| The world’s undergoing a Green Revolution...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| |

.png) | | Green Needs + Falling Supplies = Huge Opportunity For Metals Investors

| |

| New mines are becoming harder to find and build, which had the world headed towards metal shortages.

...Then the green transition boosted demand for copper, silver, lithium, nickel, uranium and many other metals dramatically.

The result:

An immense opportunity for investors who are positioned.

| | By Gwen Preston and Peter Krauth

| | Editor’s Note: I'm pleased to once again bring you some fantastic insights from Gwen Preston, publisher of the Resource Maven letter and, more to the point, co-publisher of the exciting new Evergreen Investing newsletter.

Produced with another top analyst, Peter Krauth, Evergreen Investing focuses on the amazing opportunities now emerging in the green investing trend.

In the following message, Gwen and Peter explain how metals are a key element of the unstoppable green transition — a fact that virtually guarantees much higher prices...and profits for those who invest wisely now.

I hope you enjoy their views on this trend — and the opportunity they present for you.

— Brien

| | |

July 27, 2023

Dear Fellow Investor, | | Every wind turbine uses some 215 tons of steel.

| | Every electric vehicle needs 2.5 times more copper, twice as much manganese, and 180 kg of new metals compared to internal combustion engine vehicles.

Solar panels don’t work without silver.

| | The hard truth is that going green does not mean using less metal. In fact, the opposite is true: The green transition is dramatically increasing global metal needs.

| | This isn’t an unnoticed consequence of green decisions that will be “fixed.” It can’t be fixed.

There is simply no alternative to copper for moving electricity. Of the many kinds of batteries, many require lithium and almost all require a lot of nickel. Rare earth elements power is integral to the magnets that enable many green machines.

And so, metals are a green investment. And they are a perfect way for your portfolio to benefit from the green transition, which is now an unstoppable force, because a decade of underinvestment has left metal prices too low to motivate new mine builds. As a result, there is not enough metal being produced for the green transition to happen.

You read that right: We need higher prices for many metals, especially copper, silver, nickel and zinc, so that miners can build the new mines needed to fill green metal demand.

| | In a recent issue of Evergreen Investing, I illustrated how dramatically green needs are boosting metal demand and explained why miners haven’t yet risen to this challenge. I’m sharing that commentary with you today.

| | For subscribers, I then described the ways one can invest in metals. And I named two funds that I’m buying as low-risk exposure to the green metals opportunity.

If you like the idea of investing in metals ahead of a green-driven bull market, Evergreen Investing can help you. We write about the energy sources, technologies, capital mechanisms, commodities and innovations that power the Green Revolution.

And we add new low-risk stocks to our portfolio every month. Subscribe to a monthly or annual subscription and see our current picks in clean energy, agri-food, metals, infrastructure, and carbon credits.

| | Green Needs Metals

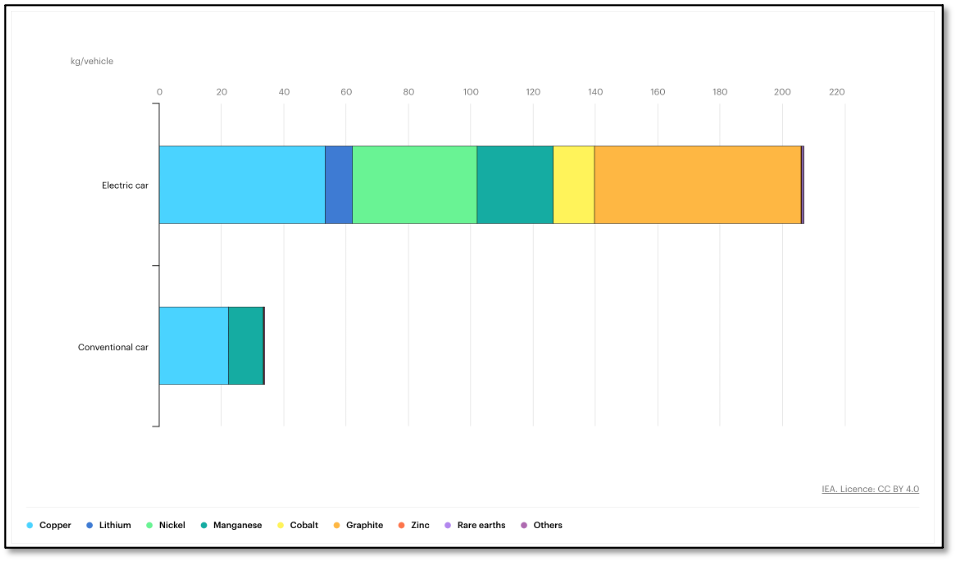

|  | | This graphic is a good illustration of how green and metal go hand in hand.

A conventional car uses 22 kg of copper and 11 kg of manganese. An electric car needs:

|

- 53 kg copper

- 9 kg lithium

- 40 kg nickel

- 24.5 kg manganese

- 13 kg cobalt

- 66 kg graphite

- 0.5 kg of rare earth metals

| | I’m not here to argue for or against EVs. I’m here to highlight investment opportunities. EVs are a rapidly growing part of how people and goods move.

And they use a lot of metals.

Of course, green metal needs go far beyond EVs. A single 3-MW wind turbine uses 335 tons of steel, 4.6 tons of copper, 3 tons of aluminum, and 2 tons of rare earth elements (in the magnets).

A solar panel works when sun energy causes electrons in silicon to detach. A coating of silver paste carries this current to a battery or power line. And silver is the only option for the task: It conducts electricity better than any other metal, it’s fire safe, and it’s light.

Each two-square-meter panel uses 20 grams of silver today, but it’s become clear that more silver is better. As a result, silver loading on solar cells is expected to double in the next few years while solar installations soar, a double whammy that has solar on track to demand all the world’s current silver production by the end of the decade. (That’s not an option, if you’re wondering, because there are many other industrial and investment applications that also need silver.)

Hydro dams use all kinds of copper. Transmission lines to move power from dams and turbines and solar installations to final destinations use immense amounts of copper and aluminum. The list of green metals needs goes on and on.

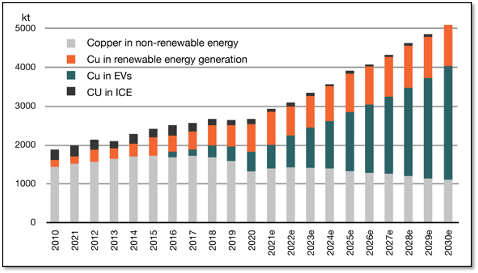

|  | | Using the International Energy Agency’s Net Zero by 2050 Roadmap, the world needs to increase production of platinum group metals, copper, lithium, nickel, vanadium, cobalt and graphite by 30% to 85%. Other estimates project even larger supply gaps and include silver and molybdenum on the list.

| | | | Why Is The World Short On Metal?

| | The green transition is boosting metal demand significantly but that’s not the only reason we’re facing big supply gaps for many metals.

| | The other reason is that supplies have not grown anywhere near enough over the last decade.

| | Let me dive into the weeds for a moment. Building a large new mine is a massive endeavour. It takes a very long time – at least a decade and often longer – to find the right deposit, drill enough holes to understand it, engineer how to mine it, permit that mine, find construction capital and then build the mine.

And it takes huge money – hundreds of millions of dollars to get to putting shovels in the ground and then a billion or more to build.

The number of projects getting this time and money keeps declining. And the projects that are being advanced are getting smaller, because smaller projects are a bit less time consuming and expensive. The charts below show what I mean: back in 2008 there were 60 copper projects moving towards development that collectively would produce 4.8 million tonnes per annum but by 2020 there were only 36 projects on the list that would collectively produce only 1.7 million tonnes a year.

| | | | There are three reasons for this trend.

| | 1. Investors have not been interested in metals. Since the Great Financial Crisis and then far more since the COVID crash, investors have leaned into tech, biotech, and market indices – and gotten great returns, at least until 2022. That meant no one cared about metals.

2. Management teams have been actively conservative. Miners overbuilt and overspent in the last metals bull market (2007-2012). To correct, mining execs shifted focus from growth to profit. That meant cutting way back on new builds.

3. Permitting keeps getting harder. Even those projects that are being advanced are taking longer to get to construction because permitting is so slow and expensive…if it happens all.

| | These apply across the mining sector.

So: Dramatic green demand is coming up against production declines across the mining space.

It’s a perfect storm…for higher metal prices.

If you want to learn how to add some low-risk exposure to this huge opportunity to your portfolio, you can learn more about Evergreen Investing here or subscribe for a monthly or annual subscription. You’ll get monthly insights and news updates that matter to Evergreen investors.

| | | | | © Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd.

#185

Metairie, LA 70002

1-800-648-8411

| | | |