| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Two weeks ago, our headline warned that “More Market Turmoil” was “Directly Ahead.”

Well, it’s here — and it’s more important than ever that you sign on now to get the latest views of today’s top experts.

| | | |

The easiest prediction for financial pundits to make these days is that there’s more trouble ahead.

|

So I’m not going to slap myself on the back for predicting in our Golden Opportunities issue of September 26th — exactly two weeks ago — that things were going to get even crazier in the markets.

|

We’ve seen incredible volatility since then, with stocks, bonds and commodities...including gold and silver...soaring and diving with every daily interpretation of the Federal Reserve’s intentions.

| |

Let’s face it, no one expected them to last this long in their rate-hike campaign.

But, as I noted last month, there’s one big data point coming at the end of this month that will exert extreme pressure on Powell & Co. to stop.

And that’s the annualized interest expense on the federal debt, for the third quarter.

It is with this report that we’ll begin to see the impact of the Fed’s most aggressive rate moves. Remember, their initial rate increase was a mere quarter point on March 17th...and that was followed by a half point on May 5th.

But then came three successive three-quarter point hikes, in June, July and September — and none of those have yet hit the statistics for interest payments.

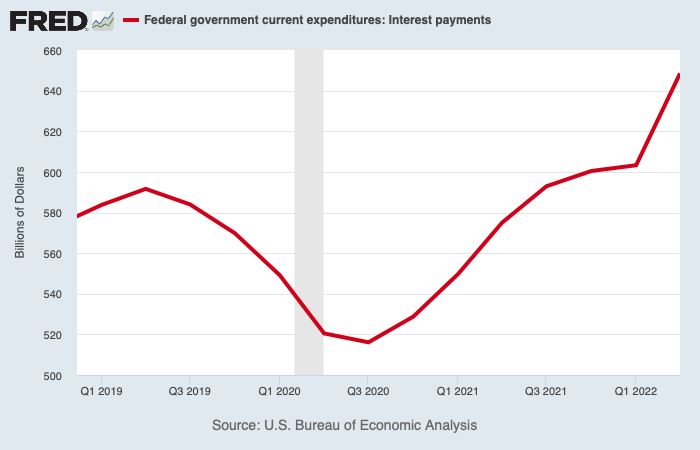

When I last reported on the second quarter interest costs, I told you that they’d soared to a new all-time record of $600 billion a year and were headed higher.

|

Well, get this: The Bureau of Economic Analysis has just updated their second quarter numbers...and quietly noted that the costs had risen to $648 billion.

|

The interest costs are rising too quickly for the government bean counters to keep up! Look at their latest chart:

|  |

The costs are soaring skyward!

Again, this annual rate of interest expense is calculated for the second quarter, before the Fed’s big rate hikes hit. The first third quarter estimate, coming out on October 27th, should be nothing short of shocking to the markets...and the Federal Reserve.

We simply must be prepared for what happens when the Fed is forced to stop. Fortunately, it’s easy for you to get the most powerful strategies and insightful analyses this week...

|

“The World’s Greatest Investment Event”

Available Virtually...From The Comfort Of Your Home

|

The blockbuster 2022 New Orleans Investment Conference is beginning this Wednesday.

While it may be too late for you to make travel arrangements to attend in person, the good news is that you can get all of this invaluable market intelligence online, from the comfort of your home or office.

You just need to sign up for our Virtual Access now.

|

Through this affordable option, you’ll be able watch everything live, as it happens — all of our exciting General Session presentations...every scintillating panel...and each in-depth workshop — on your computer or mobile device.

|

And your virtual pass will give you full access to all of our recordings, allowing you to watch everything at your leisure for months to come!

Consider the speakers you’ll get to watch as they share their top recommendations in our intimate gathering:

|

James Grant...Jim Rickards…George Gammon...Danielle DiMartino Booth...Rick Rule...Brent Johnson...Tavi Costa...Peter Boockvar...Jim Iuorio...Dave Collum...Lawrence Lepard…Jon Najarian & Marc X. LoPresti…Dominic Frisby...Adam Taggart...Bob Prechter...Adrian Day...Mark Skousen...Mary Anne & Pam Aden...Steven Hochberg...The Real Estate Guys…Brent Cook...Thom Calandra...Chris Powell...Dana Samuelson...Gary Alexander...Albert Lu...Mike Larson...Nick Hodge...Lobo Tiggre...Omar Ayales...Jeff Clark...James Stack...Bill Murphy...Sean Brodrick...Mickey Fulp...Byron King...Rich Checkan...

...and, of course, yours truly.

|

Remember: Everything — the years spent mired in the pandemic…the macro-economic set-up…the geopolitical uncertainty…the teetering stock markets…soaring inflation…a looming generational commodities bull market…and the Fed’s upcoming retreat on monetary tightening — make New Orleans 2022 a must-attend event.

By registering for full virtual access, you won’t miss a thing.

Just click on the link below...and join us virtually in New Orleans!

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| |

CLICK HERE

To Register For

Your VIRTUAL ACCESS

For New Orleans 2022

October 12-15, 2022

| | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |