| Gold continues to soar...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Gold Takes Off Again

| | | It’s another banner day for gold...and a scary one for the world.

But the drivers behind gold’s move are more than meets the eye.

| |

October 11, 2023

Dear Fellow Investor, | | Gold is taking off to the upside again, as investors rush to the supposed “safe haven” of the yellow metal and the speculators quickly cover their short bets.

| | As I noted on Monday, sometimes a good day for gold is a bad day for the world, and such is the case right now.

| | I also pointed out that there’s no good reason why anyone should buy gold when violence breaks out somewhere in the world...even when the event is as horrendous and ripe for escalation as the Hamas attack on Israel.

| | The reason to own gold is because you believe the purchasing power of your currency is going to dive even more steeply, and that prospect simply doesn’t apply in this case.

So a gold rally in the wake of a geopolitical event is...usually...something to be avoided.

Today I want to explore how that truism applies today. Or perhaps doesn’t.

| | This Time Really Is Different

| | Early last year, as the Fed was readying for the initial rate hike in its campaign to stymie growing inflationary pressures, gold started to rally.

This was surprising to many, but not to readers of Gold Newsletter. In that publication, I detailed how gold often, in fact usually, rises during Fed rate hikes. That seems counterintuitive, but the record is clear on this.

For example, during gold’s legendary bull run of the 1970s, gold continued to rise because inflation was rising more quickly than the Fed could raise rates. Finally, Volcker was able to kill off inflation by drastically hiking rates above 20%.

Now, back to early last year.

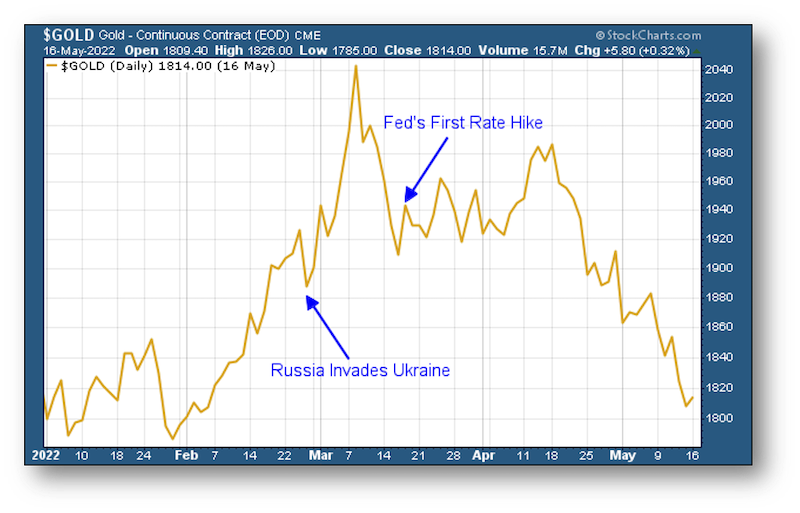

As you can see from the chart below, gold began to rise in January of last year as Fed rhetoric started to point toward an imminent rate-hike campaign. Notably, the gold price ran for at least a couple of weeks before the potential of a Russian invasion emerged.

|  | | Note that, after the gold price had risen for about a month, Russia actually did invade, and this briefly turbocharged the gold rally.

Then, after World War III failed to emerge, the crisis moved from the front page and, as usual, the gold price declined after the initial panic subsided.

| | In effect, this geopolitical crisis overwhelmed the drivers that were already in play. And the price downtrend it created as the initial fears passed led to an extenuated bear market as the Fed relentlessly raised rates over the next 18 months.

| | Fast forward to today, and we see that gold was dramatically oversold as the crisis in Israel unfolded, and in fact seemed to have bottomed on Friday, the day before the attack began.

Yes, there is the risk that the gold price will fall if and when the tensions in the Mideast subside or there is some resolution after Israel invades Gaza.

| | But we’re in a much different macroeconomic environment today, as compared against early 2022.

| | Today, the U.S. economy is straining under the burden of what may be the harshest tightening cycle ever enacted by the Fed. Bankruptcies are surging, and the lagging effects of the rate hikes are yet to be felt.

Even before the violence erupted, this rate-hike cycle had essentially peaked. So whenever these troubles begin to fade away, we will either be in or approaching the downside of the cycle.

These forces will be far too powerful for the easing of geopolitical tensions to overcome. This rally will not be killed off.

| | The Timing Is Critical

| | In short, regardless of what happens in the Mideast and when, we are about to enter a tremendously bullish environment for gold, silver and mining stocks.

And as I’ve been stressing, the timing is perfect for this year’s New Orleans Investment Conference, convening in just a few weeks.

You’ll not only hear from many of today’s top geopolitical analysts, but also leading macroeconomic thinkers and the most successful mining stock pickers in the business.

| | CLICK HERE to see our entire “dream team” of experts. It’s the best that’s ever been assembled, in my opinion.

| | Remember, you literally can’t go wrong by attending New Orleans ’23. With our iron-clad, money-back guarantee, you’ll get every cent of your registration fee back if you’re not completely satisfied.

Any delay could mean you’ll pay a much higher registration fee or fail to get into our convenient host hotel, so click on the link below to learn more now.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Secure Your Spot At

New Orleans ’23

And Save Up To $400!

| | | | | © Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |