November 4, 2024

Dear Fellow Investor, |

| Gold was smashed last Thursday, dropping over $50 an ounce at one point during the trading session.

|

| Since then, the price has traded sideways as investors contemplate the potential outcome of the U.S. presidential election, with results expected tomorrow evening...or at some point over the weeks to come.

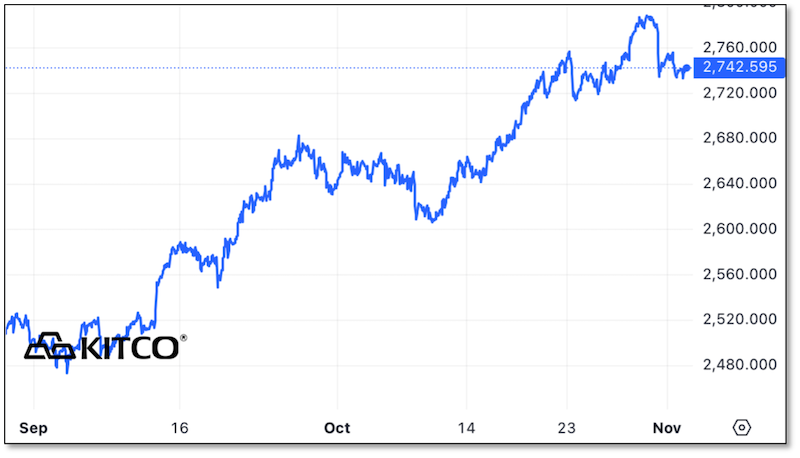

The three-month chart below places Thursday's correction into perspective:

|

|

| As you can see, Thursday’s big sell-off wasn’t anything out of the ordinary. We’ve had a number of such price smashes since this gold bull market began in mid-February. In fact, what’s really remarkable is how regularly they have come...and how the rebounds have been just as consistent.

|

| The key to understanding this is an important discovery I made in mid-summer: not only how remarkably consistent gold’s ebbs and flows have been, but also how accurately the width of its Bollinger bands has indicated the next move upward.

|

| Bollinger bands are a measure of volatility and, generally speaking, a narrowing of the bands often presages a price breakout, usually in the direction of the previous trend.

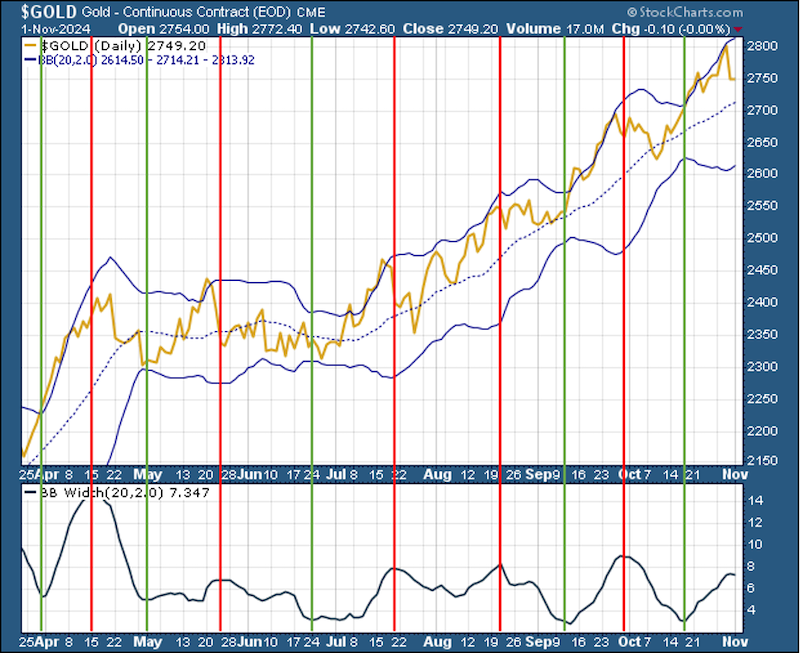

If you’ve been following my analyses since early July, you know how I’ve used the bottoms in gold’s Bollinger bands to predict the beginnings of each new price rally. You’ve also become familiar with my chart showing pinpointing each bottom in the band width.

I’ve updated that chart below, marking not just the lows in the band widths, but also the peaks.

|

|

| In this chart, the green vertical lines mark the band-width lows, while the red lines mark the highs.

As you can see, while the high points faithfully show the price peaks and thereby predict the coming pause or correction, the relative height of those turning points varied in the early months of this bull market. They’ve been more consistent since mid-summer, however, and recently formed a peak that indicated an oncoming correction.

In other words, this indicator predicted an imminent pause in gold’s big rally, as I noted in the November issue of Gold Newsletter issued just last week. That pause began with the big price decline on Thursday, just as we were putting the final touches on that Gold Newsletter issue.

|

| Look closely at the chart above and you can see that the band width in the bottom panel is just beginning to roll over.

|

| The pattern will take a bit of time to complete and reach a bottom. Judging from how regular and frequent the peaks and valleys have become, with each move from one extreme to the other lasting only about three weeks, it seems like the next rally will begin...well, right around the time of the New Orleans Conference on November 20th.

Which brings me to my next big point...

|

| A Generational Opportunity

At The “Event Of The Half Century”

|

| As you know, I’ve been referring to the current situation in metals and miners as a generational opportunity. We haven’t seen anything like it since the turn of this century.

|

| And while fortunes were created in the gold bull market that ran from 2000-2011, especially by those who invested in junior mining shares, this opportunity is much better.

|

| Consider that back then, the metals and the mining shares were completely bombed out. Gold bottomed at $252 an ounce, while silver couldn’t get over $5.00. It took a lot of courage and confidence to bet that the metals were heading higher, much less to record levels.

Today, we have the luxury of gold often setting new price records day after day...while the mining stocks have yet to truly respond, with many still hovering near long-term lows.

|

| It doesn’t take a genius to see this opportunity; it only requires a lick of common sense.

|

| We have been handed the kind of situation that we wouldn’t have dared wish for even a year ago. But this remarkable window of opportunity is beginning to close, as the price charts for quality junior mining stocks are just beginning to turn upward.

There’s still plenty of room to go, but the greatest gains are to be had by those acting now.

By now, you’re probably tired of me harping on about how important this year’s New Orleans Investment Conference is. Well, I’m about to do so again — and I urge you to listen one more time for a very important reason:

|

| The happy coincidence of a secular bull market in metals and mining...beginning just as the world’s most respected macro, metals and mining event brings together one if its greatest rosters of experts and mining companies.

|

| It also bears repeating that you won’t find a line-up of speakers like this anywhere else, including,

|

| James Grant...George Gammon...Rick Rule...Danielle DiMartino Booth...Brent Johnson...Jim Iuorio...Peter Boockvar...Jim Bianco...James Lavish...Adrian Day...Dave Collum...Alex Green...Bob Prechter...Tracy Shuchart...Avi Gilburt...Adam Taggart...Lawrence Lepard...Mark Skousen...Doug Casey...Tavi Costa...Peter Schiff…Lyn Alden…

...Chris Powell...Russ Gray...Robert Helms...Nick Hodge...Sean Brodrick...Lobo Tiggre...Jennifer Shaigec...Mary Anne & Pam Aden...Dana Samuelson...Bill Murphy...David Morgan...Gary Alexander...Jeff Deist...Byron King…Albert Lu...Omar Ayales...Gerardo Del Real...Rich Checkan...Thom Calandra...and more, including yours truly.

Plus, we’ll have a scintillating geopolitical panel — featuring popular political pundits Mary Katharine Ham, Charles C.W. Cooke and Scott McKay — to give us up-to-the-minute post-election analyses.

|

| These experts will give you valuable insights on the extraordinary macro-economic trends now in place...they’ll hand you their most compelling investment strategies to leverage these trends...and they’ll reveal their specific, top picks right now.

|

| Between their offerings and our exhibit hall packed with today’s most exciting mining companies, there’s no doubt that you’ll discover many of the next year’s top winners in the sector.

|

| It’s all happening soon, in just a few weeks. The good news is that you can still register, likely get a room in our convenient host hotel, and save hundreds of dollars from our full registration fees.

|

| Moreover, our iron-clad, money-back guarantee means you’ll get your full registration fee back if you’re not convinced it was worth many times what you spent.

|

| Again, time is running short. I urge you to click on the link below now to get the full details and lock in your place.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Learn More

And Claim Your Place At

The 50th Anniversary

New Orleans Investment Conference

|

|

| CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

|