| This top gold story just went on sale...

| | Please find below a special message from our advertising sponsor, West Red Lake Gold. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | One Of Today’s Top Gold Stories Goes On Sale

| | | West Red Lake Gold Mines (TSXV: WRLG, OTCQB: WRLGF) bought a brand new mine and two million ounces of high-grade gold in Ontario for just C$19 million.

Frank Giustra thinks it was the deal – the steal – of the century. He bought 12% of the company. Last week a block of shares from the deal financing came free to trade…and investors selling to take a double have created an opportunity to buy.

| | Dear Fellow Investor,

| | A C$20-million gold explorer with a small gold deposit in Red Lake, Ontario, shot up to $160 million in April when it inked a deal to buy the newly built Madsen gold mine for C$18.5 million.

| | Famed mining investor Frank Giustra backed the deal in a big way, calling it the gold deal of the century. That’s what you can get if you’re willing to buy a mine that failed within 19 months of first production.

Giustra is one of the most successful mining entrepreneurs in Canadian history, so he knows what he’s talking about.

He had stepped away from mining in the last decade, but recently returned because he sees big opportunity in today’s beaten-down gold sector...

| | ...And, specifically, a big opportunity in West Red Lake Gold Mines (TSXV: WRLG).

| | That Giustra bought 12% of the company gave other investors confidence this team could turn the failed Madsen mine around.

| | | Frank Giustra taking the photo of gold in the rocks at the Madsen mine.

| | That confidence propelled WRLG’s shares as high as $0.90 following the deal. Meanwhile, WRLG was completing a financing at $0.35 per share. After the financing, WRLG eased back and then traded reliably between $0.60 and $0.75 for four months…until last week, when the price dropped.

|  | | There was no news, no corporate disappointment. The story is moving ahead in all the right ways.

So why the price drop?

Because that C$0.35 financing came free to trade on Monday and some financing investors are selling to lock in a double.

It’s a very common pattern. Company raises money at $A. The share price rises to $B over the next few months, but financing investors cannot sell because their shares are locked down for four months. Once they can trade – once the free trade date hits – the share price often declines back to $A as financing investors lock in gains.

| | Even though it’s a common pattern, free-trade-date price drops are often misunderstood. Anyone new looking at the share price chart will just see a big decline and assume something bad happened.

| | But in the case of WRLG, it didn’t. That means this free-trade-date price dip is an opportunity to buy a stock that Frank Giustra and a strong team of geologists, mine engineers, and mining capital markets operators are backing in a big way.

They think the Madsen mine...

|

- Can become a strongly profitable mine in short order by implementing a few key fixes and not being burdened by hundreds of millions of dollars in construction debt.

- Can be a processing hub for stranded deposits in the area. Red Lake is famous for high-grade gold, but small deposits aren’t enough to build a mine around. Sending ore from those deposits to an already built and proven mill could unlock big value.

- And can, with a robust mine plan and clean execution, drum up the same kind of market excitement that lifted the previous owner past a $1 billion valuation.

| | The Billion-Dollar Dream

| | Pure Gold built the Madsen mine in 2020-2021. The market loved it: as the mine started up, Pure Gold’s valuation bested $1 billion.

A year later it was down 78% as the mine struggled to access enough good ore and the company suffocated under debt. Nineteen months after starting up, the mine was shuttered.

Six months later West Red Lake Gold Mines bought Madsen, in which $350 million had been invested, for $18.5 million in cash and shares.

It’s an amazing deal…if they can make Madsen work.

| | WRLG is confident it can. The mine did not fail because the gold wasn't there; it did not fail because the mill was faulty. Madsen failed because of financial decisions.

| | There were two categories of bad financial decisions. They were related and made each other worse.

First, to make the asset appeal to buyers, Pure Gold kept the mine free of royalties and limited equity raises. They relied on debt for construction capital.

Second, limiting themselves to debt meant they were tight on cash from the start. So they cut corners and pushed some big costs out into the operating budget.

| | Relying on debt, cutting construction corners, and pushing costs into the future worked together to sink the company.

| | Things that would have increased the mine’s odds of success were not done, like sufficient infill drilling in the early ore areas, developing down to richer parts of the deposit, and building enough underground infrastructure to get ore to the surface efficiently.

Not doing those things made the mine falter. And if a mine with lots of debt falters, it quickly runs up against its debt covenants. Debt covenants limit what a borrower can do, from repayment schedules to max debt-to-asset-value ratios. When a new mine stumbles, it is very easy for a borrower to trip these covenants.

Recovering from such trips is very difficult because what a struggling new mine needs to succeed is more investment, which is exactly what a company can’t provide when its new asset is faltering and debt collectors are calling.

| | The Problems Piled Up

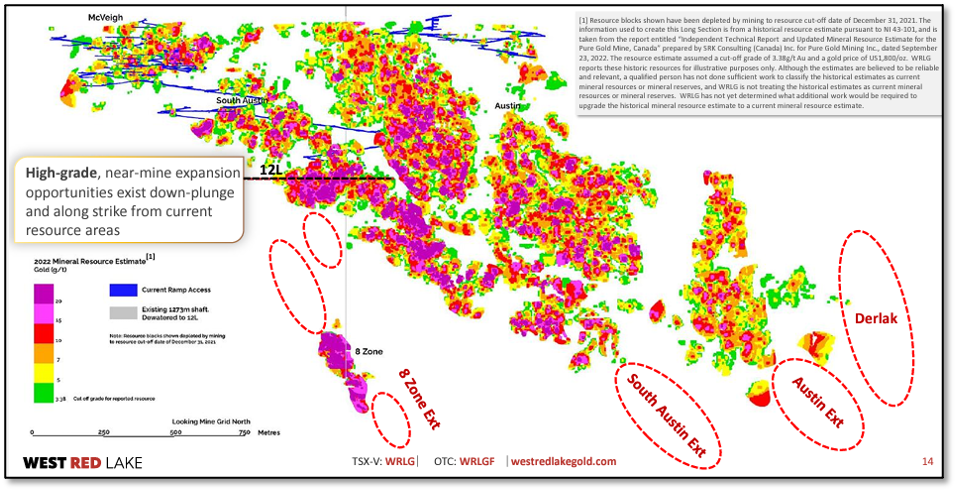

| | Cutting corners seeded problems through the mine. One of the bigger problems was where they chose to mine. The gold at Madsen sits in blobs along two parallel structures. In the block model below, red and purple are high grade; green and yellow are low grade.

| | Pure Gold’s first plan was to start mining the good stuff a few hundred meters down, in the middles of the parallel Austin and South Austin zones.

| | To get to those areas required substantial tunnelling. They started that work; it’s the blue squiggle on the right, known as the East Decline. But then they found the McVeigh zone, which they thought offered enough good-enough material to carry the mine in its first years.

They abandoned the East Decline and started a second tunnel directly into McVeigh.

|  | | Getting to ore faster might seem like a good idea…but grade is king. McVeigh is not nearly as rich as Austin and South Austin, so the material coming to the mill was lower grade than the feasibility study had assumed.

It was a bad starting point.

Then, when they pushed the West Decline through McVeigh into South Austin, they were left with only one way for people and machinery to go into and out of two mining areas. Underground traffic jams are very bad for mining efficiency.

| | On surface the problems really piled up.

| | | Mine Engineering 101 says you drop and pick up ore as little as possible, ideally only once or twice. A series of cost-saving decisions, like not driving a short tunnel under a public road, meant Madsen ore was dumped and reloaded 5 or 6 times.

That is crazy expensive and slow. And when the ore in question has significant free gold, gold literally falls out every time ore is dumped and reloaded. So they wasted time, added cost, and left gold all over the ground.

Between cutting corners on spending and COVID creating long equipment wait times, workers scrambled to keep things going. A lack of core drills meant they needed to use air core rigs for underground drilling, which required a fleet of diesel air compressors, which were very expensive to run and maintain (especially through winter).

| | Examples like these abound. Bottom line: It all meant grades were much lower than planned and operating costs were out of control.

| | Approach comes from the top; mine workers take direction and do their best to make an operation work. And the Madsen team almost had it. By the time Pure went under, the mill was processing 800 tonnes per day, recoveries were good and the mine had just enough active stopes to feed the mill.

| | WRLG’s Path From Here

| | The potential to make Madsen a profitable gold mine of scale is readily apparent, but it will take some work.

WRLG is drilling to upgrade resource confidence and making a robust mine plan. They will fix the inefficiencies on surface.

| | They are working satellite opportunities, like the high-grade, million-ounce Rowan deposit next door. WRLG’s drills suggest Rowan will get bigger and better; they are working to permit a satellite mine there.

| | The small but promising Wedge zone at Madsen offers similar potential to juice grade through the Madsen mill. WRLG will plan these satellite operations as PEA-level expansions alongside a new pre-feasibility study for Madsen early next year.

WRLG boasted a valuation of around C$120 million before free trade date selling pulled it back to C$84 million. It has about C$10 million in the bank to put into the mine, plus C$7 million in exploration capital to drill at Rowan and Wedge.

The company will finance again this year to fund some C$50 million worth of work in 2024, including most of the work and cost to restart the mine. They’ll raise some of that this fall and then issue a PEA for the restart in Q1.

By the time they complete a pre-feasibility study late next year, most of the mine restart work will already be done.

There are two levels of opportunity here.

| | First: buying for the Free-Trade-Date rebound. WRLG is getting out to tell the Madsen story over the next month. They don’t want this Free Trade Date slide to persist. So there’s a very attractive short-term opportunity here.

Second: buying for what Madsen will be worth when it restarts. It’s hard to pin a value on that as a lot of big questions (scale and grade, for instance) aren’t yet answered, but there’s somewhat of a test case in Rubicon Minerals.

| | Rubicon failed spectacularly in building the Phoenix gold mine in Ontario. The company went bankrupt, restructured, changed management and the mine plan completely, tried again and got the mine going nicely...and then got acquired by Evolution Mining for $350 million.

Madson and Phoenix are both high-grade Red Lake gold deposits, but they failed for different reasons. (Rubicon rushed into building without sufficient knowledge of the deposit.)

But even though they’re different, there’s an obvious a parallel in how Battle North (the name Rubicon took on after bankruptcy) rose from a near-zero valuation to a $350-million takeout: by fixing the errors in a new mine without being burdened by huge construction debt.

In short:

| | West Red Lake Gold is a deal with strong potential to create significant new value from a mine that failed for reasons that can be fixed in the right hands.

| | The good news is that it is now in the right hands.

With high grades, near-term production, Frank Giustra’s backing and its storied setting, West Red Lake Gold is a great story and opportunity even if gold goes nowhere.

But if gold takes off as many predict in the months just ahead, the best near-production stories will be the biggest winners. And that’s why smart investors will take a close look at West Red Lake Gold while this market-related buying opportunity lasts.

| | CLICK HERE

To Learn More about West Red Lake Gold Mines.

| | | | | © Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd.

#185

Metairie, LA 70002

1-800-648-8411

| | | |