| Strong Hands Keep Buying Gold

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Strong Hands Keep Buying Gold

| | | Who’s likely to keep buying gold despite market turmoil?

The World Gold Council reports that central banks are still buying gold at a record pace...while Jan Nieuwenhuijs reveals that China is likely still buying aggressively.

| |

August 6, 2024

Dear Fellow Investor, | | With the markets in turmoil and gold holding up better than most assets, a big question facing gold bugs is where additional buying is going to come from.

| | There’s good news in that regard.

The World Gold Council just came out with its second quarter Gold Demand Trends report, and while it confirmed my suspicions of sustained demand, there were some surprises in where that demand came from.

According to the WGC, while the gold market saw mixed trends across various sectors over the second quarter, overall demand remained robust. Despite a 6% year-over-year (y/y) decline in total gold demand (excluding Over-the-Counter investment) to 929 tonnes, the inclusion of OTC investment pushed total demand up by 4% y/y to 1,258 tonnes. This marked the highest Q2 demand since the year 2000.

The surge in gold prices significantly impacted jewelry consumption, which plummeted 19% y/y to a four-year low of 391 tonnes. This decline overshadowed modest gains in other sectors. On the other hand, central banks continued their trend of net gold buying, increasing their purchases by 6% y/y to 184 tonnes.

| | That’s on pace for another record year in central bank gold buying, despite the widely (and seemingly erroneously) reported halt in purchasing by the People’s Bank of China (more on that below).

| | Global gold ETF holdings experienced a small decline of 7 tonnes in Q2, but this was a notable improvement from the 21-tonne drop in Q2 2023. Despite early outflows, the quarter ended with nascent inflows, signaling a potential recovery. Retail investment in bars and coins fell by 5% to 261 tonnes, primarily due to decreased demand from Western investors.

In contrast, the technology sector saw an 11% y/y increase in gold usage, fueled by the rising demand for AI-related technologies. While I discount gold industrial demand, it’s surprising to see AI demand for metals rising so quickly.

The London Bullion Market Association (LBMA) reported a record average gold price of $2,338/oz in Q2, 18% higher y/y, with the price peaking at a new high of $2,427/oz in May. Of course, that record has already been smashed.) The high prices, along with robust OTC investment (329 tonnes) and continued central bank purchases, contributed to the record levels.

| | Total gold supply also rose by 4% y/y to 1,258 tonnes, driven by record mine production of 929 tonnes and the highest recycling supply since 2012.

| | Looking ahead, the WGC anticipates a balanced outlook for the rest of 2024, with revived Western investment flows potentially offsetting weaker consumer demand and slower central bank buying compared to 2023.

That last point, however, contradicts the WGC's own data showing a record pace of central bank demand so far this year. It will be interesting to see how, and if, they peel back the layers as our friend Jan Nieuwenhuijs has to report on China’s surreptitious gold buys over the last two months.

On that note, let’s see what Jan has turned up this time....

| | So Is China Still Buying Gold — And Will They Continue?

| | As you know, I regard Jan as today’s top expert on global gold flows. He’s proven that again, coming out a few days ago with a stunning new report on the recent gold-buying efforts of the People’s Bank of China.

Gold’s last price correction was extended in early June by news that China had, apparently, neglected to buy gold at all in May. And then, in early July, we got news that they had not reported any gold purchases for June as well.

On the face of it, it seemed that the precipitous rise in the gold price had prompted China’s monetary authorities to stop buying gold at all.

At the time, I joined a few others in the market by noting that this didn’t mean they weren’t still buying gold, but merely that they weren’t announcing it. As I wrote in our July issue of Gold Newsletter (subscribe here),

| | “China’s move toward gold and away from the dollar isn’t a short-term tactic, but a long-term strategy. In the past, they’ve kept quiet about their gold accumulation for years, and the transparency of recent years has been an exception rather than the rule....”

| | Now Jan has uncovered evidence that, in fact, China has been buying all along...and was simply being quiet about it.

As his report shows, export data from the United Kingdom, gold import statistics into China and domestic gold production data show significantly greater gold flows than can be accounted for by Shanghai Gold Exchange (SGE) withdrawals (which represent domestic gold demand).

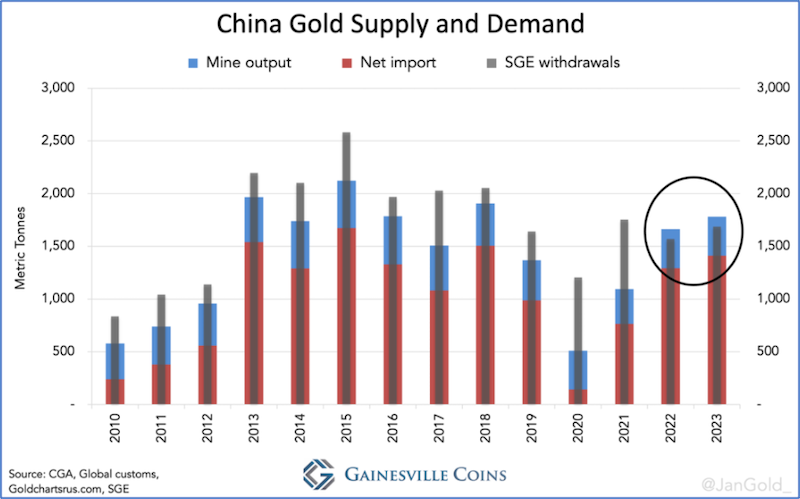

As you can see in this chart from his report, the only time in recent years when mine supply and net import have exceeded SGE withdrawals were in 2022 and 2023, when the PBOC bought record amounts of gold for its reserves.

|  | | Click image to enlarge

| | Thus, this situation is a clear fingerprint of PBOC gold buying.

To find out what’s been happening in recent months, when China has declined to announce any purchases, Jan consulted UK gold export data, which have historically shown a close correlation to announced PBOC gold purchases.

What has that indicated? As Jan writes,

| | “When the PBoC stated it had stopped buying gold in May 2024, after continuous purchases for 18 months, I didn’t believe it. The PBoC has few reasons to cease growing its gold reserves in the current geo-political and monetary landscape with a plethora of challenges.

“Probably, the PBoC wants the most gold for its dollars, so when the price rises fast it will signal it stopped buying, trying to cool the market. In the meantime, the United Kingdom exported 53 tonnes to China in May, of which likely most found its way to Beijing.”

| | If Jan’s data and conclusions are correct, and I have confidence they are, then instead of buying zero gold in May, China actually bought on the order of 50 tonnes. Rather than slowing down, they would be accelerating their purchases.

This means that, as Western investors are about to jump into gold with the Fed’s pivot, we may have both East and West buying gold together. That’s never happened before in the history of gold as an investible asset.

In other words, hang on through the current market mayhem, because the future moves in gold could be explosive — and to the upside.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

| | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |