|

Editor’s Note:

Rich Checkan is the President and COO of Asset Strategies International, and long-time friend of ours and all precious metals investors. Few experts in the industry today boast his experience in the market and dedication to helping investors maximize their protection and returns in metals, and Rich has graciously agreed to provide his latest views to us today.

— Brien Lundin

Dear Fellow Investor,

For over three decades, we have been offering gold and other precious metals to clients as wealth insurance. Simply put, it is a store of purchasing power, in a liquid form, for a potential financial crisis you hope to never have.

I’ve had numerous conversations with clients over the years, and most of them tell me they want gold, silver, platinum, or palladium for insurance. But, when the price falls — as it has for the past six or seven years — they become upset that their metals lose value.

They forget it’s the U.S. dollar, gold’s measuring stick, that’s constantly fluctuating in value. They lose sight of the fact that, in the long run, gold and her fellow metals are doing exactly what they are supposed to do…storing purchasing power.

Before gold’s last bull run where it touched $1,900 per ounce, it was languishing around $253 per ounce. It paused along the way several times — at $500 per ounce, $750 per ounce, $1,000 per ounce, $1,500 per ounce, and finally around $1,900 per ounce. Today, gold is desperately trying to hold around $1,200 per ounce.

Yet, at every one of those price levels, at the time, an ounce of gold could buy a nice new business suit…just like it did in Roman times.

But, as I mentioned at the start, we tend to lose sight of the proper role of precious metals. We want wealth insurance, but we want profit, too.

Hence, it is no surprise to me that metals sentiment is the lowest in nearly 30 years. I believe that points to opportunity — but more on that in a bit.

Compounding The Issue

There’s another problem as well for investors.

Even though gold is typically your leader in the precious metals complex, the four metals don’t always move in tandem. Oftentimes, they succumb to their own, inherent supply/demand stressors.

Even though we tend to start with gold and add other precious metals for diversity in the asset class, we often don’t take that next step either because we don’t know the proper allocation, or we get spooked by individual variations in the price of the four metals.

Over the past 36+ years, we have seen all four metals take investors by surprise, reinforcing the value of owning some of each metal.

But how?

First, let’s look at a few notable examples…

Palladium Sets Records

The first example that comes to mind is in the late 1990s/early 2000s, when palladium went on a jaw-dropping tear. In the early 1990s, palladium was available for around $100 per ounce, but that soon changed as automakers began converting to palladium in place of the more expensive platinum, quintupling global demand to 2.4 million ounces from 1992 to 1996.

At first, due to a massive stockpiling of palladium in Russia, prices rose minimally. However, when Russian supply took a significant cut in 1997, the market got a shock, driving prices to $350 per ounce.

By Spring 2000, political uncertainty in Russia drove prices to $700 per ounce, sparking panic among automakers like Ford Motor Company, who still relied heavily on palladium. By the time palladium reached $1,094 per ounce in January 2001, Ford had nearly been driven out of business!

Eventually, changes in manufacturing decreased the palladium requirement, Russian supply stabilized, and price per ounce reverted to the mid-$100s by 2003. Since 2003, palladium has climbed steadily to its current level around $910 per ounce, supported by its expanding use in pollution control technologies and continuing supply constraints in regard to regions where it can be extracted.

Silver And Gold Reach All-Time Highs

About 10 years after palladium set records in the early 2000s, it was silver and gold’s turn, with silver taking the lead. With the U.S. still recovering from the 2007/2008 economic crisis and the Eurozone facing a breakup, confidence in the global economy was paltry.

Investors quickly turned to safe-haven assets like silver and gold. In late April 2011, silver recorded a high of $49.80 per ounce as concerns about the global economy skyrocketed.

A few months later, the gold price also surged, reaching levels just above $1,900 per ounce in September 2011, as investors pushed the price of the yellow metal to all-time highs. In just a couple years, gold prices soared from $800 per ounce in early 2009 to above $1,900 per ounce by Fall 2011.

How Do I Balance This Volatility?

Clearly, individual metals can be independently volatile during market shocks. Owning the appropriate balance of each is key to balancing highs and lows.

In the past, there has only been one way to take advantage of the benefits of all four metals — by buying each metal individually and selecting the allocation of each yourself.

Recently, Asset Strategies International added a unique method for investors to determine the proper diversification of gold, silver, platinum, and palladium. Because this innovative product was created in 2008 and patented in 2013, it already has a proven track record.

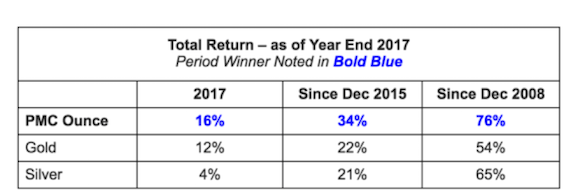

Known as the PMC Ounce™, or the Precious Metals Composite, it is composed of a fixed fractional quantity of gold, silver, platinum, and palladium. As you’ll see in the chart below, it’s even shown to provide greater returns than just gold and silver alone…

The PMC Ounce™ is not a fabricated coin, round, or bar. Each “Ounce” is backed by physical metal stored at a secure facility in your name. Below are just a few benefits unique to the PMC Ounce™…

1)Weighted and diversified

2) Blended return

3) Volatility control

4) Secure and insured storage

5) Real-time trading

6) Liquid

7) Convertible for delivery

8) Confiscation hedge

Take Advantage of This Hated Asset Class Now

Right now, precious metals are completely out of favor. The U.S. dollar is still showing some short-term strength. The stock market bubble — much like the dotcom bubble of the late 1990s — is desperately looking for a pin. It hasn’t found it yet, but it will.

It’s time to put the U.S. dollar’s temporary strength and precious metals’ temporary weakness to work for you. And the PMC Ounce™ is an excellent way to get started.

Please call 800-831-0007 or email us to learn more about this innovative way to invest in gold, silver, platinum, and palladium.

|