| Silver soars and gold follows…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | Silver Soars, Gold Follows

| |

Rumors of a new financial crisis send the metals catapulting higher and, strangly enough, also send stocks flying as the market contemplates a Fed pivot.

With the potential for huge gains or losses ahead, here are two ways you can learn how to prepare.

| | | |

It started, of all places, with silver.

|

Late yesterday and in overnight trading, gold’s poor cousin started rising in workman-like fashion. Gold had a few pops itself and had risen a few dollars after the New York opening, but couldn’t hold on to its gains even as silver just kept plugging along.

By 10:00 in New York, silver had gained over a buck and screamed past $20…but gold had still barely budged.

|

That didn’t last long, however, as the big move in silver sparked interest in gold and both kept roaring higher. Gold rose as much as $38 to $1,699, while silver jumped as much as $1.60, or an amazing 8.5%!

|

As I write, gold’s still over $35 higher and silver’s still about 65¢ over the key $20 level.

Frankly, I expect both to give up some of these gains as the bears gather strength for an attack. But this is still a remarkable move, begging the question…

| |

First off, it’s obvious that shorts are getting burnt today; the rocket-shot in silver bears all the signs of a short-covering frenzy.

But what sparked it all?

For that, we can gather some clues by the looking at what happened in the other key asset classes.

Here we see that, curiously, Treasury yields began falling early on and were soon followed by a major rally in U.S. stocks. In other words, both fear and greed were working at the same time.

The fear comes from rumors of trouble with Credit Suisse, and possibly other big investment banks, on the brink of failure due to the spreading stresses from the Fed’s relentless rate hikes.

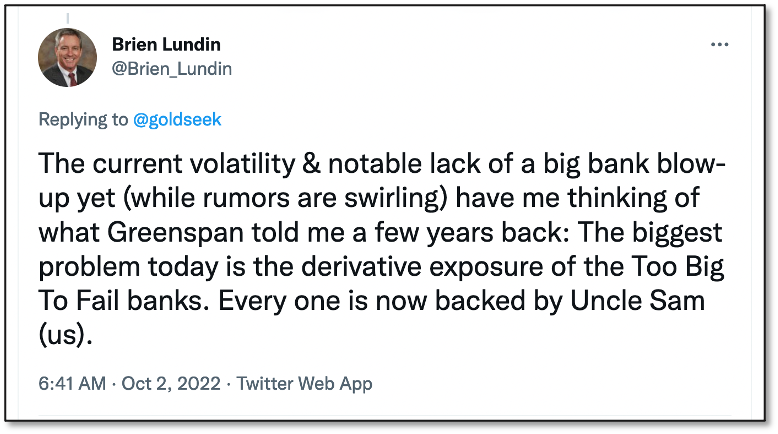

The fact that we have yet to see a Lehman-type collapse in the current environment has weirdly added to the worries as the market keeps looking for the next shoe to drop. As I tweeted over the weekend:

|  |

Because of the inter-connected aspect of derivatives, one bank’s issue would quickly become everyone’s…with the potential of a financial Armageddon.

But even short of that, the collapse and forced bail-out of just one big bank would be enough to stay the Fed’s hand in its rate-hike crusade.

And that’s where the greed came in today. Bad news has once again become good news for the speculators and, as I noted last week, anything that points to a return of central bank liquidity means “buy everything” on Wall Street.

|

Thus, the strange sign of gold and silver shooting skyward on safe-haven fears while the algos are buying every stock in sight.

| |

These are unusual times, perhaps fraught with more risk and opportunity than any I’ve ever witnessed before.

|

Two Ways To Learn How To Prepare

|

First, in one of the more fortunate coincidences you’ll encounter, this year’s New Orleans Investment Conference is being held just as the markets are erupting and all these long-standing issues are coming to a head.

Dozens of today’s top experts (click here to see who), along with hundreds of smart, successful investors, are all gathering here in New Orleans next week, from October 12-15 (Wednesday through Saturday).

|

It’s going to be an incredibly enlightening and enjoyable four days, with insight-packed presentations and panels along with lavish entertainment — perhaps the most important investment event since 2008.

|

It’s not too late for you to attend — we’ve persuaded our host hotel to keep our room block open a few more days and I’m extending the discounted registration fees through the weekend.

Just CLICK HERE now to learn more and reserve your place.

Second, I’m participating in a fascinating webinar this Wednesday, October 5th, at 7:00 p.m. Eastern/4:00 p.m. Pacific addressing “How To Fix The Financial System.”

|

That’s an ambitious topic to be sure! But with Russell Gray and Jay Martin as my fellow panelists, along with moderator Bronson Hill, we’ll be well equipped to tackle the issue.

|

I’m sure we’ll have some specific investment advice blended in, given what’s going on, but this is the perfect time for such a far-reaching discussion. With everything moving so quickly, the pathways we outline could lie just ahead.

It’s a free webinar — with invaluable insights — so CLICK HERE to register now.

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

CLICK HERE

To Register For

New Orleans 2022

And Save Up To $400

| And

CLICK HERE

To Register For

“How To Fix The Financial System”

Wednesday, October 5th, 7:00 p.m.

Eastern/4:00 p.m. Pacific

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |