| Silver junior surpasses the 100-million-oz landmark | | | Please find below a special message from our advertising sponsor, Silver Elephant Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

| Silver Elephant Mining Reaches 120 Million Ounces, Keeps On Drilling | |

Silver Elephant’s open-pit approach to its flagship project has produced eye-opening resource numbers…and drills continue to turn.

Plus, it just acquired a second silver project and completed a drill program on a third project, with assay results due in three weeks.

Backed by Eric Sprott, Silver Elephant Mining (ELEF.TO; SILEF.OTC) is making good on silver’s promise with its three active projects…and investors are taking notice.

| | |

With only about 100 silver names traded in the public markets, quality silver junior bargains are hard to find.

|

So, the market was pleasantly surprised to find Silver Elephant Mining (ELEF.TO; SILEF:OTC) had delivered a 120-million-ounce silver resource in October…while trading for under a C$100 million market cap.

|

But more’s to come, as Silver Elephant is poised to deliver additional silver resources — and a potentially higher valuation — as drills continue to turn on its multiple projects.

|

Elephant Reports Massive, 120-Million-Ounce Silver Resource At Pulacayo

|

In October, Silver Elephant achieved a rare feat in the silver junior space by reporting 120 million ounces of silver resources (in addition to 2.26 billion pounds lead and zinc) at its Pulacayo project in Bolivia.

| |

| | source: www.silverelef.com |

In total there were 101 million ounces of silver in the indicated category, and 8.0 million ounces of silver in the inferred category. Those resources were pit-constrained, while there are another 10.8 million ounces of high-grade silver resource that is at the edge of the pit.

| |

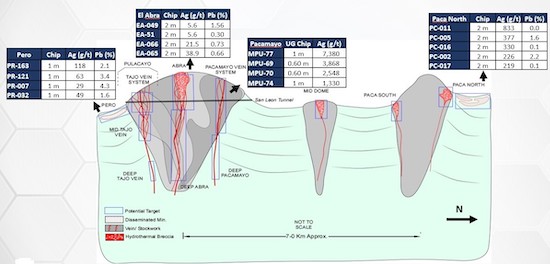

| | Pulacayo Conceptual Pit View, Economics Not Demonstrated |

About 30 percent of the project resource is from the Paca deposit, which is situated seven kilometers north of Pulacayo. The Paca mineralization is near or at surface and features a low strip ratio. The deposit is open at depth, to the north and to the east. Elephant is drilling Paca at the moment, and the results will be available by year’s end.

In the Pulacayo district, Silver Elephant has identified additional targets, with hundreds of surface samples reporting anomalous silver values. Exploration efforts are underway now to define new drill targets.

|

| | Pulacayo District Long Section Schematic |

PLUS:

Elephant’s New Sunawayo Project Borders The 350 Million-Ounce Malku Khota Silver Deposit

|

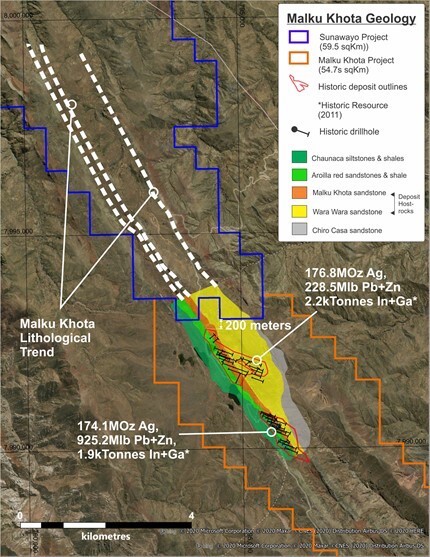

In September, Silver Elephant landed the strategic acquisition of the Sunawayo silver project, which borders on the massive Malku Khota project in Bolivia.

Sunawayo is a mere 200 meters from the edge of the Malku Khota sedex-style silver deposit, which contains 350 million ounces of silver resources. (That estimate is considered historic, as it was published in 2012.)

|

| | ELEF’s Sunawayo borders Malku Khota silver deposit |

Sunawayo is on patented land that Silver Elephant acquired from a private party, while Malku Khota is on unpatented land administered by the Bolivian government.

In January 2020, Silver Elephant applied for a mining production contract with the Bolivian government that would give it the rights to mine and explore Malku Khota. The application is under review.

The Sunawayo-Malku Khota district is remarkably underexplored.

Consider this: Roughly 3.5 kilometers of the strike from the border into Malku Khota has been drilled…and the Malku Khota lithological trend extends for another eight kilometers northwest into Sunawayo…

…Yet Sunawayo has not received a single exploration drill hole to date.

In September, Silver Elephant reported that all of its initial 48 grab samples at Sunawayo returned anomalous silver-lead grades of up to 477 g/t silver and 20% lead. This is an early indication that Sunawayo may host multiple mineral discoveries, and the company is starting an exploration program to define drill targets by year end.

Sedex-style silver-lead-zinc deposits like Malku Khota type account for 50% of the world’s lead and zinc reserves and 30% of the world’s silver resources (2019 USGS data).

Large, regional-scale sedex systems can span hundreds of kilometers and form large tonnage deposits. Examples are Glencore’s Mount Isa mine and Teck’s Red Dog mine.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

And More:

Results Are Pending From A Just-Completed Drill Program On Elephant’s El Triunfo Project

|

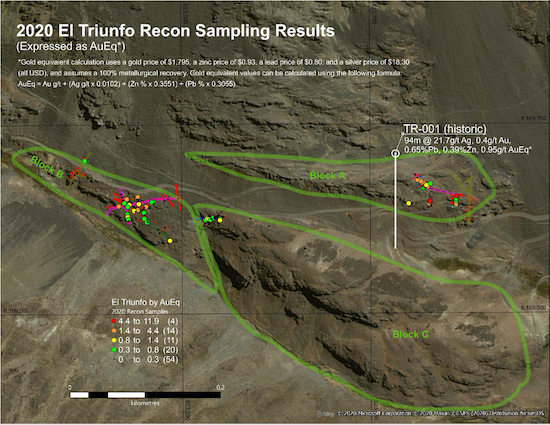

In October, Silver Elephant completed its first drill program at its newly acquired El Triunfo gold-silver-lead-zinc project in Bolivia.

The drills were collared to the east and west of drill hole TR001, which returned assay results of 94.2 meters grading 0.39 g/t gold, 21.8 g/t silver 0.65% lead and 0.39% zinc (0.95 g/t gold equivalent).

In August, samples from El Triunfo returned highly encouraging results, where 37 out of 103 samples assayed over 1.0 g/t gold equivalent, the highest being 8.3 g/t gold equivalent.

|

| | Silver Elephant’s El Triunfo Project |

A quick check of El Triunfo’s rock value with the KitcoCasey rock calculator will give you a good idea of how much one-gram-per-tonne of gold is worth today at $1,900 per oz gold prices.

|

Silver Elephant Is Bulking Up

|

Taking advantage of the $25/oz silver price, Silver Elephant’s astute management team took a fresh, open-pit approach to the historic Pulacayo underground mine and produced an impressive silver resource. The significant lead and zinc by-product credits will no doubt enhance the project economics.

Considering Pulacayo is open at depth for at least another 600 meters from the bottom of the modeled pit, excellent exploration potential remains.

Add in the Sunawayo project as another lottery ticket with great chances for another big discovery…and the fact that the company has applied for the rights to the 350-million-ounce Malku Khota project…and Silver Elephant offers even more chances at a world-class silver resource.

Even if Malku Khota accidentally lands on a major mining company’s lap instead, that outcome will likely put Silver Elephant in play, as Sunawayo and Malku Khota are joined at the hip.

And then, with bulk mineralization starting at or near the surface, El Triunfo’s resource tonnages could build up in a hurry to become yet another enviable asset for a junior like Silver Elephant.

| |

Commodity investing is all about timing.

With the departure of president Evo Morales last November, Bolivian mining is opening up to investors after a decade of underinvestment.

The public perception of Bolivia is improving. This can be seen in the $1 billion market valuation of New Pacific Metals Corp, a silver explorer in Bolivia whose silver discovery is only a two-hour drive from Pulacayo.

Silver Elephant has grown by leaps and bounds over just the few short months since it was first featured in Golden Opportunities.

There seems little doubt that the company’s resource base and project portfolio will continue to expand, with more marquee shareholder backing from Eric Sprott and others.

The question beckons: Can Silver Elephant (ELEF.TO; SILEF:OTC) be swallowed up by a larger player before it bulks up further?

Either way, shareholders win — a fact that argues for owning the company at or near current levels.

| |

CLICK HERE

To Learn More About Silver Elephant Mining Corp And Its Growing Silver Resources

| | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |