Tesla’s eye-popping rise has certainly been one of the stories of the post-shutdown market bounce.

|

And for good reason. As the chart below shows, a company with an already outsized market cap has more than quadrupled in value since March.

|

|

| TSLA has more than quadrupled from its March lows |

Analysts are positing all sorts of drivers for Tesla’s sudden ascent.

|

• The massive injection of liquidity into the market by the Fed

• The explosion of retail day-trading on platforms like Robinhood

• Tesla’s profitability advantages over traditional carmakers

|

All these elements have likely played a part, but so has the fact that the Green Revolution and EV sales growth remain ascendant in investors’ imaginations.

Not only is EV production surging worldwide, but the drive from Tesla and other EV manufacturers to increase range-per-charge is increasing the intensity of lithium use.

It all adds up to strong demand growth for lithium for years, even decades, to come.

Closer to home, U.S.-China trade tensions are sending Tesla and other manufacturers scrambling for stable supplies of the energy metal.

|

It’s a situation tailor-made for Alpha Lithium (ALLI.V; ALLIF.OTC), which has quietly secured a premier property in the heart of Argentina’s corner of the Lithium Triangle.

|

Nestled among some of the industry’s largest players, Alpha’s Tolillar project gives the company leverage on the global scramble to lock down stable lithium supplies.

|

Long Term Supply-Demand Equation In Lithium’s Favor

|

And that scramble is global — the Tesla and U.S. side of the story, potent though it is, represents just one piece of a race to electrify that involves Europe and China as well.

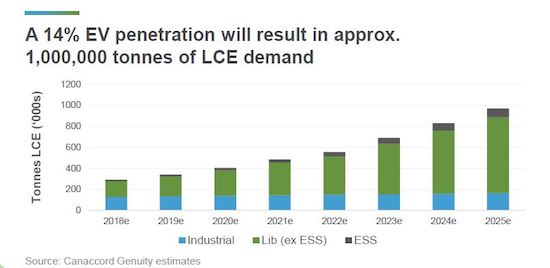

Consider this: A recent report by Cannacord Genuity estimates that EV penetration will reach 14% of global vehicle sales by 2025.

|

|

| Projected lithium demand through 2025 |

The chart above demonstrates why the long-term picture for lithium remains so bright.

As the lithium industry struggles to bring consistent supplies of the energy metal online, the demand for it is only going up, up, up in the years ahead.

Recent worldwide demand for lithium, which is typically tracked as tonnes of lithium carbonate equivalent (LCE), was over 350,000 tonnes.

Assuming the 14% EV penetration rate proves accurate, that demand is estimated to spike nearly triple to 1 million tonnes LCE by 2025.

|

That 650,000-tonne increase would require fully 26 new mines (25,000 tonne/year average) to come online by 2025.

|

And given the complications involved in bringing a new lithium operation online, the supply constraints on that level of demand increase are significant.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Key Property Within The Lithium Triangle

|

Those constraints are what make Alpha Lithium’s ability to lock up the Tolillar project in Argentina so critical.

|

For those new to the lithium space, the Lithium Triangle where Tolillar is located is considered the Saudi Arabia of lithium production.

|

The brine-hosted lithium extracted from the salars of this region — where the borders of Chile, Bolivia and Argentina meet — account for fully 36% of global LCE production.

|

|

| Alpha’s Tolillar project lies within Argentina’s corner of the Lithium Triangle |

At 27,500 hectares, the Tolillar project is vast and has never been extensively explored.

However, the private owners who previously owned Tolillar successfully produced lithium concentrations up to 504 mg/L in borehole samples.

Equally important, as the map below highlights, the project lies close to active operations and players that in some cases, sport market caps north of $1 billion.

|

|

| Tolillar sits next to key lithium players, which means needed infrastructure is already in place |

In the Lithium Triangle, it’s by no means a given that projects will have ready access to a local skilled workforce, high-grade roads, rail, airport/ trucking infrastructure and electrical/natural gas power.

Thanks to the presence of these larger players in the region, Tolillar has access to all these things…and this gives Alpha a much clearer path to production than a typical lithium junior.

|

Big Reasons For Excitement

|

That’s especially true given that Alpha’s core project isn’t just some barren “closeology” play. The Salar Tolillar has already been proven to host lithium brines.

That said, the prior owners didn’t have the resources to thoroughly outline a resource on the project.

Proof of this fact came recently in the form of modern geophysical surveying by Alpha that allowed the company to penetrate to deeper units than previously accessed by earlier work.

|

The upshot? The results have convinced company geologists that the project has the potential to host significantly more lithium brine resources than previously thought.

|

With drilling licenses recently approved, the company will soon embark on a program to test that theory.

If it meets with success, the company’s tight share structure could super-charge the share-price impact of good results.

|

The Importance Of Getting In Early

|

Tesla’s extraordinary performance has the market paying close attention to “downstream” lithium players.

That heightened market attention makes getting in early on a drill-ready story essential to maximizing your potential gains.

Alpha is set to drill Tolillar in the back half of the year, making now the time you’ll want to position yourself in the company.

|

Alpha knows the brines are there. They know where to look for more, and the long-term supply-demand situation is very much on lithium’s side.

|

Add it all up, and Alpha Lithium (ALLI.V; ALLIF.OTC) is a compelling bet on a Green Revolution that, even in the face of Covid, continues to march on.

|