| A high-potential drill-hole bet in two of the hottest districts around |

|

| Please find below a special message from our advertising sponsor, Alianza Minerals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Playing With The House’s Money

|

|

This red-hot mining bull market is hungry for discovery plays.

With two drill programs with the potential to deliver market-moving results within days, Alianza Minerals (ANZ.V; TARSF.OTC; T921.F) could be just what investors are looking for.

|

|

There are two basic models junior explorers can follow on the path to discovery.

|

The more common one is the “flagship project” model, where a company owns one or two core projects and then seeks funds to test those projects with the drill bit.

The other model is prospect generation, in which companies leverage exploration expertise (and/or deep knowledge of particular jurisdictions) to build large portfolios of early-stage projects.

To fund the more expensive aspects of exploring those projects (i.e., drilling), prospect generators typically form partnerships with more well-heeled mid-tier and senior miners.

While the “flagship project” model offers a company more control over when and how a project gets explored (and more exposure to an individual discovery’s upside), the prospect generation model gives shareholders more tickets in the lottery and generally a better chance for success.

In a gold bull market, prospect generators with the best chance of delivering outsized gains for investors have three things in common:

|

1) Strong property portfolios

2) Significant joint venture partnerships

3) Active exploration programs.

|

But add in another factor: For even the most devout prospect generator, some projects pack so much potential and have such obvious targets begging to be drilled…that the company decides to go ahead and poke the holes themselves.

Some of the biggest success stories in mining exploration have followed both paths simultaneously.

And another is now poised to do the same…

Because with an ongoing, JV-funded drilling program on a gold project in Nevada and a self-funded drill campaign coming soon on a high-grade silver target in the Yukon, Alianza Minerals (ANZ.V; TARSF.OTC; T921.F) could make big news within days.

|

Exploration’s Version Of “Betting On Black”

|

If you’ve ever played roulette, you know that one lower-risk strategy is to bet that the “pill” will land on either a black- or red-colored pocket.

Prospect generators’ large exploration portfolios are analogous to “betting on black” (or on “red,” if that’s your preference), with the potential for success increased by spreading a company’s bets over multiple projects.

|

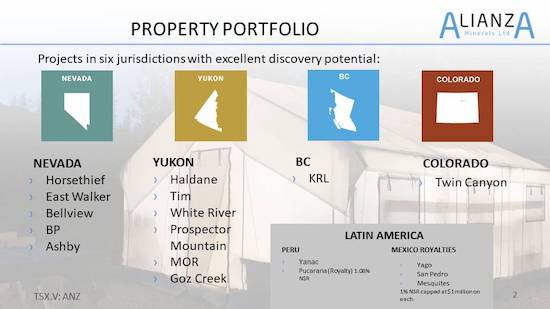

Alianza’s extensive property portfolio, which includes projects spread across five safe mining jurisdictions in the Americas, provides an excellent case in point.

|

As you can see from the graphic below, the company’s portfolio is focused on the Cordilleran regions of North and South America and includes projects in Nevada, the Yukon, British Columbia, Colorado, Peru and Mexico.

|

|

Key projects within that portfolio include:

|

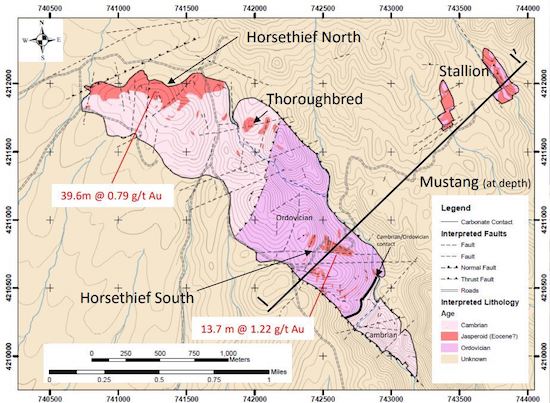

• Horsethief: Located in southeastern Nevada, this project is prospective for the type of elephant-sized, sediment-hosted (Carlin-style) gold deposits that have made the state one of the world’s leading gold jurisdictions.

• Haldane: This high-grade silver target lies within the Yukon’s prolific Keno Hills silver district (217 million ounces of silver produced between 1913 and 1989 at an average grade of 1,149 g/t silver).

• Tim: Tim sits along Yukon’s border with BC and boasts high-grade trench results (10.2 oz/ton silver and 9.1% lead over 4 meters). The nearby Silvertip Mine is owned by Coeur.

• BP and Bellview: The projects lie on the southern edge of the Carlin Trend from which “Carlin-style” deposits get their name. Alianza sees similarities between these projects and other recent discoveries along this portion of the trend.

|

Joint Ventures With Deep-Pocketed Partners

|

A key part of the prospect generator model is finding those deep-pocketed mid-tier and senior miners to help get work flowing on as many projects as possible.

Alianza has cut joint venture deals on two of its key projects — Horsethief and Tim.

The option for Horsethief is with Hochschild Mining, a London Stock Exchange-listed miner with operations in Peru and Argentina.

Hochschild’s deal for Horsethief, signed in March 2019, gives it 5.5 years to earn a 60% interest by conducting US$5 million in exploration, including US$500,000 in the first 18 months of the deal.

Once it has achieved its initial earn-in, it may increase that interest to 70% by spending another US$5 million over three years.

|

| | At Horsethief, Alianza and JV partner Hochschild are on the hunt for the type of elephant-sized gold deposits for which Nevada is famous. |

It’s an ideal situation for Alianza, as the initial funding from Hochschild has paid for the current drilling program the partners are conducting on Horsethief.

|

Given Alianza’s low trading levels and the excitement surrounding good drilling results these days, good news from this Hochschild-funded program could send Alianza Minerals (ANZ.V; TARSF.OTC; T921.F) soaring.

|

Longer term, there’s also the potential that Alianza’s JV deal for Tim — inked with Silvertip operator Coeur Mining this past January — could pay big dividends as well.

Coeur can earn an 80% interest in Tim by spending C$3.55 million on exploration over five years, making C$575,000 in cash payments and completing a feasibility study by the eighth anniversary of the deal.

The key with both deals is that Alianza gets to advance its projects while keeping a significant piece of each project’s upside, all while conserving its cash hoard.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Drills Are Turning As We Speak

|

These deals mean Alianza gets to essentially play with the house’s money on Horsethief and Tim…and to retain enough money to drill its high-grade Haldane project on its own.

That program is slated to start soon.

Given the Keno Hills district’s long history of high-grade silver production (of which Haldane has played a part), high-grade assays from this program provide another near-term catalyst for Alianza’s share price.

|

First up, though, will be the initial assays from the first six holes Alianza and Hochschild have completed at Horsethief.

Those results are due any day now, with strong gold grades likely to spike ANZ’s share price.

|

Thanks to its prospect generator model, Alianza’s Haldane program provides a backstop to the story as does the company’s broader portfolio, which promises to attract more JV deals in the current red-hot market.

Simply put, ANZ is a low-risk way to speculate on short-term drilling success and long-term bull markets in gold and silver.

Buy Alianza Minerals (ANZ.V; TARSF.OTC; T921.F) for the drill-hole speculation. Keep it for the leverage it offers on rising precious metals prices.

|

|

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |