A Head Start In The Next Gold Bull Market

When a mining company wants to go into production, it always helps to have a head start.

And with $230 million already spent by others on Bluestone Resources’ (BSR.V; BBSRF.OB) permitted high-grade gold project, the company is well on its way to throwing the switch on a world-class mine.

Dear Fellow Investor,

When gold starts to move, companies with large, identified gold resources are the first big winners...often multiplying in price when gold only moves 10%.

The good news: Gold seems ready to run, and hard.

The better news: Bluestone Resources not only has world-class, high-grade gold resources, it also boasts a long head start on a richly economic mine.

And the timing is perfect.

As the U.S. Fed nears the end of its rate hike regime, gold is ready to break out to the upside. And long-term, a global race to the bottom via currency devaluations will leave gold standing tall as the currency of last resort.

The key for investors is finding the right way to take advantage of the broader trend. And thanks to its advanced-stage Cerro Blanco project in Guatemala, Bluestone resources has exactly the kind of asset that could dramatically outperform during gold’s next run.

Grades Miners Dream About

Bluestone bought the Cerro Blanco project and its accompanying Mita geothermal project in May 2017. The project came with $230 million already spent on exploration and development, including $60 million on the geothermal project.

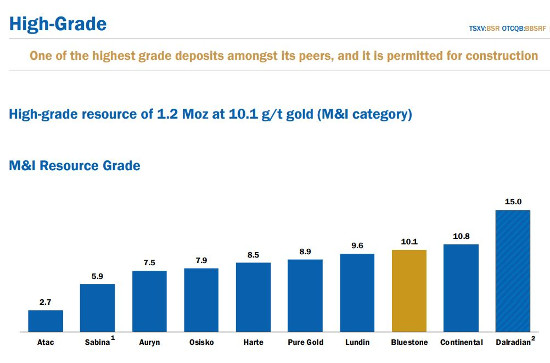

Cerro Blanco is a high-grade, underground deposit. According to the most recent estimate for the underground resource, the deposit contains 1.2 million ounces of gold at an average of 10.1 grams/tonne.

Those are eye-popping grades — the kind of grades that miners dream about.

Take a quick look at the graphic below. It demonstrates that Cerro Blanco’s 10.1 g/t average grade puts it on the high-end of its peers with exploitable gold deposits.

A Comparison of Companies with Projects Similar to Cerro Blanco

The Identified Potential For Even More

All by itself, having this high-grade, underground mineable resource puts Bluestone in a unique category among its junior mining brethren. But when you look at the bulk tonnage resource the company recently outlined on the project, things get really interesting.

The bulk tonnage estimate is not part of the feasibility study that Bluestone is working on to get Cerro Blanco into production, but it does demonstrate the huge potential here.

Using a 0.5 g/t gold cut-off, the deposit hosts a measured and indicated resource of 2.99 million ounces of gold and 13.8 million ounces of silver and an inferred resource of 0.58 million ounces of gold and 3.0 million ounces of silver.

That huge bulk tonnage resource essentially gives Bluestone a blue-sky option on Cerro Blanco that would allow it to provide even greater leverage, should gold and silver prices cooperate.

A Bonus Geothermal Project

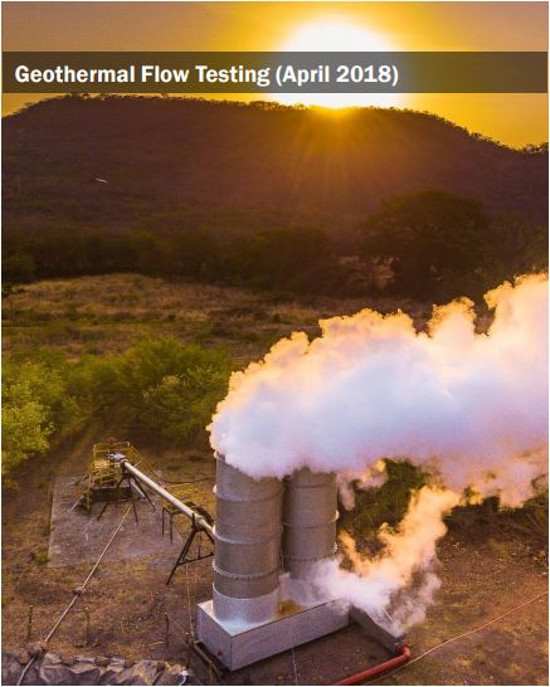

The Mita geothermal project that came with Cerro Blanco gives Bluestone some unique options as it looks to put the project into production.

The project comes with a 50-year license to operate a 50 MW geothermal plant. A flow testing program has been completed, which has improved the confidence level in the geothermal resource.

Bluestone envisions a staged approach to development that starts the geothermal plant as a smaller operation. The power generated could either be used to help power the mine at Cerro Blanco or it could be sold into the privatized national grid.

Mita Geothermal Project

Either way, Mita’s addition to this story gives Bluestone options at Cerro Blanco that similar advanced-stage projects simply don’t have.

Gold On Sale

But it’s when you take a look at the economics of Cerro Blanco that things really get interesting.

A preliminary economic assessment on the project gives it an after-tax net present value, discounted at 5%, of $317 million and an after-tax IRR of 44%.

Cerro Blanco would produce 138,000 ounces of gold per year over a nine-year mine life. Average life-of-mine head grades would be 8.14 g/t gold and 27.95 g/t silver.

The company’s current enterprise value hovers around $50 million. In other words, just the underground resource at Cerro Blanco has an NPV worth six times Bluestone’s current valuation.

Thanks to the existing infrastructure, the company is already well ahead of the game. Initial capex for putting the project into production are a modest $171 million and the high-grade promises to deliver all-in-sustaining costs of just $490/ounce.

A Unique Opportunity...While It Lasts

Simply put, Bluestone is uniquely positioned to deliver tremendous leverage on the next bull market for gold.

It has a high-grade, million-ounce-plus gold project. It has the infrastructure and exploitation permits it needs to put that resource into production. And it has the money in hand to get the project to the feasibility stage.

In other words, one day, the market is going to look up and see a company with a high-grade gold deposit on the verge of kicking out some serious cash flow. At that point, those who built a position in Bluestone Resources at today’s bargain levels will likely be very glad they did.

CLICK HERE

To Learn More about Bluestone Resources

|