September 4, 2024

Dear Fellow Investor, |

| Sometimes an investment outperforms by falling less.

|

| That’s what’s happened yesterday as U.S. equity indices sold off heavily while gold lost only a fraction of a percent. And that small loss was likely due to selling from stock traders who needed to raise cash for margin calls.

This isn’t just a short-term trend. As I’ve been writing in these letters as well as Gold Newsletter, since the beginning of March gold has been rising regardless of what the stock market, Treasury yields, the dollar or real interest rates are doing.

|

| The markets are always telling a story, and right now they’re saying that investors want to own gold.

|

| They want to own it because of the debt trap that the U.S. and other sovereigns are now facing. They want to own it because of the many signals now warning that we’re already in a recession. They want to own it because of rising costs in manufacturing that are indicating another surge in inflation.

These are just a few of the many varied reasons to own gold at this moment, and it’s why much higher price levels are ahead.

But there are also some risks just ahead that we also need to be aware of...

|

| Golden Opportunities continues below...

|

|

| SPONSOR:

Treasure Investments Corporation

|

| Treasure Investments Corporation Offers You an Opportunity to Invest in Fine Art & Precious Metals so You Can Get The Best of Both Alternative Asset Classes

|

| |

|

At Treasure Investments Corp., we believe in offering you more than just fine art. We provide opportunities. Many of you met us at last year’s New Orleans Investment Conference, and we’re excited to reconnect with you.

Own Fine Art in Precious Metals

Explore our exclusive collection of fine art, crafted from pure silver and bronze. These pieces are not only visually stunning but also hold lasting value. Owning one means you’re not just acquiring art; you’re investing in a tangible asset.

Secure Your Entire Investment by Immediately Owning Fine Art

Interested in more than just the art? With Treasure Investments, you can learn how to own a piece of the very source of these precious materials. It’s about combining the beauty of art with the value of the raw materials that create it.

Why Choose When You Can Have Both?

We invite you to discover how you can own both fine art and precious metals. This unique opportunity lets you enjoy the best of both worlds—art and investment.

Interested? We’d love to host you at our Washington headquarters. Tour our foundry, meet our executive team, and explore our world class private museum, featuring masterpieces like the pure silver Pietà and David.

Click Here: Golden Ticket Brochure

Click Here: Golden Ticket Invitation

Looking forward to discussing this opportunity. Let’s make history together.

Click Here to Watch The Video

Michael Sheppard

Partner & Director of Investor Relations

Treasure Investments Corp

dba Foundry Michelangelo

Michael@FoundryMichelangelo.com

Direct: 615-400-1099

|

|

| The Danger Behind The Pivot

|

| There’s been a lot of talk in the mainstream financial media about how historically bad September has been for investors.

Of course, these analysts are referring to the fact that September has traditionally been the worst month for U.S. stocks. But some in the gold community have also talked about this being an historically bad month for the yellow metal.

That’s not entirely true. If you go back as far as 1980, for example, September doesn’t stand out much at all. If you go back two decades, we see that September does show up as having the fewest instances of gains among the 12 months, but its average performance is middle of the pack.

|

| So I wouldn’t worry overmuch about seasonality right now. What I am worried about is the Fed’s upcoming rate cut.

|

| You see, the markets have been pricing in the Fed’s pivot since early July. For gold, we see that this is when the holdings in the GLD gold ETF first began to show significant inflows. And at the beginning of August, the mining stock indices began to outperform gold as investors began to look for leverage.

In the broader markets, there’s also been an important shift over the past couple of weeks, as bad news has once again become bearish for equities. The signs of imminent (if not already present) recession have sent the major stock indices tumbling.

The big risk just ahead is that, as the Fed meeting approaches or when they actually pivot, that move will have been fully priced in and traders will exit their trades.

|

| This “buy the rumor, sell the news” phenomenon could lead to a big sell-off across the board, from stocks to bonds to gold and mining stocks.

|

| If so, I expect it to be short-lived, because another of our favorite indicators is beginning to set the stage for the next rally.

|

| The Pause That Refreshes

|

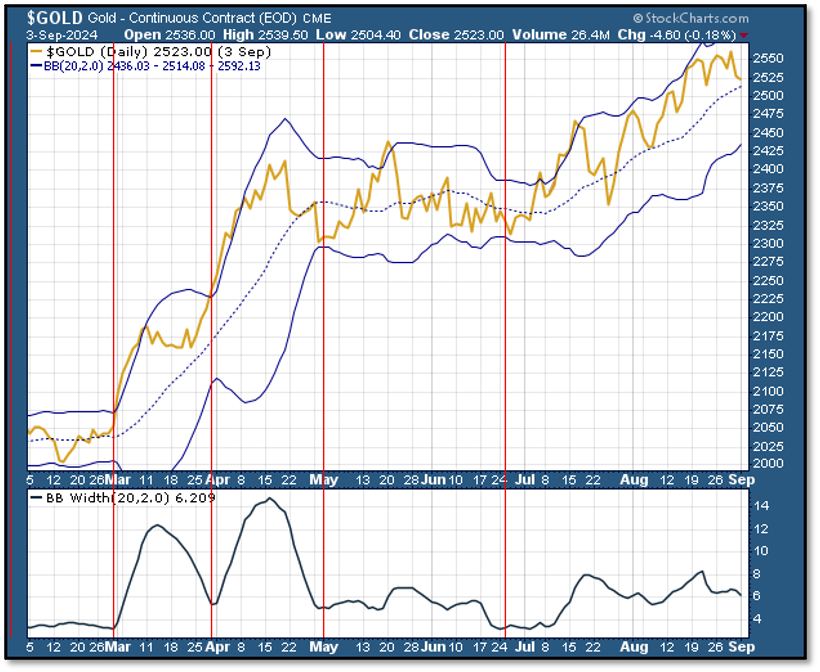

| I’ve been reporting on how remarkably accurate gold’s Bollinger bands have been during this bull market.

As you’ll remember, in early July I wrote to alert you that this volatility indicator had collapsed — the bands had “pinched” — and that this has been a precursor to significant rallies in the gold price.

Here’s an updated version of the chart I showed you then:

|

|

| I’ve drawn vertical lines marking each instance where the width of the Bollinger bands bottomed and, as you can see, these have reliably predicted the start of each new rally in gold.

Because gold has been climbing the upper band since early August, that upper band has actually risen out of the range of this chart. But if you look at the band-width panel at the bottom, you can see that the width of the bands, while falling, has yet to reach the kind of bottom that we’re looking for.

|

| Even though I expect some price weakness around the Fed decision, I think that overall volatility for gold will continue to drop.

|

| Judging from the Bollinger band trend and factoring in that expected weakness around the 18th Fed meeting date, I expect this pattern of lower price volatility for gold to continue for the next couple of weeks or so, before the next rally begins.

Note also that if we get some dovish indicators from Powell & Co. on or around the Fed meeting, we could see all of the markets take off to the upside.

Regardless, the long-term picture for gold, for all the reasons I mentioned above, remains quite bright.

So watch for some interesting trends, and perhaps buying opportunities, to develop in the near future...but make sure you’re also positioned well for the long term.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|