July 24, 2024

Dear Fellow Investor, |

| A couple of days ago I predicted that we had another week or two of sideways trading before gold was ready to take off again.

|

| As of a couple of hours ago, I thought that the yellow metal wasn’t waiting any longer — the U.S. stock market was in the midst of a swan dive, Treasury yields and the Dollar Index were lower, but gold, silver and mining stocks were trading nicely higher.

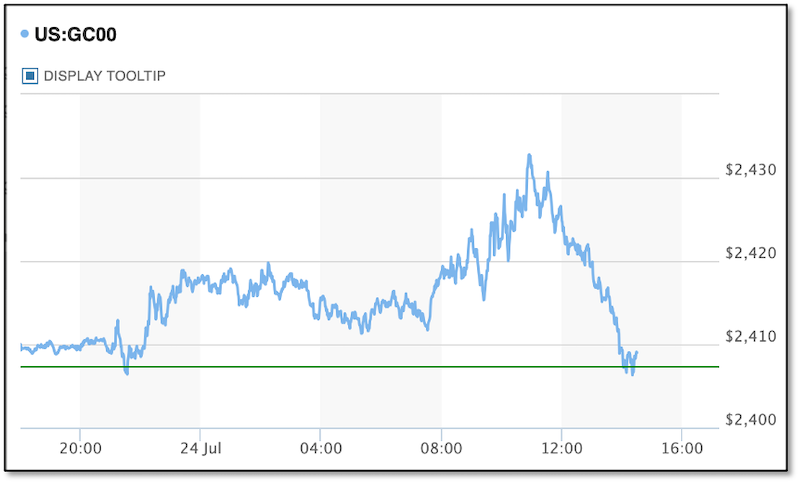

Since then, gold has given up most of its gains, and it’s not hard to see why. Here’s today’s gold chart, basis the active futures contract:

|

|

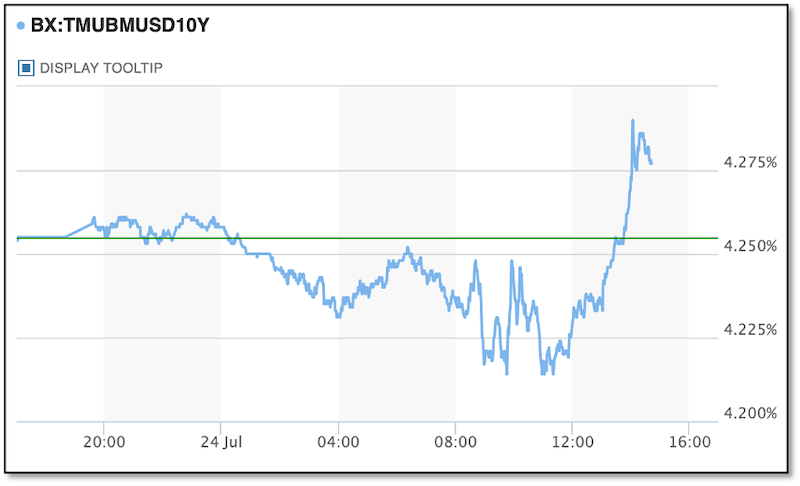

| And here’s today’s chart of the 10-Year Treasury yield:

|

|

| As you can see, gold was up as much as $25 before a spike in Treasury yields sent it lower.

|

| As to what’s driving yields higher, it seems that as the U.S. equity sell-off gained steam today, margin calls spawned a liquidity crunch that forced investors to begin selling whatever they could...with Treasurys and gold topping the list.

|

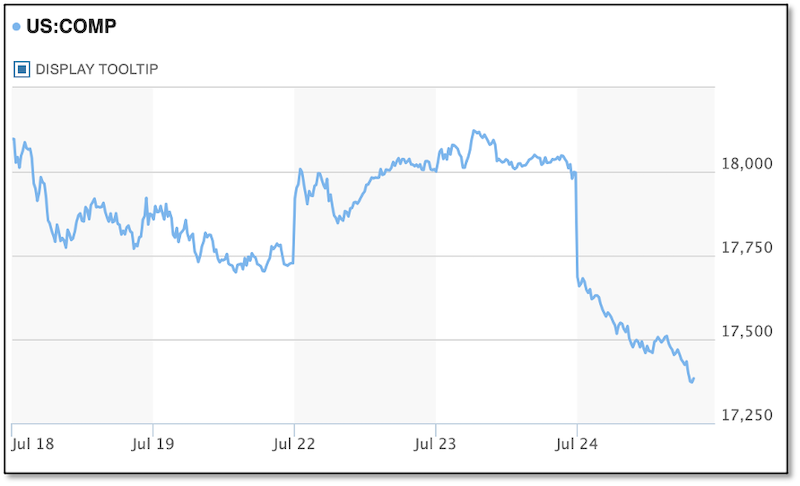

| For some context on how the stock sell-off hit hard and gained momentum, look at this five-day chart of the Nasdaq:

|

|

| With a drop of 3.4% as I write, this is the worst day for the Nasdaq since 2022.

|

| Is this the beginning of a new stock-market crash — the latest financial crisis that will force the Fed to not only begin rate cuts, but urgently drive rates lower?

|

| We’ll see soon. And while it was encouraging to see gold rising as everything else was falling early on in today’s session, it’s important to note that everything will get hit, and hard, in a true liquidity vacuum.

Good luck trying to trade that phenomenon. My advice is, if metals and mining stocks go on the bargain rack, take advantage of it to buy as much as you can.

Because the inevitable rescue plan by the Fed and other central banks will quickly send these assets catapulting higher.

|

| One of those assets that is in the early stages of a bull market, and for entirely different reasons than gold, is copper.

|

| As you know, I’m a huge bull on copper, because the supply/demand drivers for the metal are irrefutable and inescapable. I fully expect the price to double over the next four years or so as a steep demand curve runs headlong into severe supply constraints.

That’s why well-positioned copper equities may be the surest way to profit in commodities over the next few years.

Which is why you need to tune into an exciting webinar for this coming Monday....

|

| “Transforming Copper Exploration”

|

| I’ve been wanting to explore the exciting fundamentals for copper in a webinar for some time.

|

| But if you “drill down” (pardon the pun) into the copper mining sector, you see that there have also been some exciting new developments in exploration that promise to transform the industry.

|

| If you’re a junior mining investor, you need to get up to speed on these innovative new technologies and approaches. And that’s why I’m moderating a panel this coming Monday featuring two of the top executives in the industry — Alistair Waddell of Inflection Resources and Claudia Tornquist of Kodiak Copper.

Both of these experts are on the cutting edge of copper exploration, and they’re going to bring us to speed on the latest advancements in the industry, and how they’re impacting junior explorers around the globe.

You won’t want to miss this event, so I urge you to register now and make sure you’re able to catch it live at 1:00 Eastern/12:00 noon Central/10:00 a.m. Pacific this coming Monday, July 29th.

Just click on the link below to register.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Register For

“Transforming Copper Exploration”

Monday, July 29th

1:00 p.m EDT/12:00 noon CDT/10:00 a.m. PDT

|

| CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

|