| NOIC Review: Where’s the inflation? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

New Orleans 2020 was a smashing success, with compelling and important viewpoints provided by speakers and attendees alike.

Here’s Gary Alexander’s “instant analysis” of one of the biggest questions emerging from the event.

| |

You’ve probably heard by now: New Orleans 2020 was an absolute blockbuster.

|

I’m going to provide many of the most important take-aways from the event over the days and weeks ahead, but I wanted to quickly share an exceptional review just released from my long-time friend and New Orleans Conference participant Gary Alexander.

|

The former editor of Gold Newsletter for Jim Blanchard, Gary now writes a weekly column for renowned money manager and analyst Louis Navellier.

Almost immediately following the conclusion of New Orleans 2020 last Saturday, Gary had what he called his “instant analysis,” prepared for his weekly column, in my email inbox. I told him I’d seen full-fledged research reports less informing than his instant feed-back, and asked if we could share it via Golden Opportunities.

Gary and Louis agreed, and we reprint it in its entirety below. Note that you can get Gary’s columns, as well as the rest of the daily columns in Navellier & Associates’ Marketmail, at no cost. Details are below Gary’s column, and I highly recommend this quality service.

— BL

| | | Inflation Remains Low Because “Velocity” Has Fallen Off the Table | | By Gary Alexander |

Last week (October 14-17) was the 46th annual New Orleans Investment Conference, and I’ve been a speaker, MC and/or panel moderator there for the last 37 of them.

This one was uniquely “virtual” over Hopin. I hosted a political panel (with Tucker Carlson, Doug Casey and Stephen Moore) from four corners of the nation (Florida, Maine, Washington and Colorado) and I also listened to nearly all of the General Sessions from an array of other seasoned economic analysts. One of the biggest questions asked (and frequently answered) by speakers was, “with all this newly-printed money, where is the inflation?”

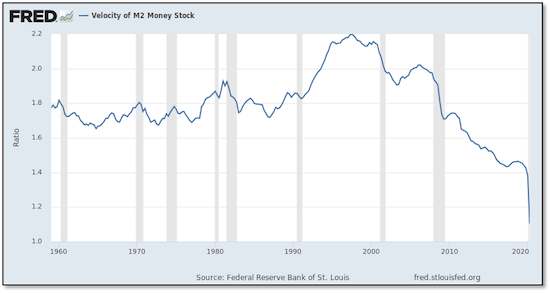

Several speakers, including Jim Rickards and Ronald-Peter Stoeferle, pointed out the rapid decline of monetary velocity – the speed at which money turns over.

Rickards even disputed the term “stimulus,” with reference to bailout money, when that money is not spent but squirreled away. A stimulus check does not stimulate the economy if it is not spent. One example he used is that when a couple would go out to dinner and a show, they may have taken a taxi to both spots, spending and tipping along the way, but when they are forced to stay home, that means several hundred dollars are not spent. The taxi drivers, restaurant owners and employees, theater operators, musicians and others are now totally out of work.

The standard equation for inflation in the Chicago “monetarist” school, championed by the late Milton Friedman, is MV = PQ, where M is the Money Supply, often denominated in M1 or M2, and V is the Velocity of that money in exchanges per year, with a normal turnover of 10 times for M1 or 2 for M2. The other side of the equation is “P,” referring to a price index for inflation, and “Q” stands for GDP.

Milton Friedman said that rising money supply generally causes inflation because he assumed that monetary velocity was constant, but velocity is by no means constant. It started going down in 1998, then accelerated its decline after the 2008-09 monetary crisis and then fell off a table here in 2020 (see chart).

|

|

If V is near zero then, Jim Rickards said, “$22 trillion (GDP) times zero (Velocity) is zero.” Velocity is by no means zero, but M2 velocity has fallen by 50% in the last two decades – from 2.2 down to 1.1.

The basic reason for this sharp decrease in velocity is the fear of deflation – the fear of the bad times to come, a job layoff, or falling prices in general – the belief that prices will be lower tomorrow than today.

People will tend to hold onto their cash if they believe prices will be lower next month, including the price of stocks. That’s why the Federal Reserve, and central bankers everywhere, fight deflation so fiercely. They need people to spend now, to goose the GDP this quarter, not next year, so the Fed has pulled out all stops in creating tools to encourage inflation in order to slay the greater devil of deflation.

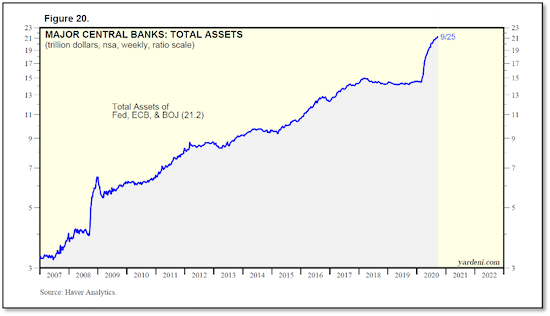

The three major central banks in the U.S., Japan and Europe increased their balance sheets by 47% in seven months (February 21 to September 25), from $14.4 trillion to $21.2 trillion, a $6.8 trillion infusion. The dollar fell 10% from March through September because the Fed created money faster than the others:

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

| | Source: Yardeni Research |

|

What It Will Take To Get All This Money Circulating

|

There are several monetary measures. For money in circulation, including checking accounts (M1), the normal velocity is 10, whereas for the broader M2 – which includes M1 plus savings deposits, money market securities and other near-cash deposits – the velocity was 2/year in 2008 and is barely one now.

| MV=PQ, where…

M = money supply in the economy, mainly M1

V = velocity of circulation.

P = price level in the economy

Q = output produced by the economy

The velocity of circulation "V" is defined as the average number of times a dollar bill circulates in the economy per year.

Assume on average a dollar bill does 10 transactions (buying and selling of goods and services) per year.

Thus, velocity of circulation "V" in this case is 10. Here, a one-dollar bill does the equivalent of 10 dollars’ worth of transactions.

So, M x V = 1 x 10 = 10 dollars | | Source: Econmentor |

With trillions of new dollars in circulation, there will be no meaningful inflation until those dollars start to circulate more. There is already some inflation in asset prices – in gold, stocks and real estate – but not in everyday prices. In general, people are sitting on their savings and their stimulus checks, if they can.

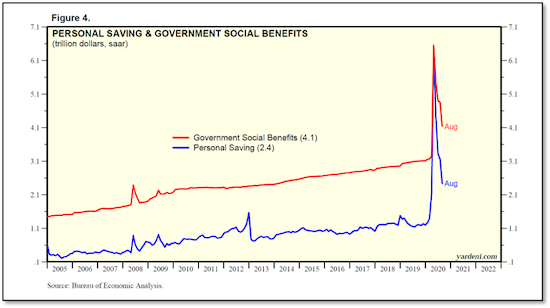

Personal savings rates and government stimulus payments peaked in the second quarter, but both are still well above historical levels. Personal savings, at $2.4 trillion, are more than double their level at the start of 2020, and government social benefits at $4.1 trillion are about $1 trillion above previous annual levels.

|

|

And now we’re talking about another $2 trillion (or so) “stimulus” package that will not stimulate the economy or generate inflation until the Covid-19 threat ends and the economy begins to open up without fear. At that time, when people spend with hope for the future, monetary velocity will return to normal and we may see a shocking rise in inflation rates across the board, in producer, consumer and asset prices.

The latter category is the most important to investors. With trillions still on the sidelines, there is still great room for expansion in the current bull market in stocks. Like the Fed says, we can put up with 4% or 5% inflation – even a temporary spurt to 10% or more – if our assets are rising faster than 10%.

The greater problem is putting the toothpaste back in the tube, curing double-digit inflation, as Fed Chairman Paul Volcker engineered in the early 1980s. That would involve raising interest rates and a new recession.

We’ll see the first official GDP figure in late October, but for the time being the Atlanta Fed’s GDPNow forecast for third quarter growth is 35.2% as of Friday, October 16, so maybe that’s fast enough growth. A 35% rebound will not get us back to pre-pandemic levels, but it’s a giant step in the right direction.

While Federal Reserve Chairman Jerome Powell is joining Congress and both Presidential candidates in claiming the economy will suffer without more fiscal aid, the monetarist St. Louis Fed President James Bullard told The Wall Street Journal last week that the economy is healthy enough that no more monetary stimulus may be needed. Maybe we should just open up the economy and let that be “stimulus” enough.

| | Editor’s Note: Marketmail is a weekly publication that includes market commentary and insight from Navellier & Associates editors. Each week, Marketmail covers five important areas:

Income Mail: Bryan Perry covers the trends impacting income-generating investments.

Growth Mail: Gary Alexander combines history and current events to explain growth trends.

Global Mail: Ivan Martchev explains the impact of global news and trends on the market.

Sector Mail: Jason Bodner tracks money flows in and out of sectors.

Look Ahead: Louis Navellier shows which economic trends are having an impact on the market and what it could mean moving forward. | CLICK HERE

To have Marketmail sent to your inbox each week. | | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |