| Gold vs the dollar – here’s who won… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Fifty Years Of Free-Floating Currencies | |

By Gary Alexander, an Aging Gold Bug

| |

Editor’s Note: It was 36 years ago that I met Gary Alexander on my first day in this industry, as he toured me, a fresh-faced junior writer, around Jim Blanchard’s growing operation. As you can imagined, it was quite the eye-opening experience, as Gary tried to bring me quickly up to speed on the entire hard-money movement and Jim’s pivotal role in it.

One of the things I discovered that day is that Gary is a unique talent — someone whose innate love of liberty combined with his steel-trap mind to create one of the most prodigious and prolific writers in the history of modern finance (among other subjects).

His “official” bio reads like this: “Gary Alexander is currently Senior Writer for Navellier & Associates. For the previous 20 years (1989-2009), he was Senior Executive Editor at InvestorPlace Media (previously known as Phillips Publishing). From 1983 to 1989, he edited Gold Newsletter and Wealth magazine for Jim Blanchard.”

His “unofficial” bio is more like this: “Jazz musician, WWOZ DJ, historian, gold bug, cockeyed optimist, six-time grandpa, Trivial Pursuit terror, Name That Tune champion.”

In other words, a man of many talents and experiences. In fact, he was not only present but also dutifully chronicling the events of August 15, 1971, as Nixon severed the dollar’s last remaining attachment to gold.

So Gary is perhaps the most qualified person to recap those events, and their repercussions, as we recognize this 50th anniversary of the end of the gold standard in the U.S….and the launch of Gold Newsletter in response.

Slightly adapted for use here, the following article from Gary first appeared in a recent edition of Louis Navallier’s MarketMail.

— Brien |

As an avid “gold bug” 50 years ago, I knew that a dollar devaluation was coming soon – I had read Harry Browne’s book on the coming devaluation – but I didn’t think the gold standard would die along with it.

On Sunday night, August 15, 1971, I was shocked to see President Nixon not only devalue the U.S. dollar but abandon the gold standard, and also institute wage and price controls despite moderate (4.35%) CPI inflation. He also boosted tariffs and added a raft of other financial plans that could stall the economy.

On top of all that, I was most shocked by the fact that the public loved most of these ideas. They hardly cared about gold, but they loved the price freezes and tariffs. Wall Steet celebrated with a huge rise in the Dow index Monday morning and economists fell over themselves praising Nixon’s foresight and wisdom.

At the time, I was resource director of a News Bureau for a magazine and radio news program, where I could easily take the pulse of the nation via now-arcane methods like newspapers and AP and UPI news tickers, so I penned a quick magazine summary entitled “Initial Reaction to Nixon’s Economic Plan.”

|  | | The New York Times buried the lede (Gold) in the 3rd headline…but AP was my primary source (Radioworld) |

Here’s part of what I wrote about the “Initial Reaction to Nixon’s Plans” that week, 50 years ago:

|

• The Public. A poll of 220 households by Albert E. Sindlinger & Co. on Monday revealed 75% of Americans favored the President’s proposals, while “most of those who dissented did so on the ground that Mr. Nixon’s actions should have come sooner.”

Mr. Sindlinger’s amazed reaction was, “In all the years I’ve been doing this business — more than 15 — I’ve never seen anything this unanimous, unless maybe it was Pearl Harbor.”

A Gallup Poll released Thursday evening after the announcement also revealed 75% in favor of the proposals…. The Gallup Poll revealed that only 15% felt they would be hurt by any of the President’s actions, 42% felt they would be helped, while a whopping 43% said the actions would have no effect on them (!) or had no opinion…. A new respect for the President and new hope for the economy emerged.

• The Investor. The stock market leaped a record 33 points on a record volume of 32 million shares.

• Economists. The consensus of most economists (although that profession rarely agrees on anything) was in favor of the wage-price freeze, against the protectionist 10% surcharge, and for the depreciation of the dollar in foreign markets. The measures to help business investments were praised, but the cuts in welfare reform and revenue sharing were criticized by social economists….

Specifically, the most famous economists of the day were spectacularly wrong. Paul Samuelson, author of the most noted economics textbook, forecast a sharp decline in gold’s price. Milton Friedman, who urged Nixon to cut the dollar from gold, predicted that ditching gold would have little impact on the dollar’s value, so Nixon said in his speech that abandoning gold would “strengthen” or “stabilize” the dollar. No such luck! As we’ll see, the dollar lost two-thirds of its value to key currencies and 98% of its value to gold.

|

There was much fear and trembling in Japan, Canada, Britain, Russia and the Common Market nations, led by France and West Germany. In the next issue (October 1971), I posted a much longer analysis (“America Faces the Dollar Crisis”) about the long-term outlook for the U.S. dollar on the world stage. In that article, I wrote extensively of Japan’s challenge to maintain the value of its yen at 360 to the dollar:

|

“The Japanese absorbed $3 billion in U.S. dollars in just the one week following August 15 for the sole purpose of avoiding a revaluation of the yen. The U.S. requested a revaluation by 17 to 25 percent, the largest of postwar revaluations, but the Japanese did not want to revalue even half as much. Finally, reluctantly, on August 27, the Japanese were forced to ‘float’ the yen.”

|

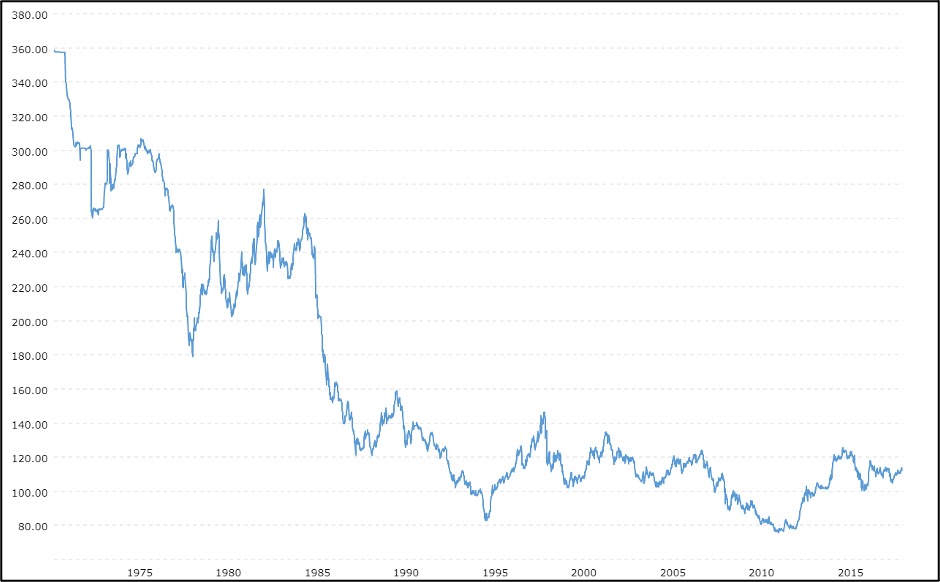

Japan relied on a cheap yen to promote exports, so their “forced float” caused a quick (increase in the yen’s value) from 360 to 260 yen per dollar within a year, then 180y/$ by 1979 and 80y/$ by 1995. A new fad, currency trading, came into fashion – a useless zero-sum game now amounting to $2 quadrillion dollars a year, 100 times the GDP output rate, while manufacturing withers. As Steve Forbes put it, Nixon’s move led to “four decades of slow-motion wealth-destruction, as the value of the dollar dropped 80 percent.”

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| | Japanese Yen per U.S. Dollar Since the 1971 “Float” Began |  |

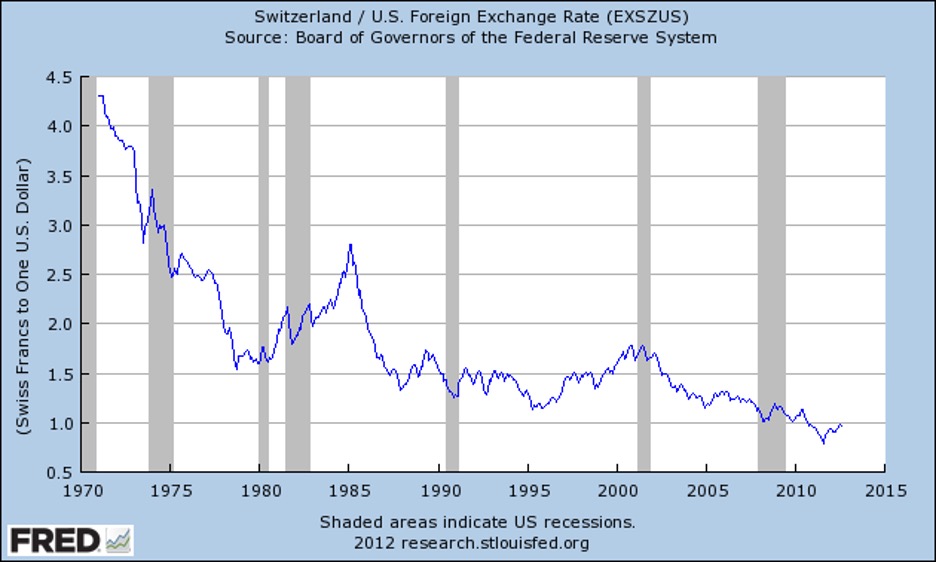

From this track record, we can see that the dollar’s devaluation to the yen was about 50% within seven years (1971-78) and 78% within 25 years, but the dollar was also way too high to the German mark (four to the dollar, or $0.25) and to the Swiss franc (4.3 to the dollar, or $0.23). By 1978, the Swiss franc had risen to 1.5 to the dollar, or $0.67, almost a tripling in value to the dollar. Eventually, the franc gained parity to the U.S. dollar by 2010, as the Swiss always had more than sufficient gold backing for its franc.

|  | | Source: Federal Reserve Bank of St. Louis |

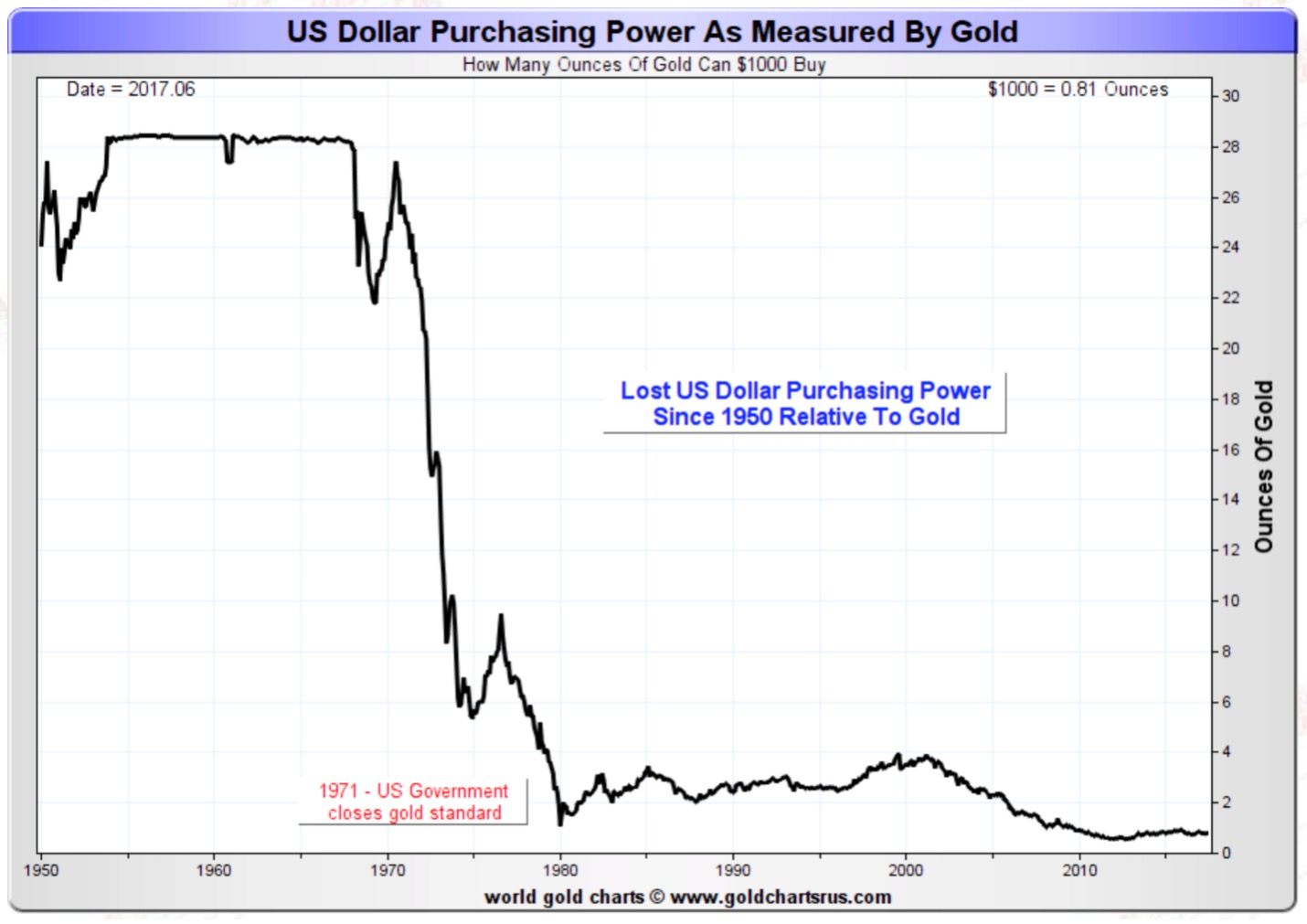

The dollar’s biggest 50-year devaluation, however, came in terms of gold. Even with gold’s recent drop to $1,765 per Troy ounce, and all-time highs in the S&P 500 and the Dow Industrials on Friday, August 6, gold is still up over 50-fold from its fixed $35 price in 1971 – and it has still beaten both stock indexes:

|

Investment |

August 6, 1971 |

August 6, 2021 |

50-Year Gain |

GOLD |

$35.00 |

$1,765 |

+4,943% |

S&P 500 |

94.25 |

4,436.52 |

+4,607% |

Dow Jones Ind. |

850.61 |

35,208.51 |

+4,039% |

| | Data source: “The Almanac Investor” for historic stock market averages |

Most of gold’s increase came in the first decade of the dollar float, from 1971 to 1980, but gold also grew seven-fold from 2001 to 2011 – and it doubled again from its lows in late 2015 to its peak last August 2020.

|  |

Gold has its ups and downs – and its skeptics can always show you some long stretches of zero growth – but it has beaten all paper currencies over the last 50 or 100 years by a wide margin.

Although gold has also beaten the major stock market averages over the last 50 years, that is not the role of gold over time. Gold’s primary role is to beat paper currencies (and bonds, not stocks), but it can also top stocks, at times.

Nixon’s 1971 announcement came as a total surprise to most Americans, but it will be no surprise to me if the press pays no attention to the fact that the dollar is so far down to gold and key currencies since then.

The official gold standard is long gone, but the unofficial gold standard lives on, with individual investors disciplining their central bankers by balancing their portfolios with real money, the “golden constant.”

| | Editor’s Note: As mentioned in my introduction, Nixon’s decision to cease gold-dollar convertibility not only launched an era of the dollar’s devaluation in relation to the yellow metal, it also prompted Jim Blanchard to launch his fight to legalize gold ownership in the U.S….and Gold Newsletter as his primary tool in that fight.

To help celebrate our 50th anniversary, we’ve transcribed the first issue of Gold Newsletter that Jim and his friends typed out in 1971, and presented a picture of that historic inaugural issue. Along with this, we’ve provided a special 50th Anniversary discount code giving you a $50 savings off a full-year subscription to Gold Newsletter.

I think you’ll find this first issue fascinating; you can read it here. | | | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |