How To Maximize Your Portfolio In Gold

GoldMining Inc. (GOLD.TSX; GLDLF.OTCQX) exploited the down turn in the gold market to amass tens of millions of ounces of gold resources.

With gold poised for a bull market, GoldMining Inc. is the best stock to multiply your returns on the yellow metal.

Dear Fellow Investor,

“Buy low, sell high” distills business and investing to its essence.

Companies that can accumulate assets on the cheap during down markets stand the best chance of outperforming their peers when bull markets re-emerge.

It’s a strategy that GoldMining Inc. (GOLD: TSX, GLDLF: OTCQX). has executed to perfection, assembling a world-class project portfolio that spans the Americas and boasts 9.5 million ounces of gold in the measured and indicated categories along with 11.7 million ounces in the inferred category. And GOLD did so by leveraging the down market for gold to buy assets at fire sale prices - in some cases less than US$1/oz.

So what makes GoldMining such a compelling play on gold now?

Simply this: Indicators show that gold is bottoming right now, and a seasonal rebound is about to bring significantly higher prices.

CLICK HERE

To subscribe to get updates directly from

GoldMining Inc. to your email

That’s in the very short term. Longer term, sovereign debt levels across the world have risen to unmanageable levels with a major crisis brewing in both the emerging markets and even Europe...setting the stage for massive currency devaluations over the years to come.

Bottom line, we know that much higher gold prices are inevitable. And it’s very likely that the next move will usher in a bull market similar to the one we saw from 2004 until 2011 when gold prices exceeded US$1,900/oz.

History shows that when this bull market attracts its initial rush of investors, the first and biggest winners are those with established gold resources with leverage to higher prices.

In other words, companies exactly like GoldMining.

Gold Bought Off The Discount Rack

It’s hard to beat the leverage that the right gold equities can offer investors on the yellow metal.

A good case in point is the mini-boom that occurred in gold in 2016.

While gold prices rose about 25 percent from $1,050 to $1,370, companies with established assets did much better, in some cases increasing as much as 100% or 200% during the same period.

That said, since 2011, the yellow metal has largely traded down to sideways, allowing companies like GoldMining to scoop up companies and projects extremely inexpensively all around the Americas in places like Alaska, Brazil, Colombia, Peru and Canada.

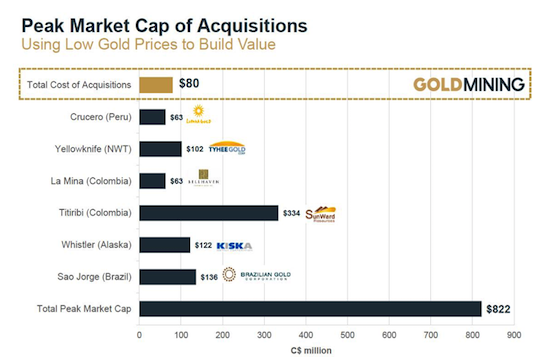

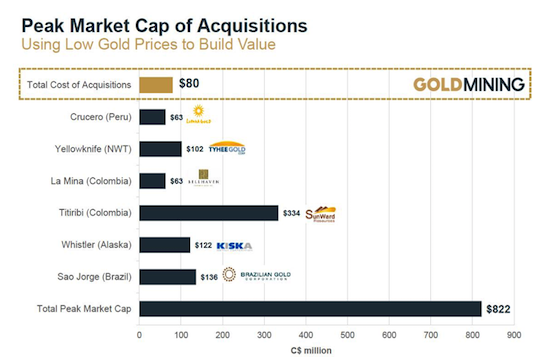

The following chart — showing the peak market caps of the companies that GoldMining has brought into its portfolio — tells a compelling story.

Cumulatively, these companies had a combined peak market cap of C$822 million, and yet, as you can see, GoldMining amassed the lot of them for a mere C$80 million. The company’s current market cap hovers around C$120 million.

You read that right. If the next bull market brings the projects in GoldMining’s portfolio back to their peak value, it would deliver nearly a seven-fold increase in the company’s valuation versus the current stock price of ~C$0.85.

Americas Projects In Safe Jurisdictions

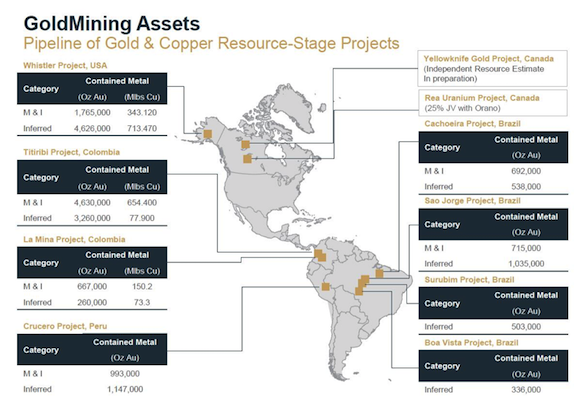

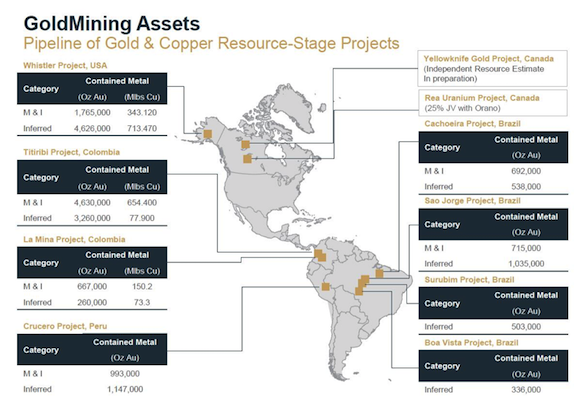

Those 9.5 million ounces of gold in the measured and indicated categories along with 11.7 million ounces in the inferred category are spread across the Americas and reside in safe mining jurisdictions.

That’s key, because the market often applies a political discount to projects and companies operating in countries without strong protections for foreign investment.

With projects in Brazil, Colombia, Peru, Canada and Alaska, GoldMining boasts an enviable portfolio of high-value projects in politically stable countries.

Here’s a quick rundown of its contained gold resources in all categories by country:

• Colombia (Titiribi and La Mina): 5.3 million ounces of gold in the measured and indicated categories and 3.5 million ounces of gold in the inferred category

• Brazil (Cachoeira, Sao Jorge, Surubim, Boa Vista): 1.4 million ounces of gold in the indicated category and 2.4 million ounces in the inferred category

• Peru (Crucero): 1.0 million ounces of gold in the indicated category and 1.1 million ounces in the inferred category

• U.S. (Whistler): 1.8 million ounces of gold in the indicated category and 4.6 million ounces in the inferred category

• Canada (Yellowknife): Resource estimate in progress

Plus, GoldMining has some optionality on uranium, thanks to a 75% interest it holds in the Rea property in the Athabasca Basin. (Note: uranium prices just hit a 52 week high on improving fundamentals – this asset is becoming more valuable by the day!)

Opportunities To Grow Via The Drill Bit

As they currently stand, these resources give GoldMining the opportunity to take off in valuation when the next bull market for gold arrives. But the company also has opportunities to expand those resources with drilling.

Here are a few of those opportunities:

Sao Jorge: An untested 2.5-kilometer resistivity high extends southeast of the deposit area at Sao Jorge, opening up the option of substantial growth via drilling.

Cachoeira: The eastern side of the shear zone that hosts the mineralization at Cachoeira in not well explored, and the existing deposits remain open down dip.

Titiribi: This district-scale project has no less than three deposits along with six high-value prospects that are open for expansion.

La Mina: With infill and step-out drilling, the La Garrucha prospect will potentially add additional gold-copper resources to the existing resource base.

Crucero: This project hosts a sizable gold resource in an underexplored Peruvian gold-belt with significant upside.

Yellowknife: Host to multiple bulk-mineable and high-grade targets.

Simply put, these are large projects that have significant potential to grow with further exploration, a fact which provides a dose of blue sky upside to an already compelling gold story.

Leverage, Leverage, Leverage

As we approach the last quarter of 2018, we find gold at a key crossroads.

By their own estimates, the U.S. Federal Reserve is likely to cease its campaign of rate hikes in 2019. Investors are already beginning to factor this into their investing decisions, and the bull market for gold that we’ve been waiting for is likely just around the corner once Fed rate hikes end.

That’s what makes now the perfect time to get positioned in high-leverage gold plays, and GoldMining Inc. may be the best of the lot.

Think about it: This is a company that has managed to amass a

world-class resource with 9.5 million ounces of gold in the measured and

indicated categories along with 11.7 million ounces in the inferred

category for a mere C$80 million.

Of course, past results are no guarantee of future performance. But let’s look at where GoldMining was trading during gold’s 2016 rally when GOLD was the #1 top performing gold stock on the Toronto Venture Exchange.

The record shows that GoldMining had an EV/oz of US$20/oz. in June of 2016 versus today's EV/oz of US$4/oz...even though GoldMining has increased its global resource by 108% during this time. That’s 5 times today’s level of US$4/oz. — and an indication that a resurgence of gold to just its 2016 prices could send GoldMining’s share price soaring towards new all-time highs!

And if gold renews its assault on the $2,000 mark, the sky is literally the limit for this well-positioned gold company.

Those who invest in GoldMining today — before gold turns the corner — could be very glad they did.

CLICK HERE

To Learn More about GoldMining Inc.

|