| An established gold resource with the potential for growth |

|

| Please find below a special message from our advertising sponsor, Granada Gold Mine. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

| A “Sweet Spot” For A Gold Stock |

|

Granada Gold Mine (GGM.V; GBBFF.OTC) is in a sweet spot for junior gold companies, boasting an established gold resource, proximity to infrastructure, a safe jurisdiction and exploration upside.

A number of announcements are expected in the weeks ahead on drill results, bulk sampling and a planned resource update.

|

|

In the world of gold exploration, location matters.

|

Companies looking for the yellow metal often find the best place to go looking for it is in one of the world’s major gold jurisdictions.

That moniker certainly applies to the Abitibi Greenstone Belt that runs through Quebec and Ontario.

|

Since the turn of the 20th century, the Abitibi has produced more than 170 million ounces of gold.

|

And within that broader belt, the Cadillac Break trend that transects the Quebec-Ontario border has generated 75 million ounces of gold in the past 100 years.

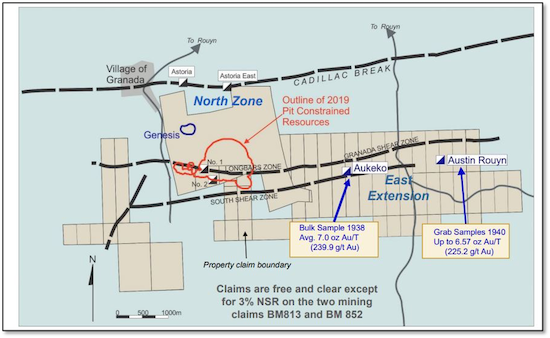

It’s along the portion of the Cadillac Break that runs between Val d’Or and Rouyn-Noranda, Quebec that Granada Gold Mine (GGM.V; GBBFF.OTC) has secured its flagship project.

Recent work on the project has indicated that, despite more than a century of mining, more gold remains to be found in this part of the world. In fact, Granada Gold has already outlined a significant gold resource on its project.

As you’re about to see, Granada’s eponymously named Granada project has the potential to grow in the weeks and months ahead.

|

Located In One Of The World’s Elite Gold Districts

|

Granada Gold Mine has owned its flagship project since 2006 and has taken advantage of its location in the heart of the Abitibi.

Because there’s so much mining infrastructure nearby (no less than 10 gold mills lie in close proximity), GGM may have options in terms of how it develops its existing resource.

Adding to the allure of its location is the presence of a highly skilled labor force, full highway and rail access and a site squarely within Quebec’s electrical grid.

Combine these advantages with Quebec’s reputation as one of the more mining friendly jurisdictions on the planet, and Granada Gold’s project puts it way ahead of companies with projects that are more remote or in areas that are politically dicey.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

And Granada’s advantages don’t stop there.

You see, thanks to almost 117,000 meters of drilling in 873 holes, Granada has a well-established resource.

In a sector where junior explorers are desperate to outline even a small resource, this substantial deposit (762,000 ounces measured and indicated and 455,000 ounces inferred) gives GGM the possibility of producing up to 80,000-100,000 ounces of gold per year.

|

|

Moreover, this is an open-pit resource that should be simple to mine and process with good recoveries.

The company already has the permits in place to develop it as an open pit with a 550 tonne-per-day “rolling start” that could see its ore shipped to a local mill, in which case revenues may begin to flow that much more quickly.

GGM is also in the process of reviewing permitting and engineering work on the project with the goal of potentially building an on-site mill at Granada.

|

An Abundance Of Growth Targets

|

However the company decides to develop this resource, there’s likely more gold to be found on this project.

Drilling on various targets, including those on, around and under the existing pit, indicate the potential for the discovery of a significant amount of underground mineralized material at Granada.

Current drilling is focused on growing and/or upgrading the resource around the existing pit, with future plans for testing the nearby Genesis target, drilling deep toward the Cadillac Break that runs just to the north of the property boundary and fully assessing the Aukeko and Austin Rouyn targets on the eastern end of the property.

|

|

Drilling in 2018 and 2019 on the project yielded gold grades on a par with the 8-10 g/t grade of the ore that got mined on the property in the 1930s.

Perhaps more intriguingly, a recent 1,220-kilogram grab sample from the Vein No. 1 target returned a 55.7 g/t of native gold, which often gets missed in normal drilling.

This last fact is why GGM is plying the area around the pit with additional bulk sampling, as that work has the chance to possibly improve the resource by capturing more of that native gold.

Management notes that this latest sample yielded grades more than four times the drill grade of the core.

|

So Many Potential Catalysts

|

When it comes to investing in a gold company in the current market, you want to make sure it has plenty of news flow in the pipeline.

Granada Gold Mine has an abundance of potential catalysts, including:

|

• Drills are turning right now on both the established resource and nearby targets (the two-kilometer LONG Bars zone that hosts the resource represents just a portion of the property’s 5.5-kilometer section of the Granada shear zone)…

• Bulk sampling of the resource area, a more representative means of sampling, stands to possibly contribute to revising the resource estimates by capturing more of that native gold…

• Recent high-grade assays could attract market attention, as they have for many other gold explorers recently…

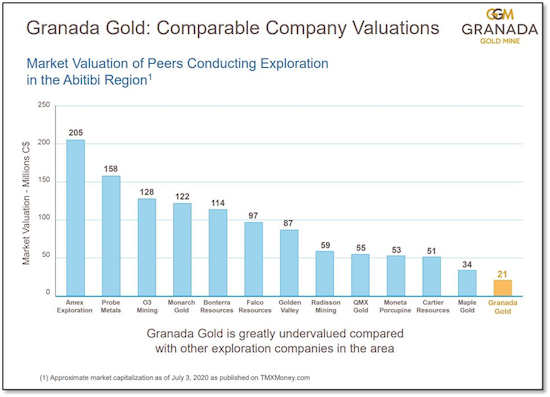

• And then there’s this: A significant re-rating of Granada seems likely based simply on the in-situ value of the deposit. As the chart below indicates, Granada Gold has a lot of room to catch up with its Abitibi-focused peers in terms of valuation.

|

|

With this many possible paths to a higher market cap, it’s hard not to believe that the market may be asleep at the switch here.

But given gold’s bright future, that oversight might not last.

If you’re looking for a junior mining stock that’s situated in a “sweet spot” of the market — with an array of news flows over the weeks ahead — you may want to consider Granada Gold Mine.

|

|

CLICK HERE

To Learn More about Granada Gold Mine Inc.

|

|

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |