| And so it begins: $1 trillion a year and more…

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | And So It Begins...

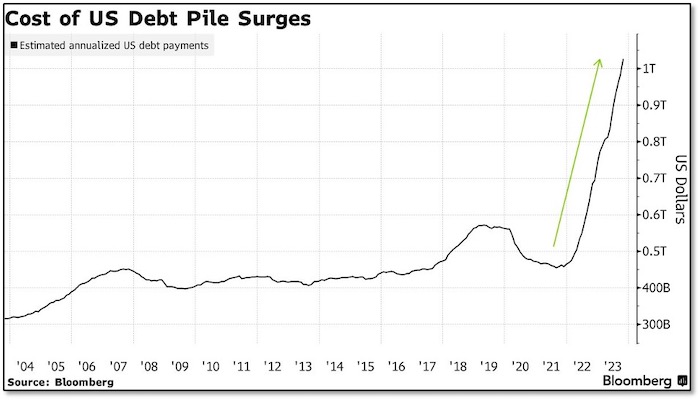

| | | The annual interest expense on the federal debt has soared past the triggering $1 trillion level just as Moody’s downgrades U.S. credit worthiness.

Everything we’ve been predicting is now coming to fruition — and that includes the upcoming reactions in the markets.

| |

November 13, 2023

Dear Fellow Investor, | | Now it’s getting serious.

| | I had expected to dedicate this issue to a recap of some of the amazing presentations delivered at the just-concluded New Orleans Investment Conference.

But events have overtaken my plans.

Specifically, you may have heard that Bloomberg just reported that the annual cost of financing the U.S. debt has soared to over $1 trillion per year.

As Bloomberg notes, “Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month, Bloomberg analysis shows. That projected amount has doubled in the past 19 months from the equivalent figure forecast around the time.”

|  | | This chart shows how quickly interest costs have escalated as not only the debt has grown at a frightening pace, but also as interest rates have soared. The result is a mind-boggling increase in the bottom-line interest expense.

And it’s going to get much worse in the months just ahead, as a significant percentage of Treasury debt — most of which was placed in short-term paper even when rates were near zero — is reset at today’s far-higher rates.

But none of this is news to you if you’ve been a subscriber of ours for any period of time. I’ve been warning of this precise event...and the resulting political repercussions when interest costs ran past the “big number” of $1 trillion...for years now.

I’ve been harping on this inevitable event because it would trigger doubts over U.S. credit worthiness and calls from left-wing politicians to repudiate these debt and redirect payments toward entitlement spending.

...And that kind of talk would spark a crisis in the dollar.

Bloomberg agrees: “The worsening metrics may reignite debate about the US fiscal path amid heavy borrowing from Washington. That dynamic has already helped drive up bond yields, threatened the return of the so-called bond vigilantes and led Fitch Ratings to downgrade US government debt in August.”

The process is gaining steam now: On Friday, Moody’s joined Fitch in downgrading U.S. debt from stable to negative:

| | “In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

| | Bloomberg was the first to report that federal interest expense has now crossed the $1 trillion threshold. There are other official measures that will soon do the same, including the Fed’s own numbers, which are updated quarterly.

As I’ve reported, the Fed has the number at “only” $981 billion.

When they next update the figure, after this quarter ends, it will be well above $1 trillion, and that will spark more commentary and consternation among the political class.

| | What’s Going To Happen Next?

| | As you might expect, this topic was covered like a blanket at our recently concluded New Orleans Investment Conference.

If you haven’t heard yet, this was truly a blockbuster event, as hundreds of investors packed the halls to hear the latest views of today’s top experts.

| | They heard compelling presentations by Matt Taibbi...James Rickards...Danielle DiMartino Booth...George Gammon...Konstantin Kisin...Rick Rule...Dominic Frisby...Brent Johnson...Lyn Alden...Dave Collum...Peter Boockvar...

...James Stack...Peter Schiff...Jim Iuorio...Tavi Costa... Adrian Day...Adam Taggart...The Real Estate Guys...Gwen Preston...Brent Cook...Mark Skousen...Nick Hodge...Robert Prechter ...Chris Powell...Albert Lu...Gary Alexander...

...Dana Samuelson...Jeff Hirsch...Steve Hochberg...Mary Anne & Pamela Aden...Bill Murphy...Gerardo Del Real...Omar Ayales...Rich Checkan...Keith Weiner...

| | ...And yours truly.

The debt, deficits and the inescapable trap the Federal Reserve has backed itself into were prime topics of conversation. Attendees heard analyses of the latest data, and predictions of what the upcoming market reactions will be as the debt and monetary policy collide.

If you were there, you know how valuable these four days were. If you missed it, well...you have another chance.

That’s because every minute was recorded on video, and you can enjoy it all.

And get this: While hundreds of investors spent thousands of dollars each to fly to New Orleans to enjoy dozens upon dozens of invaluable presentations, panels and workshops...

...You can get all of this information for mere pennies on the dollar.

Of course, the experience is far, far better — even irreplaceable — in person. The conversations in the halls with speakers and other attendees is alone worth many times the cost of attending the New Orleans Conference.

| | But our virtual option, with access to every minute of General Sessions, Workshops and Corporate Presentations on high-quality video is easily the next-best thing.

| | You won’t be able to enjoy the delectable New Orleans cuisine we served attendees, but you can watch the whole event from the comfort of your easy chair!

In addition, you’ll receive our comprehensive written transcript of every General Session presentation when it’s available in a few weeks.

Add it all up, and you can understand why this has been called “the greatest bargain in all of investing.”

| | OK, I’m quoting myself there. But take a look at that speaker list again, and remember that many saved their best views and recommendations for New Orleans and that these remarkable presentations (and scintillating panels) are available nowhere else.

| | I don’t see how any serious investor can pass up this bargain at just $199 for the entire package.

So, if you are a serious investor with your wealth at risk as the massive level of global debt hurtles toward a spectacular collision with insurmountably high interest rates...click on the link below to learn more about our New Orleans ’23 video recordings.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. As you may have heard, the panels at New Orleans ’23 were mind-blowing. In particular, our “Booms, Busts, & Bubbles Panel” with Albert Lu (MC), Lyn Alden, Peter Boockvar, Dave Collum and Jim Iuorio was an absolute hoot.

You need to watch them all, and you can by simply clicking on the link below.

| | CLICK HERE

For Immediate Access To

The New Orleans 2023

Video Recordings

| | | | | © Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |