October 28, 2024

Dear Fellow Investor, |

| The metals and miners are trading flat today, although we’re seeing a number of junior mining companies making news...and being rewarded in the market.

|

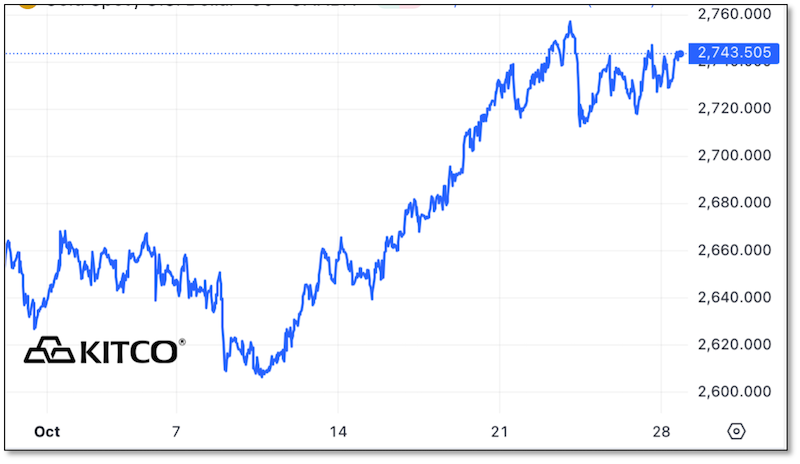

| As you can see, the gold price is now consolidating its gains of the past two weeks.

|

|

| As far as I can see at this point, this isn’t the kind of a consolidation that will last for long. Gold is still riding its top Bollinger band skyward and the width of the bands has yet to begin to drop. We’ll see what happens over the next few trading sessions, but for now I expect the metal to resume its upward climb in short order.

For today, as I’m writing our November issue of Gold Newsletter and preparing for my presentation at this year’s New Orleans Investment Conference, I want to focus on the big picture — to explain why this is such an historic opportunity.

|

| Golden Opportunities continue below...

|

|

| SPONSOR:

Preferred Coin Exchange

|

|

| New Orleans Investment Conference makes history with its 50th Anniversary!

|

|

| It took 40 years for the world to realize the Chinese Panda Program is the leader today. With the massive expansion and value ready to set forth, many don’t know that the New Orleans Investment Conference is the only conference worldwide to have ever had not one but two fully government issued and regulated show pandas. To celebrate the 50th anniversary of this prestigious event, Shanghai Mint is honoring the anniversary by releasing the three rarest show pandas of all time.

One of the greatest legends in modern times at the US Mint, Thomas Cleveland has designed both sides of this celebratory show Panda!

China’s Gold Panda coin program was begun in 1982 to compete with the South African Krugerrand, which was known as the Godfather of modern gold coins. However, because mainland Chinese citizens were forbidden to own or possess any gold coins until 2002, Panda coins were minted in China, but then exported out of the country.

Fully 80% of these coins found their way to the United States. And, because the coin designs generally changed on a yearly basis, they attracted demand from both collectors and investors.

The best-kept secret is the limited mintage for each size bullion coins for the first 24-plus years of the program.

For more in-depth details of this magnificent story, find us at NOIC booths 207 & 306!

|

| Preferred Coin Exchange

|

|

| Decades In The Making

|

| My primary thesis is this: We are in the end game of a four-decade-plus trend of ever-easier money.

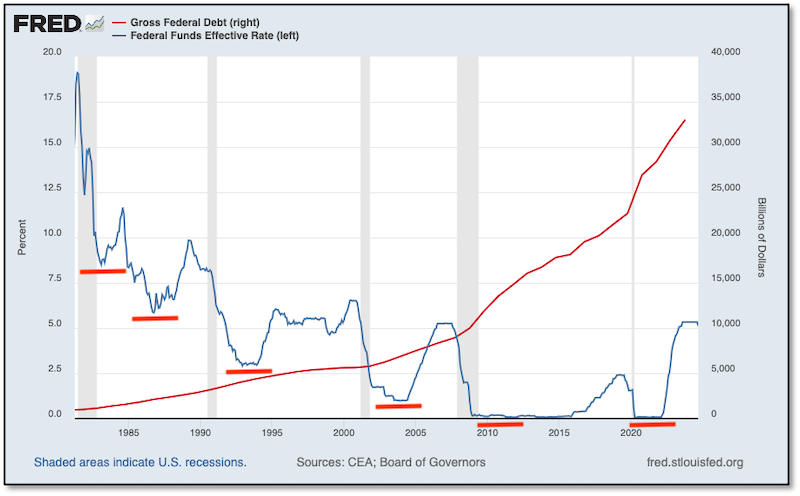

Once Paul Volcker began lowering interest rates, after hiking them above 20% to kill off inflation, the Fed began a trend of ever-lower rates.

In reaction to each recession, and sometimes in advance of an anticipated one, the Fed would follow the same prescription: It would lower the fed funds rate.

|

|

| After each economic emergency passed, the Fed would try to raise rates again, but could never get past the mid-point of the previous range before the economy and the markets would demand another rate hike. (The lone exception was the last cycle, but in fairness it didn’t take much rate-hiking to get above the previous high of 2.5% on the fed funds rate.)

There are two important take-aways from the chart above:

|

| 1) The bottoms of the interest-rate cycles form an ever-lower stairstep pattern to zero. Once we reached zero in the Great Financial Crisis of 2008, the Fed was forced to come up with extraordinary policies like quantitative easing to get the same effect, and was then forced to perform multiples of that policy after covid.

In short, because the patient had developed a tolerance for the drug, ever-greater doses are necessary to get the same effect. Thus, the Fed’s reaction to the next crisis will make our heads spin.

2) As you can see, ever-easier money encourages ever-greater debt accumulation — to the point where debts become unmanageable at anything approaching historical norms on interest rates.

|

| Thus, interest rates must remain lower than the inflation rate, or the entire house of cards collapses.

The bottom line to all of this is that we must have negative real rates going forward, and this is extremely bullish for monetary metals and associated investments.

|

| A Generational Opportunity

|

| Of course, there’s much more to my macroeconomic thesis, but this is the story in a nutshell.

So what to do about it?

|

| For one, we need to own physical metals as insurance against the inevitable depreciation in our currencies.

And second, we need to be positioned in investments that leverage the macro trend of rising metals prices as measured in fiat currencies.

|

| As I mentioned in a podcast this morning, the current situation in metals and mining is generational in scope. The last time we encountered such an opportunity was in the early 2000s.

But today’s opportunity is much better. Back at the turn of this century, both the metals and the mining sector were at long-term price bottoms. It took extraordinary courage and conviction to buy mining stocks in the belief that the metals were heading higher.

Today’s opportunity, contrast, is something we wouldn’t have dared hoped for: Gold is setting new price records on an almost daily basis, silver is starting to take off...

...Yet mining stocks are still mired near long-term lows.

|

| Not For Long...

|

| As I said, this is the kind of opportunity that we wouldn’t have dared wish for...yet it has been placed in front of us now.

We’ve seen a parade of the world’s top investors sing the praises of metals and miners in recent days, from Ray Dalio to Stanley Druckenmiller to Paul Tudor Jones and more. But in fairness, you don’t need to be a genius to see the current opportunity. All you need is a lick of common sense.

|

| But this window is closing. As I noted above, the junior mining stocks in our Gold Newsletter portfolio are now starting to move. If this is going to be like the early 2000s as I believe, vast fortunes are going to be made in the weeks and months ahead.

You simply can’t afford to sit idly by and watch this happen.

|

| I strongly recommend that, if you aren’t already subscribed, you join the family of happy Gold Newsletter readers by CLICKING HERE.

I similarly recommend with great urgency that you sign up for this year’s blockbuster 50th anniversary New Orleans Investment Conference. The world’s top experts on macro, metals and mining are coming to share their top strategies and picks.

Again, you simply can’t afford to miss this event.

I urge you to click on the link below to learn more and secure your place now. You’ll not only save hundreds of dollars on registration fees, but you’ll likely guarantee a place in our convenient host hotel (if you act immediately).

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Learn More

And Claim Your Place At

The 50th Anniversary

New Orleans Investment Conference

|

|

| CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

|