| Cash flow from the get-go separates this play from all the others

| | | Please find below a special message from our advertising sponsor, Elemental Royalties. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| |

| Cash Flow

From The Get-Go

| |

Royalty companies are popping up all over the resource sector, and for good reason: They’re widely regarded as the safest and most richly rewarding way to play a rise in metals prices.

But one new company — Elemental Royalties (ELE.V) — has separated itself from the pack with the key advantage every other company is searching for: immediate cash flow.

| | |

It seems like every resource investor wants to buy an early-stage royalty company these days.

And understandably so: The market typically values royalty companies at the head of the pack, so getting in a well-run company at the beginning of its growth curve can pay off handsomely.

It can be confusing sorting through all of the new royalty company options out there, but one key factor rules over all others: cash flow.

|

And it is in this regard that one newcomer — Elemental Royalties (ELE.V) — stands tall…because it’s already collecting the kind of income that other companies are still seeking.

|

The “Royalty” Of Resource Plays

|

In an uncertain world, gold is a terrific hedge against volatile markets and depreciating global currencies, and some component of the yellow metal should exist in everyone’s portfolio.

However, investing in gold or gold companies at any stage is not without its own set of risks. If you pick the right horse and your timing is perfect, you can win the big bet on an exploration company. But there is a litany of risks that accompanies that higher potential, as well as operating costs and hassles for producing miners.

This is why a gold royalty is hands down the safest way to gain exposure to gold as a component of a diversified portfolio.

|

Royalty companies don’t carry the same kinds of worries, risks and costs that operating companies do; they simply collect their checks on every ounce of production.

|

That’s why they might be considered the, ahem…the royalty of resource plays.

But get this: If you want to maximize your profit potential, better to pick an earlier-stage royalty company — one that is generating cash flow from day one…is nearly doubling its revenue annually since inception…and with a valuation that seemingly has nowhere to go but up.

Does that exist?

Yes, it does — because all that can be found in Elemental Royalties.

| |

The brilliance behind a gold royalty play such as Elemental is that the company has already locked in a reliable flow of cash based on existing gold ounce production, despite the market volatility that the producers find themselves at the mercy of.

Essentially, a gold royalty company “loans money for” or “buys” production ahead of actual production. Many royalty companies that have committed funds are still waiting for future production, and are therefore exposed to risk until that project is developed, potentially years down the line.

Royalty companies are certainly nothing new, and the leaders have been wildly successful in the past decades. Consider how these companies can grow into behemoths:

|

• Franco-Nevada (NYSE:FNV) Market cap: US$26.7 billion at $140 per share

• Osisko Gold Royalties (NYSE:OR) Market cap: US$2 billion at $12 share

• Sandstorm Gold Market cap: US$1.2 billion for $6 per share

|

As a speculative retail investor, those price tags may seem out of reach. But if you want early-stage, high-leverage exposure, consider that Elemental Royalties now trades at a relatively low C$90 million valuation, and about $1.30 per share.

There’s been a big jump in the number of new gold royalty companies emerging, but next to none have built a base of revenue from the get-go for a safer bet.

How did ELE achieve this? Let’s just say it’s elemental:

The core team at Elemental Royalties did its homework in the lean years, launching the company privately in 2017 and getting the machine up and running long before going public in 2020.

|

By that point, the company was already cash-flow generating and steadily increasing its gold equivalent ounces (GED) earnings from large, stable producers.

|

During those early, lean years when the gold price was dormant, the company sought out these cash-producing royalties from third parties that had held them as non-core assets. Many of these royalty-owners needed cash for immediate debt and/or working capital for merger and acquisition activity.

Yes they were hard to find…and yes it took a lot of negotiation savvy…but Elemental’s operating team was opportunistic. Better yet, they conducted non-competitive negotiations in a challenging bear market.

As they say, timing is everything.

In fact, according to CEO Frederick Bell, the company is now at the critical inflection point with all of its overhead now covered, and new revenue adds to its free cash flow and acquisition power.

After all, your cost-of-sales is essentially an office and a team of smart, savvy individuals. Consequently, Elemental has been nearly doubling its revenue annually since inception, and it is set to maintain a base of steady revenue growth on “auto-pilot” even if it does absolutely nothing from this point on.

Of course, that’s the exact opposite of the plan.

Here’s a quick timeline of how Elemental built its current portfolio of flagship assets:

|

• February 2017 — 0.25% GRR on Base Resources’ Kwale mine

• July 2018 — 1% NSR royalty on Equinox Gold’s Mercedes mine and a 2.25% NSR royalty on Austral Gold’s Amancaya mine

• January 2020 — 1% NSR royalty on Endeavour Mining’s Wahgnion mine

• February 2021 — Acquires South32 royalty portfolio, with its flagship Karlawinda, welcoming South32 as a major shareholder

|

And to give you an idea of the production they are tapping into:

|

• Wahgnion: 1% NSR produced 175,000 oz. gold in 2020 and on track to maintain this over the original 10 year mine life.

• Karlawinda: 2% NSR Australia’s newest gold mine – first payment in Q3 2021, targeting up to 125,000 oz. of annual gold production over a 10+ year mine.

• Amancaya: 2.25% NSR satellite operation located 60 kilometers from the Guanaco mine and mill, now providing ~98% of mill feed. 55,000 oz. of gold production in 2020, targeting 45,000-50,000 oz. of gold production in 2021.

• Mercedes: 1% NSR Equinox Gold. Currently producing ~50,000 oz. gold following restructuring, potential to return to 80,000-90,000 oz. gold production royalty payable to Elemental from July 28, 2022.

|

Elemental also acquired a 2% gross-return royalty on the pre-feasibility staged Laverton gold project in Feb. 2021. The project is located in the Eastern Goldfields region of Western Australia, and we’ll see more news on that in the coming months.

All told last year the above translated to US$5.1 million in revenue, or 2,889 gold-equivalent ounces, and a profit of US$3.6 million EBITDA. Elemental’s target for 2021 is in the range of $7.2 million to $7.9 million depending on the gold price, or 4,000-4,400 GEO, and — if it was to just rest on its laurels — should achieve a top line of $10+ million in 2022.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

These are all good reasons to invest in Elemental Royalties. But why consider the company for your portfolio now?

Consider this…

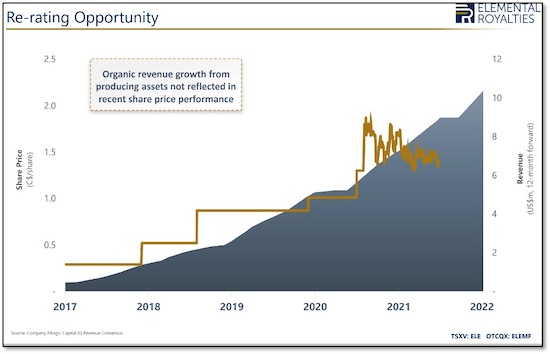

As per the chart below, the appreciation of ELE’s share price, or relative pre-trading valuation up until this point, has been in line with its top-line CAGR (Compound Annual Growth Rate) of 75%.

|  |

However, only recently since the pull-back of the gold run, has the price momentum begun to wane.

Remember, what does cash care about the gold price?

| |

In short, Elemental’s share price has a lot of catching up to do in terms of the current cash flow. But the company isn’t sitting still.

Elemental’s CEO Bell puts it well:

“Last year our two biggest deals were a $12.5 million royalty on Endeavour Mining’s Wahgnion project and a $55 million acquisition from South 32, which doubled the size of the company with each of these acquisitions. What that really did was give us this great blend of value and scale — and both are really valuable in the royalty space.

“Since we started in 2017, we have nearly doubled the revenue every year and it is on course to double from 2020 going into 2022 again if we do nothing else. What’s unique about us, with the South 32 acquisition, this year is the first year we have 12 months of revenue from Wahgnion, our biggest royalty, and we have our new biggest royalty that started production in Q2, Australia’s newest gold mine, Karlawinda.”

Consider that next year will be the first year Elemental will have a full 12 months of revenue from Karlawinda, and then in 2023, the company will have a full 12 months of revenue from Equinox’s new Mercedes acquisition.

|

One of the benefits of a highly scalable royalty model is that over the next few years, without doing anything else, Elemental will have more revenue and more royalties paying cash each year…and all from only the current portfolio.

|

Everything new will become exponential gravy.

Timing is everything in investing. And getting on the Elemental train now, before share price can catch up with the company’s revenue growth…

…And before the company can make more transformational acquisitions…

…Stands to pay off very well indeed.

|

CLICK HERE

To Learn More About Elemental Royalties

| | | |

© Golden Opportunities, 2009 - 2021

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |