October 23, 2024

Dear Fellow Investor, |

| There’s red all over the screen today, as the global bond sell-off continues...and it's dragging equities and commodities, including gold and silver, down with it.

|

| If you’ve been listening to the major financial media this week, you’ve noticed the concern in the voices of the talking heads. Treasury yields, and indeed yields across the globe, have been surging despite central banks’ efforts to send rates lower.

I sensed something was up last week, and it prompted me to post this on X:

|

|

| I got a lot of responses from that tweet, running the gamut from giant meteors to any number of conspiracy theories.

But none of that was what I was sensing. Which is, a growing skepticism that global debts will be paid back in currencies worth anything close to today’s values...that sovereign yields are currently commensurate with the risks...and that the rickety house of cards that is the global financial system is teetering.

|

| Most market pundits view falling Treasury yields as a sign of “safe haven” investing. But, as I’ve said, sometimes rising yields are a sign that investors are rushing for safety...because they’re viewing Treasurys as the source of the risk.

|

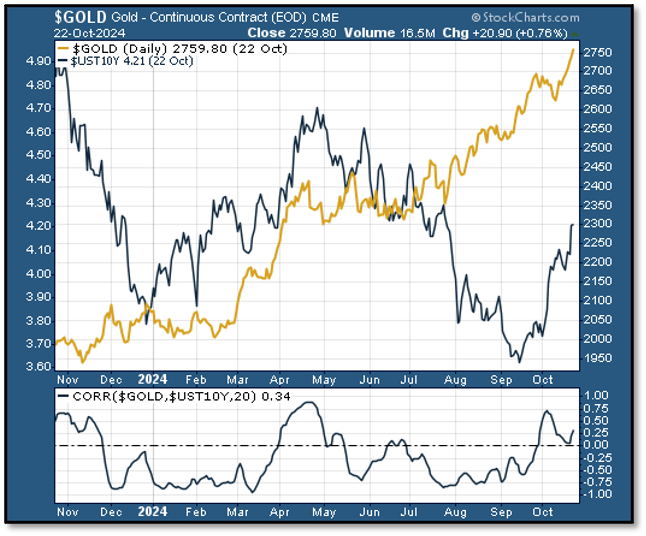

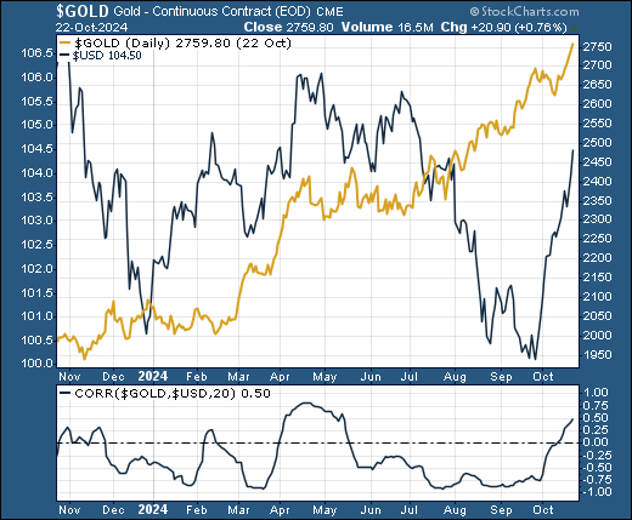

| Consider two charts I’ve been featuring in my presentations...

|

|

|

| The first chart shows the gold price plotted alongside 10-year Treasury yields, while the second plots gold against the Dollar Index. The bottom panels in each show the rolling 20-day correlations. When the correlation line is below zero, there is an inverse relationship; when the line is above zero, there is a positive correlation wherein the two assets are moving together.

Gold should have an inverse correlation with Treasury yields and the dollar. But, as you can see, that correlation has been positive a number of times over the past year.

I first commented on this in my presentation at last year’s New Orleans Conference, when I noted that the phenomenon was a sign of emerging skepticism over the U.S. federal debt.

|

| Now that’s become one of the dominant themes in mainstream financial media, as the markets are trembling in response to a future of high deficits and unmanageable interest expense.

|

| As I said, Halloween isn’t for a few days...but things are already getting scary.

Here’s what I think you need to do about it.

|

| Time To Get Serious

|

| As I noted, gold and silver are down today, along with every other asset class. We don’t have a liquidity vacuum developing...yet...but it could happen at any time.

Don’t get discouraged that the metals are down today, because this is the kind of situation where they will flourish. Rising Treasury rates and a stronger dollar, in the face of spiraling debt-service costs, is precisely what the Fed doesn’t want.

|

| They’ll soon be forced to double down on their efforts to get rates much lower. And gold and silver will soar in reaction.

|

| This is also the kind of situation wherein the New Orleans Conference shines. And conveniently, it is happening within a few weeks...and bringing in dozens of the world’s top experts on macroeconomics, geopolitics, metals and mining.

It’s an opportunity that you simply can’t afford to miss if you have any money at risk in these markets.

I urge you to click on the link below to reserve your place, while there’s still time.

You see, our rates are about to rise significantly. You can save hundreds by registering now.

|

| But more urgently, our room block is going to close this Friday.

With all we have going on at the conference, from presentations, workshops, break-outs, social gatherings and receptions, it is an enormous advantage to stay in our convenient host hotel, the New Orleans Hilton Riverside.

|

| But if you don’t sign up and reserve your room through our room block link, you may not be able to stay anywhere near our event.

Again, it is urgent that you act now to claim your spot in New Orleans. Click on the link below to see our star-studded cast of experts and save hundreds.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Learn More

And Claim Your Place At

The 50th Anniversary

New Orleans Investment Conference

|

|

| CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

|