There’s a huge disconnect right now on whether higher inflation is here to stay.

|

The Fed is saying that the pricing pressures we’re seeing are transitory, and merely the result of supply-pipeline disruptions due to Covid.

|

Of course, their definition of “transitory” has changed from a few months to a few quarters, but that’s a story for another day.

|

Importantly, the markets seem to have bought into the Fed’s propaganda. By and large, they’re betting that inflationary pressures will ease and, even if they don’t, Powell & Co. will be able to nip it in the bud.

I’m betting they’re going to be terribly wrong.

|

| Golden Opportunities continues below... |

|

SPONSOR:

Black Mountain Gold (BMG.V; BMGCF.OTC) |

| Ground-Floor Opportunity |

| It’s rare that a newly public gold explorer comes out of the gate with a clear path to outline a million-ounce-plus resource. |

Fast off selling their last exploration company for hundreds of millions of dollars, the management team behind Millennial Lithium has found another project in Arizona with rich resources — this time in gold — that has been completely overlooked by others.

In fact, the last owners of this project had to abandon it at the bottom of the last market cycle, leaving behind $15 million in mine infrastructure…an historic gold resource…and dozens of high-priority targets peppered all across the project. |

| Will this be the team behind Millennial Lithium’s next project to quickly sell for hundreds of millions of dollars? |

| The weeks ahead will tell — but with Black Mountain Gold being new to the market and still unknown, smart investors will want to learn more about this ground-floor opportunity while it lasts. |

CLICK HERE

To Learn More About

Black Mountain Gold |

|

The Fed’s Fat Finger On The Scale

|

I’m constantly asked why the gold price hasn’t risen — and in fact has been weak — in the face of recent inflationary pressures.

My answer has been that the price of gold isn’t set by the kind of supply/demand dynamics that move the values of most commodities. Instead, the gold price (and the silver price as well) are set by speculators in the “paper” metals markets, primarily the Comex futures exchange.

These speculators aren’t concerned in the least whether investors, savers and even nations around the world are increasingly buying gold...or whether the supply of newly mined gold has peaked.

They’re only worried about Fed monetary policy and what hints are out there as to future Fed decisions.

|

Such is the result of markets that are completely driven by, and addicted to, the monetary adrenaline dished out by the Federal Reserve and other central banks.

|

The speculative, hot-money investors setting the prices of the metals and other assets through the futures markets also aren’t concerned much about today’s higher inflation readings.

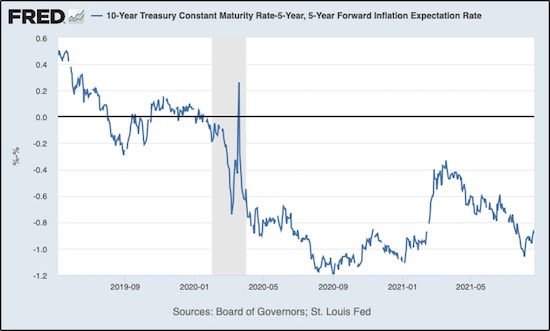

They’re taking comfort in the fact that inflation breakevens — the difference between Treasury nominal yields and the inflation-adjusted yields on Treasury Inflation-Protected securities (TIPs) — are forecasting lower inflation ahead.

It’s important to understand that these breakevens are the market’s prediction of the inflation rate over the maturity of the TIPs securities. And it’s also important to understand that these breakevens are forecasting much lower inflation than we’re seeing right now.

Thus, real yields (yields adjusted for inflation) aren’t too alarming...if you’re using these predictions.

|

|

As you can see in the chart above, real yields as measured by these inflation breakevens are “only” negative to the tune of about 0.9% right now. And the speculators setting the price of gold aren’t very animated over real yields that still aren’t too extreme by this metric.

But there are a couple of problems here...

For one thing, consider that these inflation breakevens are distorted tremendously by the fact that it is the Fed itself that is the biggest single buyer in the TIPs market, accounting for about 25% of all purchases.

The Fed is buying for its own obscure reasons...and not with a profit motive...so its fat finger on the scale is tainting whatever signals the TIPs market may be delivering.

Secondly, consider that if we used actual, real-time inflation statistics — such as the government’s own CPI measure — then real yields are much more deeply negative.

In fact, across most of the Treasury yield curve, real yields are now negative 4% or lower.

|

That matches up with the most extreme levels of negative real yields that we saw in the 1970s, back when these fancy inflation breakevens didn’t exist and investors had to use the CPI.

|

So why aren’t gold and silver rocketing higher like they did in the 1970s?

Because in addition to the arcane measures of predicted inflation that we have today, we also have much more robust, and misguided, paper metals markets.

For now, and until investors realize that inflation is here to stay and the Fed is simply unable to raise rates to stop it, gold and silver are being held in check by these speculators in paper gold and silver.

But a few weeks or months down the line, the story will be a lot different — and I’m betting that today’s metals prices will look like bargains.

|