| Hang on for gold’s correction...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | A Bull Market Break

| | | Gold looks like it’s correcting right now, although the longer-term prospects look better than ever. In fact, it seems that the entire financial universe is aligning in favor of gold.

| |

September 30, 2024

Dear Fellow Investor, | | Gold’s lost about $40 over the past couple of sessions, after setting yet another all-time high and threatening to close above $2,700 on a spot basis.

| | Frankly, it looks like this bout of weakness could last a while. Let’s take a look at why.

As you may remember, in early July I showed you a chart showing how, during this nascent bull market in gold, price breakouts had been reliably predicted whenever its Bollinger bands narrowed.

As a bit of background, Bollinger bands are a measure of volatility, with the center line marking the 20-day moving average while the upper and lower bands typically mark two standard deviations above and below that average. When the price is near the upper band, it signals that an asset is overbought (and perhaps due for a correction), and vice versa for the lower band.

| | Another way to use this tool is to find times when, as I noted above, the bands “pinch.” This shows a period of low volatility and consolidation during an established trend, and often presages an imminent breakout, usually in the same direction as that trend.

| | That’s why I showed you the chart in early July: The bands were narrowing and thereby predicting a price rally that, during the middle of summer, would surprise just about everyone.

Just as predicted, we saw gold take off and, again as predicted, everyone was stunned. Except you, of course.

| | The Other Side Of The Coin

| | Take a look at that same chart of gold and its Bollinger bands, updated for today’s values:

|  | | As you can see, we had another chance to buy gold when the bands pinched a few weeks ago and, since then, gold has been riding the upper band higher.

Now that rally has lost steam and the bands are, just barely, starting to come together again. The record of this bull market shows that the process of narrowing has so far taken anywhere from one to three weeks, so we could see some continued price weakness.

The good news is that, from a fundamental standpoint, everything seems to be turning in favor of gold.

| | The Investing Universe Aligns

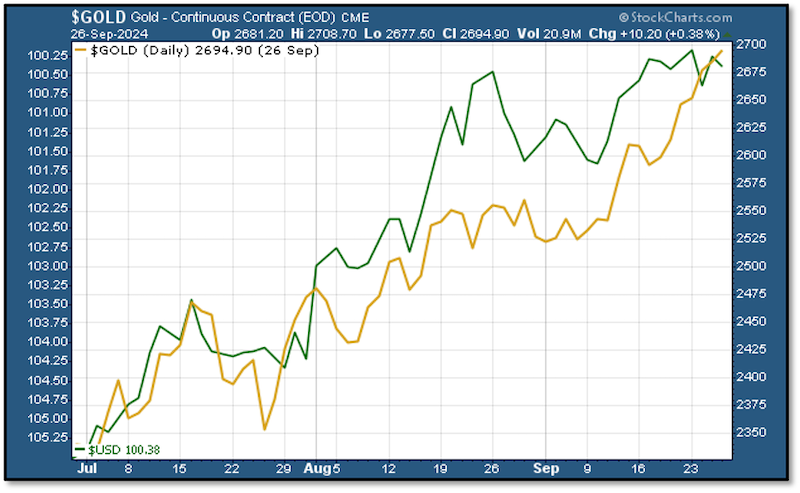

| | First, we had the Fed pivot, which the markets began to price in early in July (resulting in the aforementioned surprise rally in gold). Consider this chart of gold and the Dollar Index, with the DXY scale inverted.

|  | | The contestants on Dancing with the Stars wish they could move in such unison.

To sum up, in anticipation of the Fed’s move from rate hiking to the rate cutting side of the cycle, investors began to buy gold and sell the dollar. We’ve also seen option interest in gold futures rise along the way, as many traders functionally adopted a pair trade strategy with gold and the dollar.

| | They did other things, as well, moving into the GLD gold ETF, buying U.S. equities and, more specifically, beginning to move into gold mining stocks to gain leverage to the metals powerful rally.

| | Thus, the Fed pivot has been the biggest fundamental factor working in gold’s favor. But there have been other ingredients added to the gumbo in recent days, notably the slashing of bullion import tariffs by India and a series of significant monetary and fiscal easing moves by China.

As I’ve often said, a hallmark of a bull market is when even bearish developments are interpreted bullishly. But this is taking things to an entirely new level, as it seems every major new development is undeniably bullish for gold.

| | The bottom line is that we’re in a long-term, secular bull market for gold. And we need to be positioned for it.

| | One of the best ways, of course, is through high-quality junior mining equities. And in that regard, I urge you to visit our Gold Newsletter YouTube channel for in-depth interviews with a number of top exploration and development companies, including those highlighted below.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |