|

Dear Fellow Investor,

Buy low, sell high.

Sure, it’s a well-worn business and investing cliché. But it still cuts to the very essence of sound business and investing strategy.

And it’s precisely the strategy that GoldMining Inc. (TSX: GOLD | OTCQX: GLDLF) has followed to build a large portfolio of gold assets during a bear market that, until recently, has plagued the gold sector.

These are premier assets that span the Americas and lie within safe jurisdictions. Previous owners of these assets invested C$283 million to develop these projects. All have large, established gold resources. All were acquired at bargain-basement prices.

And all are poised to offer GoldMining and its shareholders significant leverage now that a new gold bull market appears to be in full swing.

That bull market began early this summer, cued by the Fed’s dramatic reversal to easier monetary- policies...and the explosion in negative-yielding sovereign bonds around the world to over US$17 trillion at present.

After raising rates fairly consistently since 2012 in an attempt to normalize monetary policy, the Fed abandoned the effort earlier this year — a clear acknowledgement of the headwinds that the U.S. and global economies are now facing, particularly Europe.

That switch in sentiment, combined with ongoing trade war worries, was enough to send gold soaring over the past few months. And while that momentum has been checked in recent days, the long-term story for the yellow metal remains compelling.

Simply put, the Fed and other central banks will have to maintain an easy-money bias, with negative real yields, because of the massive levels of debt that have been accumulated all around the globe.

In fact, governments and central banks will have no choice but to dramatically devalue their currencies to keep their economies afloat. It’ll be a race to the bottom for paper currencies, with the one clear winner being gold, which is emerging again as a safe haven as it has for centuries.

Given that long-term view, the recent consolidation in the gold rally provides the perfect entry point for those looking to leverage the secular bull market directly ahead.

This Summer’s Run Underscore’s GoldMining’s Potential

And few companies offer the kind of leverage on rising gold prices that GoldMining does.

The company’s performance during gold’s run this summer (similar to the explosive 2016 rally in GoldMining shares) demonstrates its potential to super-charge gains in gold prices. In short, when the price of gold trends higher, GoldMining shares are the “go-to” name in the gold sector.

From a May 29 close of $1,277.50, gold raced to as high as $1,552.00 on September 4. That’s a 21% gain. By comparison, GoldMining closed at C$0.81 on May 29 and peaked at C$1.41 on September 4, a 74% gain.

That’s right, while investing in the physical metal would have earned you a tidy gain this summer, a comparable investment in GoldMining Inc (TSX: GOLD | OTCQX: GLDLF) would have more than tripled your return.

And it could do much better as the gold price continues to rise: Independent analysts have recently come out with price targets as high as five times GoldMining’s current price level.

Such are the fruits of investing in well-positioned, resource-rich gold stocks when the price of gold is headed higher. And with gold and GoldMining giving back some of those gains in recent weeks, the timing is perfect to place a new bet on gold’s bright long-term future.

A Massive “Vault”

Of Gold Resources

Why does GoldMining make such a compelling play on gold prices?

It starts with that aforementioned portfolio of gold projects, acquired during an era of much lower gold prices. The chart below shows the kind of value the company’s management team was able to accumulate during the bear market.

%20copy.jpg)

The total cost of the projects in GoldMining’s portfolio came to C$80 million and, as you can see, the peak market value of those projects was more than 10 times that amount.

Collectively, the company’s projects contain 10.5 million measured and indicated gold ounces and 12.4 million inferred gold ounces. That’s a “vault” of gold resources that has, and will, attract investors looking to play the gold equities by buying companies with large, established resources like GoldMining Inc (TSX: GOLD | OTCQX: GLDLF).

Projects To Watch

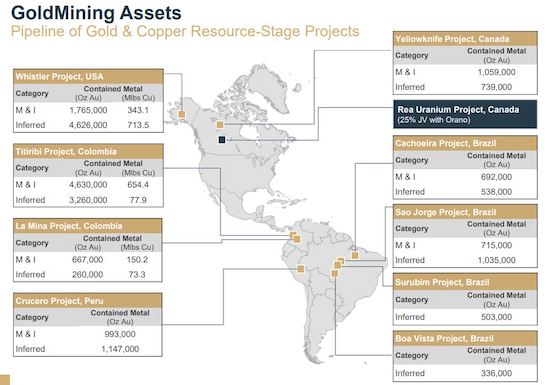

As you can see from the graphic below, GoldMining’s portfolio spans the Western Hemisphere, with projects in Alaska, the Northwest Territories, Colombia, Peru and Brazil, some of the best places to do business in the gold industry.

This collection of million-ounce-plus gold projects boasts relatively low maintenance costs, which means the company can advance projects when it makes sense and hold others for longer-term development due to its low “cash burn.”

Projects to watch within GoldMining’s portfolio include:

• Yellowknife (NWT) — Located in the underexplored Yellowknife Greenstone Belt, which hosts the high-grade, multi-million-ounce historic Con, Giant and Discovery mines. An updated resource estimate on Yellowknife pegs its measured and indicated resource at 1.1 million ounces and its inferred resource at 0.74 million ounces. It is included on National Bank Financial Markets’ 2018 list “Who Owns the Best Projects.”

• Titiribi and La Mina (Colombia) — These two projects give GoldMining a large footprint in Colombia’s underexplored Mid Cauca Belt. Together, these projects contain more than 5 million ounces of measured and indicated gold and 3.5 million ounces of inferred gold. Plus, they boast over 800 million pounds of measured and indicated copper.

• Sao Jorge (Brazil) — This large, near surface gold deposit in Brazil’s Para State contains 0.72 million ounces of indicated gold and 1.0 million ounces of inferred gold. It’s well situated with respect to infrastructure with road access and electrical power to site. It is also included on National Bank Financial Markets’ 2018 list “Who Owns the Best Projects.”

• Whistler (Alaska) — Whistler has several gold-copper porphyry targets that could grow the existing resource significantly. The current global gold resource includes 1.8 million ounces in the indicated category and 4.6 million ounces in the inferred category.

The Market Provides A Window Of Opportunity

Simply put, GoldMining Inc (TSX: GOLD | OTCQX: GLDLF) is a well-managed gold company with the kind of massive gold resources that are sure to catch the attention of general investors as the long-term uptrend draws them to the sector.

And the company is well-funded, too. With C$7 million in its treasury and zero debt, GoldMining has ample funds to maintain its asset base (and to potentially grow that base with a timely acquisition or two).

The seasonal pattern for gold suggests it will continue to trade sideways to down in the weeks just ahead, giving astute investors a chance to reload on the best stories before the bull market returns in full force in the New Year after the tax loss season has concluded.

Remember, GoldMining more than tripled gold’s percentage gains during this summer’s run for the yellow metal. The market is providing you with a window to maximize the next big jump in gold prices.

Want to leverage that possibility? Look at GoldMining Inc (TSX: GOLD | OTCQX: GLDLF), now.

Attend A Free Webinar

With Brien Lundin, GoldMining Chairman Amir Adnani

And a “Mystery Guest” you won’t want to miss!

CLICK HERE

To Pre-Register For This

Upcoming Webinar And Get The Full Details

|