|

| It’s a hybrid model for exploration that’s made for this gold market.

|

| Headwater Gold (HWG.CN; HWAUF.OTC) combines the prospect generator model of mineral exploration with 100%-owned, self-funded projects.

For those who are new to mining, prospect generators are junior explorers that use their early-stage exploration savvy to lock up quality projects and then find partners to fund the more expensive aspects of exploration, like drilling.

|

| The advantage of prospect generator model is it allows the prospect generator to minimize dilution and financing risk with partner funding on projects in exchange for an interest in those projects.

The advantage of self-funded exploration is that the junior usually retains 100% of the upside of exploration on that project.

|

| Headwater Gold enjoys the best of both worlds with its large project portfolio located in the western United States and centered in the prime exploration trends of Nevada. The company is on the hunt for high-grade, low-sulphidation epithermal deposits in this part of the world.

|

| As you’re about to see, it has attracted a major to fund work on several of those projects...and it has kept a handful of projects to itself to explore on its own nickel.

|

| This hybrid model is working: Headwater has already made one discovery and looks likely to make more as exploration progresses, making this the perfect time to look at adding it to your portfolio.

|

| Major Exploration Deal With Newmont

|

| The joint venture deal that Headwater Gold has with Newmont on four of its Nevada projects promises to deliver a wealth of near-term news flow.

Newmont inherited the deal with Headwater when it took over Newcrest in late 2023.

The market seemed to be concerned that Newmont wouldn’t be interested in continuing the deal, but Newmont recently reaffirmed its commitment to exploring the shared projects, particularly the flagship Spring Peak gold project where it has committed to a 7,000 meter drill program for 2024 and green-lit the doubling of the land package.

|

|

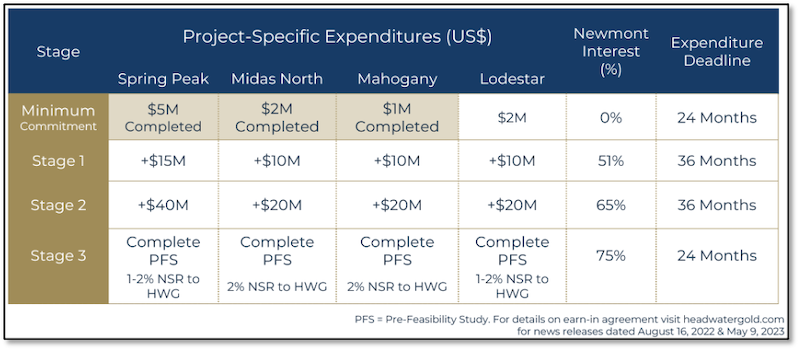

| Click image to enlarge.

Large ongoing exploration commitments to advance Headwater Gold’s Projects.

|

| Newmont has 24 months (36 months for Spring Peak) to spend $10 million on the four projects.

The above table shows the expenditure levels for Newmont to achieve a 51% interest in these projects, as well as the levels to reach a 65% interest and a 75% interest on each.

|

| In essence, Newmont has an option to spend between $30 million and $60 million each on developing these projects to the prefeasibility stage.

Headwater will retain a free carried interest in the projects all the way to prefeasibility where it will also be granted a royalty.

|

| Why would Newmont agree to such a deal?

Because Headwater is exploring for high-grade gold in Nevada, and that’s what gold majors like Newmont want.

|

| Headwater Actually Posted A Profit In 2023 —

An Exploration-Stage Rarity

|

| This joint venture deal is a big win for Headwater Gold, as it gets paid a 10% management fee for its work on the shared projects.

That’s money that goes right back into the company’s treasury.

|

| In fact, Headwater posted a profit in 2023 thanks to this fee, a rarity in the cash-burning world of junior exploration.

|

| Simply put, the company has maintained a high level of activity with minimal dilution, and done it all by being cash flow positive.

|

| Active Drilling On Spring Peak

|

| As mentioned, the flagship project in the JV deal is the Spring Peak property.

The project is located along the Walker Lane Trend in western Nevada, adjacent to the big, historic Aurora district that Hecla Mining now owns and is advancing.

|

|

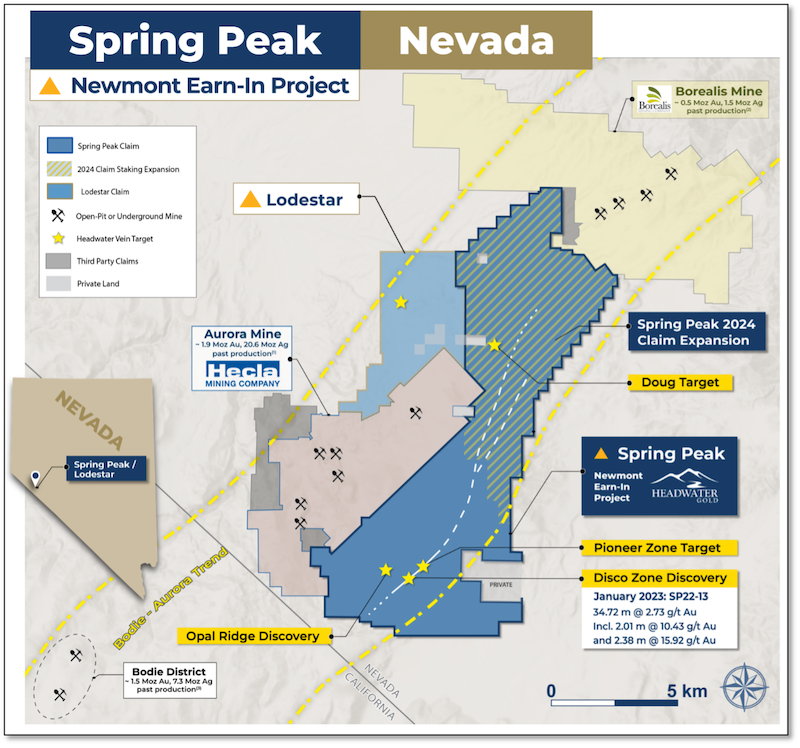

| Click image to enlarge.

Spring Peak is the jewel in Headwater’s crown of Nevada gold properties.

|

| Prior to the Newmont acquisition, Newcrest funded two drill programs on Spring Peak in 2022 and 2023.

|

| These programs led to the discovery and expansion of the Disco zone, which now spans 400 meters in strike and remains open to the northeast, southwest, at depth and up-dip.

|

| Newmont and Headwater are currently conducting a 7,000-meter, 2024 drill program at Spring Peak that will look to build on highlight intersections from the Disco Zone like 15.9 g/t gold over 2.4 meters.

In a sign that Headwater and Newmont like what they’re seeing from Spring Peak, Headwater recently doubled its land position in the area. There’s now 13 kilometers of strike extent in the historic district.

Simply put, the partners are intent on finding a Newmont-sized asset at Spring Peak and have the land package and exploration budgets required to pull this off.

|

| Upside From 100%-Owned Projects

|

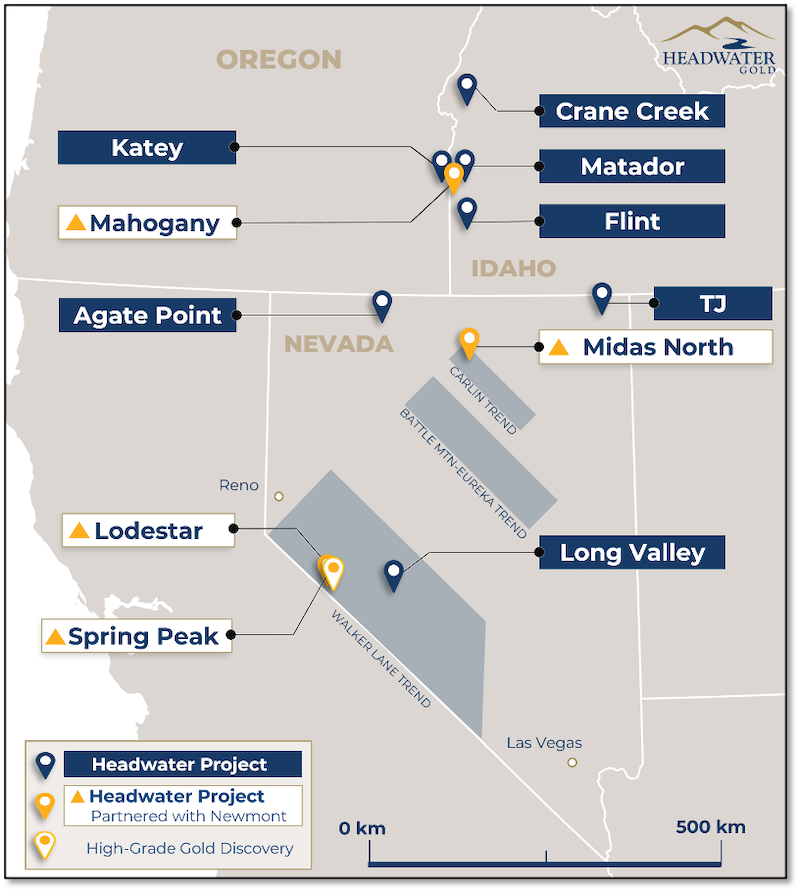

| While Headwater is getting paid to explore and grow Spring Peak, it is also conducting greenfields exploration on its seven 100%-owned projects in Nevada, Idaho and Oregon.

These are high-quality projects with little or no royalty burden.

|

|

| Click image to enlarge.

In addition to its joint-ventured properties, Headwater is advancing seven 100%-owned gold properties.

|

| Many of these projects are drill-ready with epithermal vein targets. Historically, Headwater has drilled one or two 100% funded projects each year and intends to continue this pace of exploration.

In addition to news flow from work on these projects, there’s also the possibility Headwater will make a splash with potential new projects, thanks to the company’s history of dynamic activity on the acquisition front.

Many wonder how Headwater has been able to build such a large high-quality portfolio of properties. This is largely due to a proprietary database the company has built and a team of local experts that have been able to identify these potential high-grade gold systems.

|

| The Drills Are Turning Right Now...

|

| Bottom line: Newmont and Headwater are actively drilling the highly prospective Spring Peak project...

...And drill results from that program are due out soon.

If you’re looking for a prime catalyst for a gold exploration company, drill results from a premier target in Nevada are just what you want. And given the gold grades that this project has already produced, Spring Peak could soon deliver more high-grade assays in the days just ahead.

Add in a potential drill program on the partners’ shared Lodestar project and the activity on Headwater’s 100%-owned projects, and you have a junior explorer that could take off without any help from gold prices.

|

| But good results when gold is reaching for record highs? You couldn’t wish for more.

|

| Headwater Gold has the team, the business model, the projects, the financial strength and the catalysts to be one of the biggest winners in the current gold bull market.

And with drill results just ahead, the time to learn more is now.

|