|

| Copper is arguably the most critical of the critical metals.

|

| Not only does it provide the main source of electrical and cable wiring, but it also undergirds the electrification trend sweeping the planet.

|

| Simply put, without copper, the modern economy would not exist as it currently does...and has no hope of growing for the future.

|

| And with increasing demand for the red metal running straight into a looming shortage of supply, the base metals industry is increasingly desperate to find new sources.

One way for investors to make money on this copper gap is to bet on companies aggressively looking for new copper deposits.

|

| A company that fits that bill nicely is Red Canyon Resources (REDC.CN; REDRF.OTC).

|

| As you’re about to see, Red Canyon has used a hybrid prospect generator model to amass no less than seven copper projects in the desirable jurisdictions of the western U.S. and British Columbia.

On one of those projects, the first ever drill program recently confirmed a new copper-molybdenum (moly) discovery, and all are capable of drawing the attention of a major joint venture partner.

Read on to discover why Red Canyon Resources is ideally positioned to add value to this recent copper-moly discovery and make exciting new copper discoveries in Tier 1 jurisdictions.

|

| The Copper Supply Shortfall Is Already Here

|

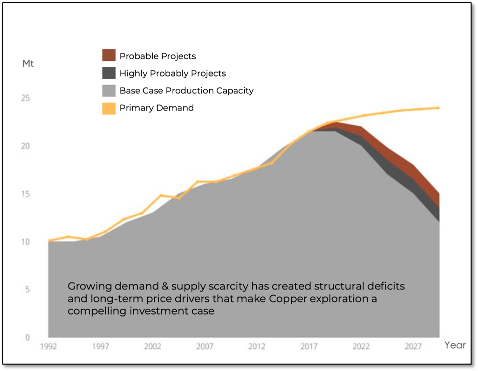

| To get a sense of the situation facing the copper sector, take a look at the graph below.

|

|

| Increasing copper demand is running headlong into structural supply deficits.

|

| Analysts have been talking for years about the looming, major copper supply shortfall that will power copper prices skyward.

This chart shows that the copper supply crunch is already here.

Primary demand — excluding the huge projected demand growth necessary for the new, electrified economy — already exceeds current and planned production. This chart also shows that the trends toward urbanization and electrification are going to keep the demand curve for copper headed upward.

Meanwhile, in the next five to 10 years, the supply of copper is going to be severely stressed.

|

| Driving the grim supply picture are falling production and head grades at existing mines, the lack of new copper mines coming online and the dearth of new copper deposits being discovered.

|

| Add in a permitting and construction process for copper mines that can take 10 years or more, and you have an industry on high alert for copper deposits in mining friendly locations.

|

| Projects In Places Majors Love

|

| Those locations have several key features, including a predictable mining regime, nearby infrastructure and access to a skilled workforce.

Red Canyon’s lead projects are its Kendal project in western-central British Columbia and its Scraper Springs project in northeast Nevada.

Both projects cover the bases in terms of proximity to infrastructure, a location in pro-mining jurisdictions and the presence of potential employees.

|

| These features make these projects attractive targets for both joint ventures with major mining companies and eventual buyouts.

|

| In a world where many copper deposits are in far-flung locations, having projects that can more quickly be converted into active copper mines is critical to Red Canyon’s appeal to majors.

|

| Kendal:

A Greenfields Project Sees Drilling

|

| The Kendal project is a greenfields project with access to rail, roads, water, a nearby town and a nearby deepwater port.

Ticking all the key infrastructure boxes, the project has just seen its first ever drill program, which confirmed a new copper-moly porphyry discovery.

Red Canyon’s target at Kendal is to outline a 1 million tonne to 3 million tonne deposit, and it’s recently completed 2,562-meter drill program on the project has produced very encouraging first results.

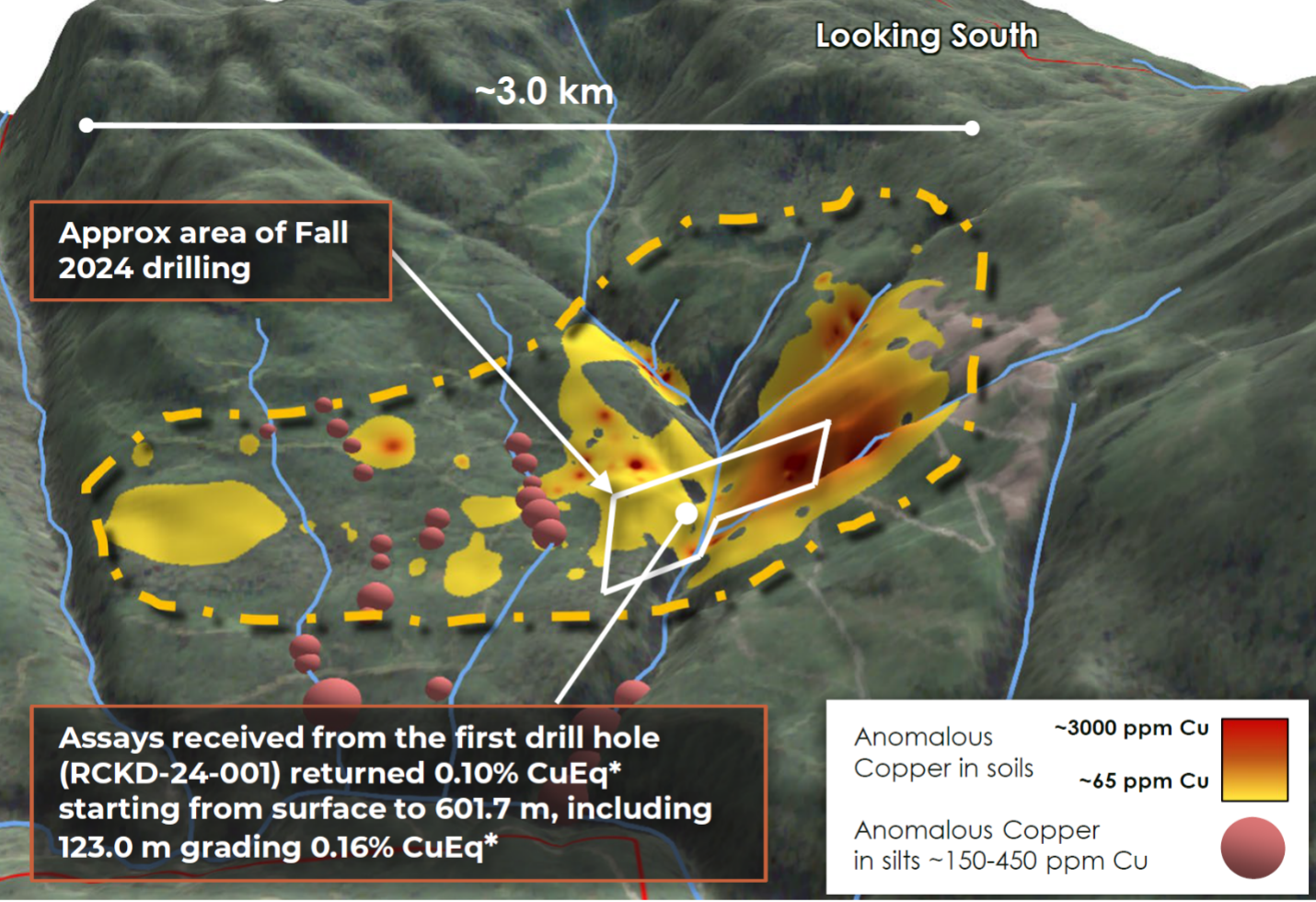

Earlier this month, Red Canyon released the initial assays from the first hole, which was drilled on a large area of coincident alteration and anomalous copper-in-soils.

|

|

| Click image to enlarge

Red Canyon’s Kendal project is defined by a large zone of alteration and anomalous copper-in-soils that could indicate the presence of a large copper porphyry system.

|

| That hole cut a long, 601.7-meter interval from surface of 0.10% copper equivalent. Those aren’t quite Eureka grades yet, but based on known metal zoning within large copper-moly deposits, the company’s geologists feel confident that this and upcoming results will help them vector in on a potential higher-grade porphyry center at Kendal.

Copper-moly porphyry mines worldwide are some of the largest, highest value sources of metal and are targeted and controlled by the largest mining companies.

More assays are still to come from this program, and each of the five holes drilled encountered significant alteration and evidence of copper and moly mineralization.

|

| Scraper Springs:

A Massive Alteration Footprint

|

| Providing earlier-stage promise is Red Canyon’s Scraper Springs project.

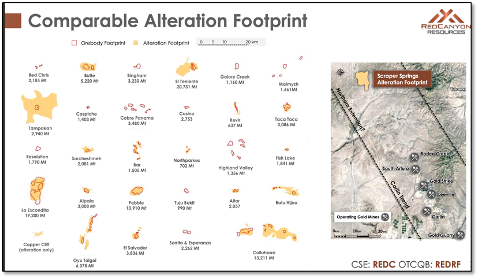

The graphic below shows you how the alteration footprint at this northern Nevada project compares with some of the world’s largest copper-gold deposits.

|

|

| Click image to enlarge

Scraper Springs’ alteration footprint compares favorably to the world’s largest copper deposits.

|

| Located north of the intensive gold-mining infrastructure along the state’s prolific Carlin Trend, Scraper Springs’ alteration footprint spans no less than 16 square kilometers and is centered on rocks of similar age to Utah’s large Bingham Canyon copper mine.

|

| A 2022 IP survey on the project identified a zone of resistivity that could mark a significant intrusion at depth. A primary drill target is an IP feature located at around 400 meters depth.

|

| The company has recently completed an expanded program of geophysics at Scraper Springs and expects the project to be drill ready for Q2 2025.

Although at an earlier stage than Kendal, Scraper Springs gives Red Canyon another large project near infrastructure that could attract a major.

|

| The Power Of Discovery

|

| Again, in all, Red Canyon has seven copper projects spread across British Columbia and the western U.S.

The largely unrecognized promise of the Kendal discovery and the early potential of Scraper Springs make for a compelling opportunity in the exploration copper space and opens the potential for a future partnership with a major mining company a definite possibility.

|

| With a tight share structure and a motivated and talented management team, Red Canyon Resources has made the first steps in identifying a new copper-moly system at its Kendal project.

|

| While additional work is required to fully define the potential of Kendal, this early success is rare, and no small feat for a small cap company.

And given the current supply-demand gap facing copper, and the need for new copper discoveries to fill the supply deficit, Red Canyon Resources’ share price may also soon be in high demand.

Before that can happen, the time to start doing your homework on Red Canyon is now.

|

| CLICK HERE

To Learn More about Red Canyon Resources Ltd.

|