|

The legal cannabis market, expanding at its current rate, will grow 350% in the 10 years from 2017 to 2026. It should be at $15 billion next year and $20.9 billion by 2022.

That’s big, right? Well, the market for CBD is growing EVEN FASTER.

CBD is short for cannabidiol. It is a non-psychoactive substance found in cannabis and hemp. And it has proven medical benefits. Unlike THC — the compound that produces the high in cannabis — CBD doesn’t make people feel “stoned.”

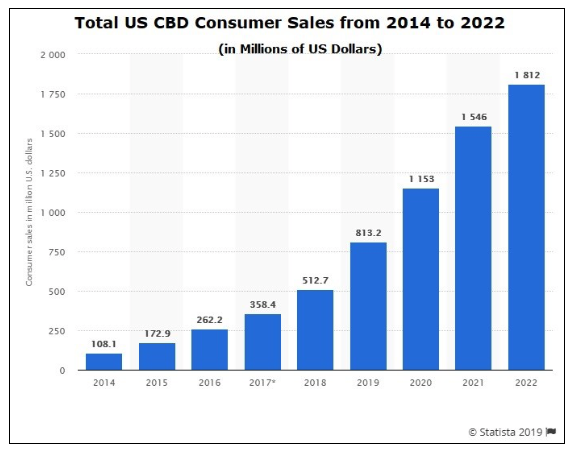

The U.S. hemp-based CBD market was worth $358 million in 2017. It’s worth about $813 million now. By 2022, it should be worth $1.8 BILLION.

That’s growth of 405%...or a compound annual growth rate of around 40%. Wow!

Select companies that are leveraged to CBD could do very well.

And as luck would have it, Uncle Sam is clearing the road for CBD profits...and giving you a golden opportunity to buy on the cheap.

From Blue Grass to Hemp Grass

The 2018 Farm Bill (aka, the Agriculture Improvement Act) legalized hemp on the federal level. It explicitly allows the transfer of hemp-derived products across state lines. It also puts no restrictions on the sale, transport or possession of hemp-derived products...like CBD.

Hemp contains very little THC and a lot of CBD. As long as it has less than 0.3% THC and is grown by licensed farmers, hemp is legal.

Why did this happen? Because Kentucky Senator Mitch McConnell believes the Bluegrass State could become a center of hemp agriculture in America.

“At a time when farm income is down and growers are struggling, industrial hemp is a bright spot of agriculture’s future,” McConnell said when the bill passed.

The Farm Bill also says that any chemicals like CBD derived from hemp will be legal if the hemp is produced by licensed growers in a manner consistent with government regulations.

CBD is already finding medical success in Epidiolex, an anti-seizure medicine developed by GW Pharmaceuticals (NYSE: GWPH). That opened the door to FDA regulation of CBD. For now, the agency says CBD is not allowed as an ingredient in food, drinks or dietary supplements.

A Cloud Could Lift

That’s why CVS and Walgreens can sell CBD oil, but not CBD-infused drinks. But the FDA will allow CBD in cosmetics, oils, tinctures and other supplements. Weird, huh?

The FDA said it plans to expedite federal rules and regulations on CBD. We’ll see the new rules potentially by the end of summer or early fall.

And once regulations are in place, that will lift a cloud from over companies that market CBD.

All that sounds good, right? But in the meantime, the FDA is looking over CBD marketing as it exists now, and it doesn’t like what it sees.

Marketing Smackdown!

The FDA sent a nasty letter to U.S. cannabis company Curaleaf (OTCQX: CURLF) letting management know that some of the claims the company makes about CBD on its website are not backed up by science.

In its letter, the FDA gave a laundry list of Curaleaf claims that explicitly or implicitly say their products can treat ADHD, anxiety, pain relief, Alzheimer’s, Parkinson’s disease, cancer, schizophrenia, fibromyalgia, eating disorders and PTSD.

Mind you, a lot of people say that CBD does help these problems. But the science to back up such claims is very thin. A LOT more research will need to be done to suit the FDA.

Anyway, this angry letter hammered Curaleaf’s share price. The company says it will reply to the FDA within 15 working days, and will work with regulators to clear this up.

The funny thing is that CBD is a small part of Curaleaf’s business. It’s a multi-state operator (MSO) with seed-to-sale cannabis operations in a dozen states, and more on the way. So, if you think things will work out for Curaleaf, that’s a buying opportunity.

But you have to read between the lines. Curaleaf is the largest MSO in the U.S. What the FDA was doing was firing a shot across the bow of all CBD manufacturers and marketers.

I think the FDA is trying to throw a good scare into these companies. Mission accomplished.

Another One In The Bargain Bin

In the meantime, there is collateral damage. And it’s at Charlotte’s Web (OTCQX: CWBHF).

Charlotte’s Web produces and markets hemp-based CBD. It gets all its revenue from CBD sales. So, you can bet that when the FDA slapped Curaleaf, Charlotte Web’s share price also felt the pain.

As an old friend of mine on Wall Street used to say, “When the paddy wagon comes along, it takes the good girls downtown along with the bad.”

But Charlotte’s Web doesn’t make the same kind of claims that Curaleaf does. Its marketing is masterfully crafted. It’s written by people who are selling to customers who know what they’re buying.

So, Charlotte’s Web’s smack-down seems especially undeserved.

The bottom line is I think BOTH of these companies are on sale. One has a problem it can fix. The other just got smacked for no good reason.

And once those regulations are in place, these two companies — and other CBD makers — could do very well indeed.

The CBD Wave Is Coming

After all, celebrities are lining up to use CBD for whatever ails them. And I’m not just talking stoners like Willie Nelson, or people who got hit in the head a lot like Mike Tyson.

Yes, both endorse CBD. No surprise, right? But I’m also talking about …

• Dancer Mandy Moore, who uses CBD on her feet to help with pain caused by high heels.

• Actor Morgan Freeman, who uses it to ease fibromyalgia and severe muscle pain.

• Golden State Warriors basketball coach Steve Kerr, who uses CBD for chronic pain.

• Actor Tom Hanks, who treats anxiety with CBD. He’s also teamed up with Cornell University to study how CBD can help those with Type 2 diabetes.

I will bet you dollars to doobies that every CBD maker in North America wants to be the brand America comes to trust. The Colgate of CBD. Just as others want to become the Miller of Marijuana...or the Coca-Cola of Cannabis.

Future profit potential in select hemp, cannabis and CBD-leveraged companies is wide open. That’s why it’s such an exciting time to invest in this space.

All the best,

Sean

P.S. I’d like to invite you to attend Weiss Ratings’ first-ever “Million-Dollar War Room,” a series of webinars that I’m hosting starting on Monday, Aug. 5. At these exclusive events — free for Golden Opportunities readers — I’ll discuss new opportunities in what I’m calling the “Cannabis Boom 2.0,” or the second wave of cannabis profits.

For more details, just click here. Hope to see you there!

|