some of the smartest players in the gold industry.

For profits in the mining industry, discovery stories are in a class by themselves.

And considering the projects and people it has to offer — plus the timing of drilling right now — ALLEGIANT is one of the best discovery stories you’ll find, in this (or any) market.

CLICK HERE

To Learn More about Allegiant Gold

|