| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

Things looked dismal for gold over the last few trading sessions, but the metal has resisted a major sell-off once again and is now on the rebound.

|

|

Gold bugs disagree over whether there’s an organized cabal working to keep a lid on gold prices, or whether it’s a largely accidental alliance of actors with mutual interests, or whether there’s any manipulation at all.

|

But there’s one thing they can all agree on today: Whatever they’re doing and whoever’s doing it…it isn’t working.

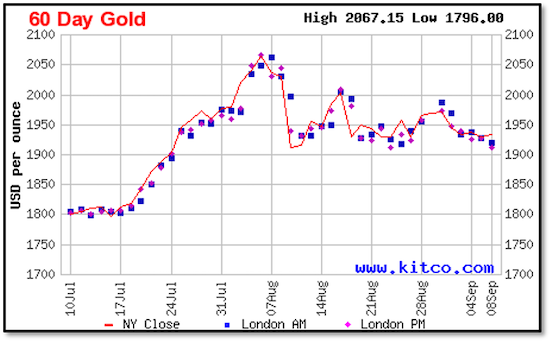

| Gold has had two major rallies during this pandemic, with each adding about $300 to the price in a matter of just a few weeks. After the first big rally, gold traded sideways for about 10 weeks, working off the overbought condition through time instead of a big price correction.

As regular readers know, my thesis has been that we entered a similar sideways pattern in early August, and that gold would once again resist a major price decline as it digested the second big rally during July.

|

| As you can see from the chart above, that prediction looked good for a while, but was put to the test once again over the last few trading sessions.

Not reflected in that chart is today’s big rebound in gold, however.

| | Golden Opportunities continues below... | | Sponsor: | This 'Off-The-Radar' Metal Is Outperforming Gold

While economic conditions have driven many investors to gold, palladium has quietly surged to record heights.

Palladium stocks are making a big move, and it’s not the majors who are set to strike it rich. If you’re looking for a highly-leveraged way to bet the current bull market will roll one, this junior explorer is very much a buy. Click here for the exciting details. | |

Gold traded in a wide, $30 range yesterday, after selling off about $20 and then rallying to a gain of about $10, before settling a few dollars into the green.

The rebound continued at the New York open today, with the metal up about $15 at this writing, and silver up even more on a percentage basis.

Just as encouraging: The gold mining stock indices are all up about 3%, which is a very positive confirmation of gold’s big move.

In fact, at their lows the major gold stock indices had fallen by a minimum Fibonacci retracement of 23.6%, a sign that the bottom may have been in.

If so, gold is set for a quicker rebound than we saw the last time, and is about to renew its major bull run.

At the very least, it seems that the metal has bounced off of the support levels in this sideways consolidation, and we’ll continue to digest the last rally and build energy for the next big move.

Either way, the buying opportunity we now have in the junior miners has a limited time window. Anyone hoping to ride this train to the new heights ahead will need to act soon.

There are two ways to do so:

|

|

1) Subscribe to Gold Newsletter or our Gold Newsletter Alert now. CLICK HERE to subscribe.

2) Sign up now — right now — for our upcoming New Orleans Investment Conference, being held from October 14-17. Although this year’s event is being held virtually, we’re using that “disadvantage” to instead provide you with on-going content and market intelligence for months to come.

In fact, it’s already begun, as Rick Rule, Brent Cook and I held an exclusive, private Zoom call for Conference members last week…and we unveiled no less than six top stock picks.

You can get access to that call, as well as all of the other invaluable information we’re delivering, by registering now at this link.

|

Whatever you do, act now. Because this gold, silver and mining stock bull market has years to run…and the current buying opportunity may last only days.

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |