Nevada’s Next

Takeout Target?

A happy bit of luck landed the Tuscarora gold project in the lap of American Pacific Mining (USGD.CSE; USGDF.OB).

The company has hit the ground running on the Nevada project, with a drill program already turning up high-grade gold — and results pointing toward a much bigger discovery.

Dear Fellow Investor,

There’s a distinct pattern emerging in Nevada. And it’s making fortunes for well-placed investors.

You see, junior explorers and developers are acquiring projects and adding value via the drill bit. And, in the process, they’re attracting the attention of larger companies intent on acquiring Nevada’s most promising projects.

Three recent cases in point are:

1) Rye Patch Gold — Alio Gold acquired Rye Patch and its Florida Canyon project earlier this year in an all-share deal valued at C$128 million.

2) Klondex Mines — In July, Hecla Mining picked up the Nevada precious metals producer for US$153 million in cash and 75 million shares of Hecla.

3) Northern Empire Resources — Just last week, Northern Empire was rewarded for its work on its Sterling Gold project in Nevada with an acquisition offer from Coeur Mining for $90 million.

Early investors in all of these companies were able to multiply their money when the bigger companies opened their checkbooks.

One of the most recent junior explorers hoping to win a future beauty contest with larger industry players is American Pacific Mining.

The company just went public in March, and it is already garnering investor attention for work on its Tuscarora project in northeast Nevada.

American Pacific’s goal is nothing short of proving up a large gold resource on this high-value project and then finding a willing suitor to take the project (or the company) off its shareholders’ hands…but at a significant premium to current trading prices.

Landing Tuscarora

That Tuscarora was available for acquisition earlier this year was due to a bit of good fortune.

The selling company, Novo Resources, had turned up good drill results on the project in 2016, but then metal detector prospectors began to turn up gold on its Karratha project in Australia, and the company’s share price took off like a rocket.

With Karratha now clearly Novo’s flagship project, the company decided to sell Tuscarora to focus on developing its Australian project.

American Pacific’s management team had connections with Novo CEO Quinton Hennigh, and was able to work a deal for the project, which it acquired for C$375,000 in cash and 800,000 shares.

This was a project Hennigh was intimately familiar with, having drilled it both as head of Novo and as an exploration manager for Newcrest in the late 1990s.

He saw the potential for the project’s Navajo vein, which was mined along two kilometers, to extend under gravel cover. The results Novo produced in 2016 helped to validate that premise.

Drilling Turns Up High-Grade Gold

Located 35 kilometers northeast of Nevada’s prolific Carlin Trend, Tuscarora has yielded quite a bit of high-grade gold, both in the Novo program and in the just-finished American Pacific program on the project.

Highlights from the Navajo Vein in 2016 included 3.1 meters of 74.18 g/t gold, 1.5 meters of 143.50 g/t and 1.5 meters of 21.50 g/t. These are exceptional results in a part of the world where 1 g/t is considered mineable!

American Pacific’s initial 16-hole, 3,143-meter program has hit some tantalizing intersections as well along the South Navajo Vein. Initial highlights included 3 meters of 9.39 g/t gold and 1.1 meters of 9.22 g/t gold.

Then, just as we were going to press, the company released the last batch of assays from South Navajo, with some amazing results:

• Hole 13 cut 1.5 meters of 10.30 g/t in an area fully 450 meters north of the main South Navajo zone.

• Hole 16 cut 6.1 meters of 2.06 g/t, 7.6m of 2.47 g/t and 9.1 meters of 5.88 g/t gold, with the hole ending in mineralization.

• Hole 15 saw the highest grade hit, with 1.5 meters of 18.40 g/t gold

And, as impressive as these early results are, they are by no means the end of the story at Tuscarora.

Blind Targets Could Yield Tremendous Growth

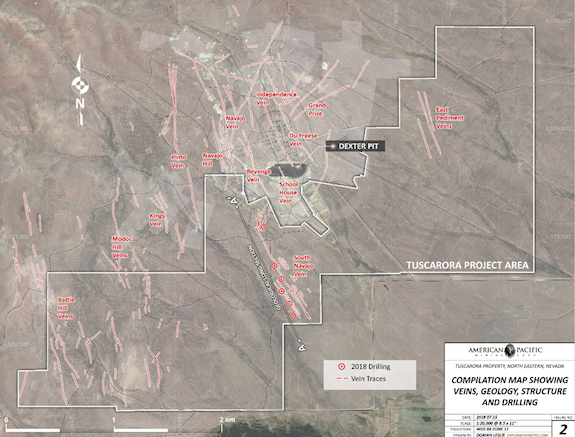

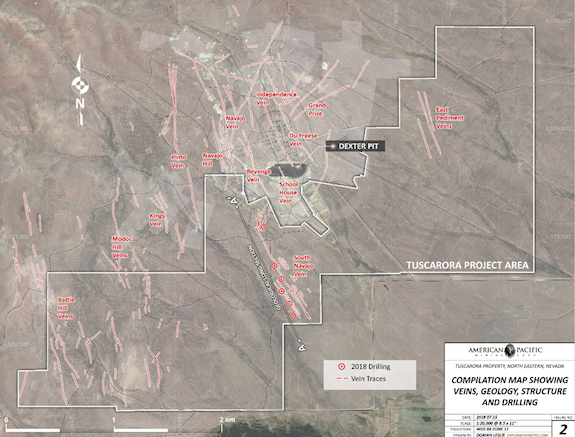

Take a look at this map of vein targets both within and just north of the Tuscarora property boundary.

The vein systems delineated in red to the north of the property include that Navajo Vein that was mined for 2 kilometers before being lost to gravel cover. But as you can see, Navajo is not the only vein identified in the area.

As the South Navajo Vein on American Pacific’s property proves, the mineralization for Navajo extends below that gravel cover onto Tuscarora.

Now imagine, as the company’s geologists are postulating, that five or six of those other veins also extend onto Tuscarora and possess similar gold grades at depth?

All of a sudden, a highly prospective gold project would become an electrifying find, one that could easily attract the attention of a resource-starved major.

The Importance Of Getting In Early

Having raised an initial C$3 million to fund work on Tuscarora, American Pacific has about C$1.5 million left after this most recent round of drilling. That’s money it can use to test for at-depth extensions of the veins in the area.

Should that work produce hits, given the early results from South Navajo, the sky’s the limit for American Pacific’s share price.

As you can see from the recent experience of Rye Patch, Klondex and Northern Empire, an exit via a major takeout is a distinct possibility.

Those who position themselves in American Pacific now will reap the rewards of this developing gold discovery story.

CLICK HERE

To Learn More about American Pacific Mining

|