| A potential turning point for gold and silver…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Gold and silver are perking up, just as one of our favorite technical indicators is now flashing a buy signal.

| |

It looks like I might’ve been a bit too conservative on the timing of gold’s next rally.

|

I didn’t expect it until shortly before the Fed’s next meeting concludes, on the 22nd of this month, or even a bit later. That’s because one of the key technical indicators that I’ve watched for decades seemed to need a bit more time to complete its cycle.

|

But it hasn’t waited around, and just delivered the buy signal we’ve been waiting for.

|

Long-time Gold Newsletter readers will recognize that the technical indicator I’m talking about is the 14-week stochastic for gold. It’s a momentum indicator, and tends to run in fairly regular cycles, at least for gold and silver.

Take a look at what I’m talking about….

|  |

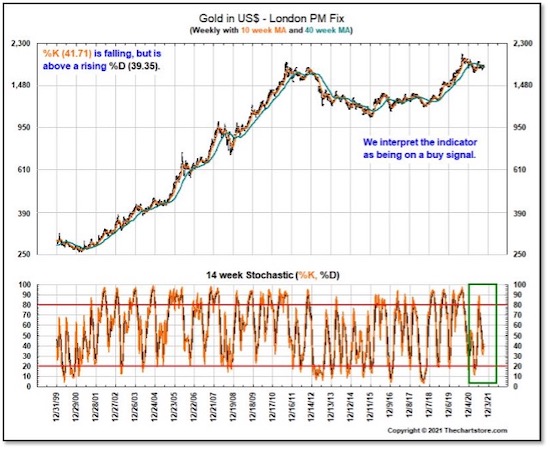

As you can see in the chart above (taken from our friend Ron Griess’ weekly Chart Blog on his fantastic site, TheChartStore.com), the stochastic in the lower panel typically hits an extreme level — either above 80 on the upside or below 20 on the downside — before reversing.

In a strong bull-market environment, it will remain around or above the 80 mark, indicating sustained upward price momentum. That’s what we saw quite often in the 2000s.

Conversely, during the 2011-2015 bear market, the stochastic would often linger around the 20 level or below, a reflection of consistent downward price momentum.

Now notice the area Ron’s marked with a green rectangle. The stochastic had been on a standard course toward the 20 level, and I’d roughly estimated that on this trajectory it would take until the second half of this month (around the time of the Fed meeting) to hit the target before, hopefully, reversing.

Well, the stochastic didn’t wait to hit that mark, and already reversed in recent days. In fact, as Ron notes on the chart, it has delivered a buy signal.

Now take a look at the same stochastic for silver….

|  |

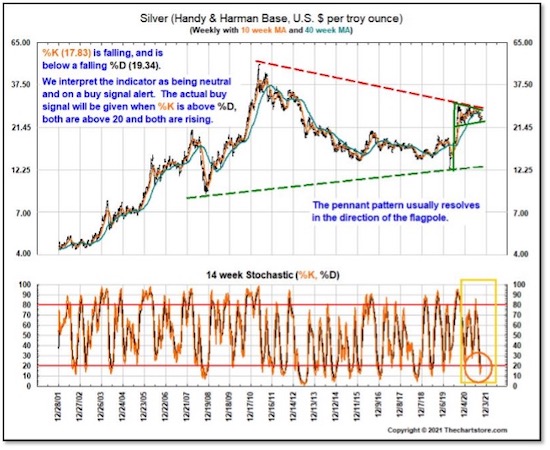

As you know, silver almost always moves in the same direction as gold, and for the same reasons, but moves more dramatically. It outperforms gold on the upside…and sadly on the downside as well.

That’s just what it just did, in fact, as the price chart and 14-week stochastic panel indicate. Silver actually blew right through the 20 mark on the way down and hit a dramatically oversold 10 level over the past few weeks.

|

The stochastic hasn’t reversed and delivered a buy signal just yet. But, as Ron notes, it seems poised to.

|

Now, we’ve had many head-fakes in the metals during this correction. But as long as the stochastics for gold and silver were headed lower, I haven’t been fooled by them.

Gold’s down a bit today, as the New York manufacturing survey came in with a positive surprise reading.

But the bigger, macro picture remains as bullish as we’ve ever seen. And with my favorite technical indicators now flashing green for both gold and silver, or about to, I’m sensing the turn-around we’ve been waiting for is here.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. With this year’s New Orleans Investment Conference just around the corner, the timing couldn’t be better for a metals rally.

If you’re a serious investor, you need to attend this blockbuster, in-person event.

I know that Hurricane Ida made headlines around the world, and New Orleans was hit hard. But the city is merely in clean-up mode now, with power restored virtually everywhere in the city. Our host hotel, the Hilton Riverside, as well as the rest of downtown and the French Quarter, is now fully back in normal operation.

And on the Covid front, infection rates are dropping quickly and we’ll only be operating under a mask mandate for our conference functions. (There are added restrictions within the city for those who aren’t vaccinated, so make sure you’re aware of them if you fall in that category.)

The bottom line is that New Orleans 2021 is happening, and it’s going to be an extraordinarily valuable event.

Consider our speaker roster — one of the best you’ll ever see:

Dr. Ron Paul, James Grant, Jim Rickards, Danielle DiMartino Booth, Jim Iuorio, Doug Casey, Rick Rule, Peter Schiff, Dave Collum, Grant Williams, Dominic Frisby, Tavi Costa, Lawrence Lepard, George Gammon, Brent Johnson, Peter Boockvar, Mark Skousen, The Real Estate Guys (Robert Helms and Russell Gray), Adrian Day, Gwen Preston, Adam Taggart and dozens more — including yours truly — are going to present their best investment ideas to you.

Time is short though, and our room block is filling up quickly, so I urge you to CLICK HERE to get all the details and reserve your place while you still can.

| | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |