| Stock market jitters point toward gold rally

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | | Day Of Reckoning

| | Last week’s market turmoil is pointing toward another financial crisis — one that would bring the Fed and other central banks to the rescue again...and launch another furious rally in gold.

Plus: An exciting webinar opportunity this Wednesday...

| |

November 17, 2025

Dear Fellow Investor,

| | The U.S. stock market spent the last couple of trading sessions dancing along the edge of a precipice.

| | On Thursday, the Dow shed 797 points (1.65%), the S&P 500 lost 113 (1.66%) and the tech and AI-rich Nasdaq fell 536 points (2.29%). Bitcoin and even the dollar were hit hard.

Gold fell only $39.50 (0.94%) during that melee, but dropped about $80 (2.0%) the following day, as the stock market struggled to stabilize and ended up mixed.

Today brings relatively flat trading across the board, with nervous investors trying to figure it all out. Gold was sold off at the open of New York trading, but as I write it’s trying to claw back those losses.

As it stands now, last week’s volatility was a warning shot across the market’s bow...and a reminder of the weird relationship between investors and the Fed.

| | The Addiction To Easy Money

| | Codependency. That’s the best way to describe the relationship between the Fed and the stock market these days.

We can argue about cause and effect, but I’ve long believed that stock market sell-offs like we just witnessed are not only a reaction to hawkish Fed news, but also the market’s way of giving the Fed a warning that they need to return to their dovish ways.

Usually, the Fed gets the message.

We’ll see in this instance, as additional hawkish rhetoric from Fed governors continued to make investors nervous, but someone apparently whispered assurances to calm things down Friday.

Interestingly, despite all the volatility and some very significant downdrafts in gold, the yellow metal ended with a weekly gain, and on a spot basis remains well above the pivotal $4,000 level.

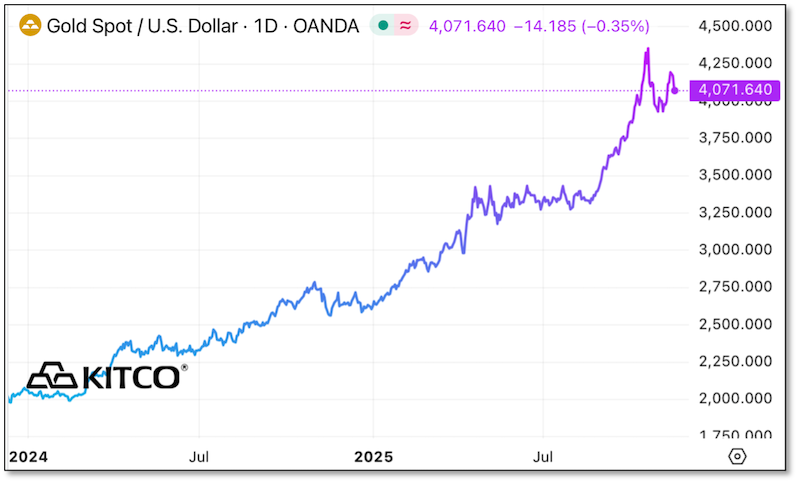

|  | | If we zoom out, we see that this “correction” hasn’t been very severe at all. In fact, it’s been only the second 10% draw down during this long bull market.

|  | | Again, this correction hasn’t been too painful so far.

In fact, this was one of the main points I made to attendees during our recent New Orleans Investment Conference.

| | The Most Important Event In Years

| | It was apparent to all this year’s gathering was the most heavily attended New Orleans Conference in many years. I argued that it was also the most important, for a number of reasons.

| | The first revolves around my opening question to the crowd: “How does it feel to be right?”

| | I acknowledged that it feels great that Wall Street and mainstream investors had finally come to understand the situation that we’d been talking about for many years...slapping the label of “debasement trade” onto the debt trap that we’d been warning of.

But I also cautioned the attendees that no one, not even the most ardent gold bug, had predicted the kind of bull market we’d been experiencing — with a dizzying run to over $4,000 built upon a foundation of powerful central bank buying and recently turbocharged by speculative Western investment.

Then I challenged them to try, over the course of the conference, to figure out what gold was telling us, and where it was going.

Of course, I shared my own views. You’re probably well aware of them by now, but I’ll summarize them for you here:

| | This latest rally in gold began on August 22nd, with Fed Chairman Powell’s Jackson Hole speech in which he conceded an initial quarter-point rate cut. Gold bounced higher, and then began rallying further as dour jobs data fueled investor expectations of more cuts before the end of this year.

As trend-following money jumped on the golden bandwagon, and as the market also began to price in a multi-year rate cutting cycle with Trump’s new Fed head coming into office in May, gold soared to a high of $4,355...at which point the overheated, speculation-fueled ascent burned out.

Gold then fell, but settled around a 10% loss from the peak — far lower than traditional technical analysis would have predicted. In fact, this was only the second true correction in this bull market, with one other 10% drop coming a year ago, when there were post-election rumors that Trump would launch a national Bitcoin reserve.

Every other setback in gold has been merely a pause in the ascent, a trading range that bled off the exuberance through time rather than price.

My view, as expressed during the conference, was that gold was likely to continue trading sideways for a bit, before beginning the next rally on some manner of supporting evidence for more Fed rate cuts.

| | It seemed that gold was proving me wrong, at least a little, when it quickly jumped $85 on Wednesday, on news that Atlanta Fed President Raphael Bositc would be retiring in February...thereby hastening Donald Trump’s control of the central bank.

Then the subsequent setbacks last week supported my call for an extended trading range before the next big move higher.

The next couple of weeks will tell the tale.

But the most recent episode of market jitters reminds me of my friend Bob Prechter’s presentation in New Orleans last week, in which he predicted that the vastly overvalued, teetering U.S. stock market was due for a crash. That event would create the kind of typical liquidity vacuum that would bring all assets down, including gold.

And that correction in gold would complete a classic Elliott Wave downcycle, before a massive subsequent move higher according to EW principles.

| | The target for that move? Well above $20,000.

| | Bob’s presentation in New Orleans was, as usual, one of the most compelling. I recommend that any serious investor give his service a look (here), and also consider purchasing the complete recordings of every General Session presentation and panel, every Workshop and every Corporate Presentation from this historic event (here).

In the meantime, I’m going to provide my latest views on gold, the markets and macroeconomics this Wednesday evening, when I appear on what I find to be one of the most enjoyable and enlightening webinar series around....

|  | | My friends Rich Checkan and Adrian Day produce an exceptional webinar series and I’m always happy to participate.

Their “On The Move” production provides deep dives into the current market drivers with always-interesting guests, and I expect and hope that this Wednesday’s event will add to their sterling reputation.

| | It should, because this event is well-timed, coming so soon after our New Orleans Conference, in which both Adrian and Rich participated.

| | The views presented in New Orleans were thought-provoking and sometimes controversial, often running counter to the consensus from both mainstream and hard-money analysts.

I know that Adrian and Rich are eager to share their impressions, as am I.

I strongly urge you to join us for this free webinar on Wednesday. Just click the link below to make sure you get in.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Register For The

On The Move Webinar

With Adrian Day, Rich Checkan and Brien Lundin

Wednesday, November 19 • 7:00 p.m. EST

| | | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

| | | | © Golden Opportunities, 2009 - 2025

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |