Joe Biden is coming for Big Tobacco.

|

He wants to reduce the content of cigarettes to non-addictive levels and to get the FDA to completely ban menthol cigarettes.

On the consumer trend side of things, 70% of smokers want to quit smoking...but dislike current smoking alternatives.

|

Into this charged environment steps TAAT Global Alternatives (OTCQX: TOBAF / TAAT), a company whose non-tobacco-based alternative cigarettes give smokers the experience they crave, without the addictive qualities of nicotine.

|

As you’re about to see, TAAT is a product for the times, and one that you can jump on board in the early innings, before exponential growth leads to the possibility of a wealth-generating takeout.

|

A Nicotine-Free Way For

Smokers To Enjoy Smoking

|

With Big Tobacco facing a hostile administration and smokers themselves looking for ways to begin stepping away from their nicotine addiction, the TAAT brand of tobacco-free cigarettes is a product for its time.

TAAT cigarettes uses a patent-pending biomass product, called Beyond Tobacco®, that’s engineered to smell, taste and smoke like a regular cigarette.

|

| |

Current smokers who have sampled TAAT cigarettes have been thrilled to have an alternative to e-cigarettes, which lack traditional smoking’s physical and social cues.

|

Indeed, the fact that 70% of existing smokers won’t switch to e-cigarettes explains why vaping has been marketed primarily those new to nicotine (i.e., young adults and teens).

|

TAAT cigarettes, by comparison, are marketed squarely to existing smokers.

|

A $75 Billion Addressable Market

— Just In The U.S.

|

And from an investors’ perspective, TAAT Global Alternative’s brand of tobacco-free cigarettes stands ready to profit handsomely from Joe Biden’s War on Tobacco.

Consider these facts about TAAT’s addressable market:

|

• 34 million Americans are smokers, a $75 billion annual market

• The global market is vastly bigger, approaching $1 trillion

• With taxes and regulation pushing the average pack of cigarettes north of $10, most smokers are looking for way to save money on their habit

• The most popular cigarette type, preferred by 40% of smokers, is menthol...and menthol cigarettes are squarely on Biden’s hit list

|

TAAT’s Beyond Tobacco® formulation allows it to avoid the hefty excise tax placed on regular cigarettes. That means TAATs retail for around $5, or half the cost of regular cigarettes.

|

| |

Better still, if traditional menthol cigarettes do get banned, it will create a natural market for TAAT's menthol brand, which as a non-tobacco, non-nicotine product would sidestep the ban.

As a result, TAAT’s market opportunity is extraordinary. Consider that if TAAT can convert 1% of the U.S. market alone, that would result in $340 million in annual revenue.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

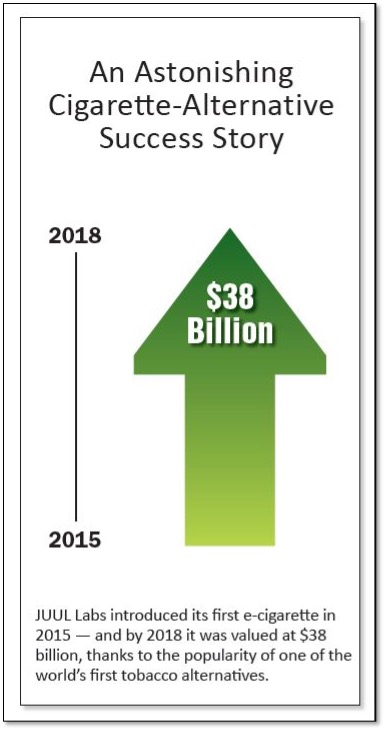

Exit Template: JUUL Goes From

Zero To $38 Billion In Just Three Years

|

For the window into the longer-term exit strategy for TAAT, consider the recent experience of e-cigarette maker JUUL.

|

JUUL’s e-cigarettes hit the market in 2015 and by 2018, they accounted for 72% of the market, with revenues hitting $2 billion.

|

But, as was mentioned, much of that success came as a result of attracting those new to smoking who didn’t want to smoke cigarettes.

Some 70%-80% of smokers who tried e-cigarettes went back to smoking traditional cigarettes because they missed the smell, taste and experience of smoking.

Still, JUUL proved so successful that the Altria Group took a 35% stake in the company in 2018 for $12.8 billion (for an implied market valuation of $38 billion).

|

|

And with Big Tobacco continually on the lookout for new, non-tobacco products to diversify its portfolio and respond to a hostile regulatory environment, TAAT Global Alternatives could become a lucrative takeout target of its own someday.

|

|

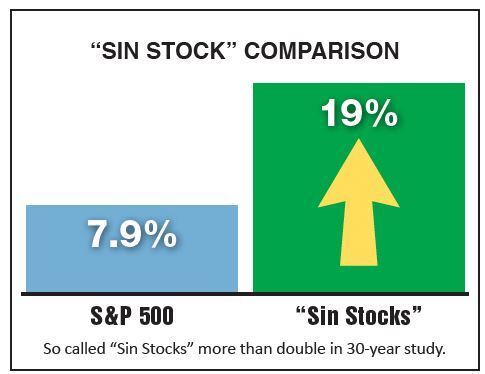

The investment case for “sin stocks” like tobacco (and alcohol and gambling and weapons manufacturing) is strong.

If you want to diversify your portfolio and make sure you own stocks that protect against the whims of the economy, owning a sin stock or two makes a great deal of sense.

And there’s even the possibility of beating the market…

The Journal of Portfolio Management shows that between January 1970 and June 2007, sin stocks generated an average annual return of 19%, or more than double the S&P 500’s 7.9% return over that period.

|

|

Are there investors who, for religious or moral reasons, won’t invest in sin stocks? Absolutely.

But most investors are comfortable with adults making adult decisions about their lives and have no problem owning a sin stock if the investment case makes sense.

|

|

That investment case certainly made sense to TAAT’s top management team, which comes predominantly from Big Tobacco.

|

• Founder Joe Dieghan, the developer of the Beyond Tobacco® product on which TAAT cigarettes are based, led the JJuice e-cigarette brand to a successful exit

• CEO Setti Coscarella was a lead strategist for Philip Morris’s Reduced Risk products. He knew the addressable market and when he saw what Joe Deighan had developed, he eagerly jumped ship to head up TAAT.

• Chief Revenue Officer Tim Corkum spent 21 years with Philip Morris and brings an in-depth knowledge of business development, sales strategy and key account management

|

It’s rare that a start-up attracts this kind of management firepower, but such is the draw of the cigarette alternative market.

Coscarella and Corkum willingly left Big Tobacco because they saw the trends toward cigarette alternatives and decided to bring their deep market experience to TAAT.

|

10 Reasons To Own

TAAT Global Alternatives

|

As you can see, the investment case for TAAT Global Alternatives is robust, and this short report has really only scratched the surface.

In parting, here are 10 Reasons to Own TAAT today:

|

1) Joe Biden has tobacco in his crosshairs, and if he gets his way, there will be a huge market opportunity for TAAT’s tobacco-free, nicotine-free cigarettes

2) Most smokers prefer the taste, feel and crackle of TAAT brand cigarettes to the e-cigarette experience

3) At roughly half the price point of traditional cigarettes, TAAT gives smokers a ready-made way to save money while weaning themselves from nicotine

4) If Biden succeeds in banning menthol cigarettes, it will create a ready-made market for TAAT’s menthol brand, which as a non-tobacco product would escape the ban

5) As a non-tobacco, non-nicotine product, TAAT has no restrictions on how it can advertise, market and merchandise

6) The TAAT selling proposition was so compelling, it convinced top talent from Big Tobacco to sign on to run the company

7) Big Tobacco is still big business: It’s a $925 billion global market and a $75 billion U.S. market

8) If TAAT can convert just 1% of U.S. smokers, it will be on track for $340 million in annual revenue

9) Beyond Meat, a meat-alternative brand, saw a 2,444.3% spike in revenue in just five years and generated a 445% gain for early investors. TAAT is poised to do the same or better for the tobacco-alternative space.

10) E-cigarette maker JUUL went from nothing to a $38 billion valuation in just three years. TAAT is similarly set up to become a potentially lucrative takeout target for Big Tobacco.

|

CLICK HERE

To Learn More about TAAT Global Alternatives

|