| Soaring deficits...who cares?

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Soaring Deficits:

Who Cares?

| | | Our friend Gary Alexander puts this year’s New Orleans Conference — and the last few decades of government spending — into perspective.

| |

November 20, 2023

Dear Fellow Investor, | | Editor’s Note: Gary Alexander is one of

my longest-standing friends in the industry. He’s been a stalwart defender of free markets and personal liberty for decades, and was one of the chief writers for Jim Blanchard’s organization when we were working together back in the ’80s.

I’ve also leaned on Gary to serve as one of my MCs for each year’s New Orleans Investment Conference, because he employs his steel-trap mind and deep experience to put things in proper perspective, often with fascinating anecdotes and humor.

At this year’s New Orleans Conference, Gary helped keep things on track once again, and also as usual penned an insightful recap for Louis Navellier’s organization. With approval from all involved in that fine outfit, I’m pleased to present Gary’s notes and observations here.

With the fascinating way Gary has of putting things in perspective, I think you’ll find this very enlightening.

— Brien

| | | Soaring Deficits – Who Cares? (Congress Doesn’t)

| | By Gary Alexander

| | “Let it rain and thunder, let a million firms go under!

I am not concerned with stocks and bonds that I’ve been burned with.

Who cares what banks fail in Yonkers…

As long as you’ve got a kiss that conquers!”

– George & Ira Gershwin, in “Who Cares?” (1931)

| | Over two-thirds (70%) of Americans support a bipartisan attack on the national debt, but maybe only 10 of 535 Congressmen and Senators (2%) do. The other 98% are more concerned with bringing pork home.

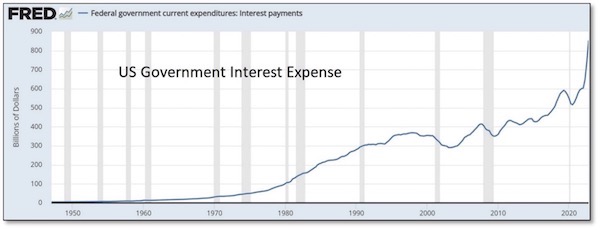

In the past year, the real federal budget deficit has more than doubled, from $933 billion to $2 trillion, according to a progressive Democrat, Ben Ritz, director of the Progressive Policy Institute’s Center for Funding America’s Future. His bias may be different than mine. He wants more funding for progressive programs, but he says (in The Wall Street Journal, “Why Democrats Should Care About Debt,” November 7, 2023), “debt service costs crowd out progressive priorities. Annual interest payments are already at their highest level as a percentage of GDP since the 1990s. By 2028, the government is projected to spend more than $1 trillion on interest payments each year – more than it spends on Medicaid or national defense.”

This brings me back to the 49th New Orleans Investment Conference, held November 1-4, where the conference director of the last 25 years, Brien Lundin, took time out from his many administrative duties to change his opening talk from a pre-planned survey, “Metals and Miners: A Generational Opportunity,” arguably more profitable for his attendees, exhibitors, and his company, to something more urgent, the soaring national debt, given a new title of “Strange Bedfellows,” taken from Shakespeare’s “Tempest.”

|  | | The above line was spoken by Trinculo, a jester, a man shipwrecked in The Tempest, seeking shelter on an island beside a sleeping monster, Caliban, a deformed native whom he first takes to be some sort of strange fish. When he realizes that Caliban has arms and legs and is warm-blooded, he correctly deduces that what seemed

like a fish is an islander. The plot grows, but Brien’s point is that New Orleans folk are familiar with hurricanes creating “strange bedfellows.” During Hurricane Katrina in 2005, a similar story circulated from the southern marshes about a 30-foot wall of water ripping a man from his home, forcing him to float on a wall of wood from his home, joined by strange bedfellows, an alligator, water moccasin and nutria – a large rat. They floated around together, looking at each other until one said, “Truce?”

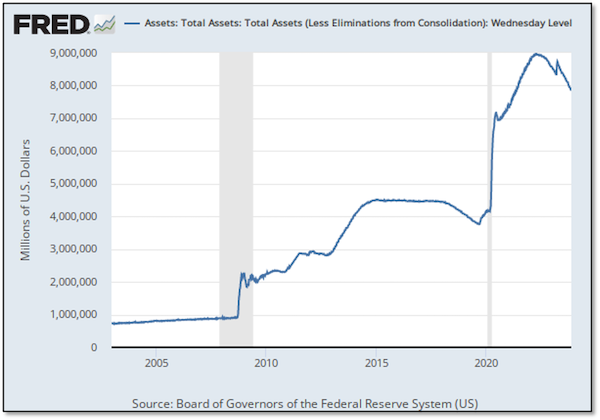

These ancient tales seem to be portents of today’s markets. In most markets, Brien said, we see gold running opposite to the dollar and interest rates, but in October, after Hamas invaded Israel, gold soared, and Treasury yields kept rising. Usually they go in opposite directions, but after six decades of multi ever-easier money, markets became addicted to the last 14 years of near-zero interest rates and this built up several bubbles. In the last 18 months, the Fed shocked the world with the most rapid rate increases in history, plus promises of “higher [rates] for a longer” time.

This is a problem since: (1) G20 nonfinancial debt has doubled since 2008 to $250 trillion; and (2) yields have quadrupled in short order to 4%+ yet the average coupon on that debt is only up 50 basis points so far. When debt resets catch up, annual interest costs will soar by $8 trillion, equal to the combined GDPs of Germany and Japan. So, rates need to fall!

The Fed’s policies have been too extreme under Powell, he said, lurching from ultra-easy to ultra-harsh, from 5,000-year lows (rates have never been zero), to the fastest increase ever, even while in QT mode.

Powell may want to become a new Paul Volcker – a successful inflation fighter – but he doesn’t have the toolbox (and I might add the training or experience – the “chops”) to pull it off. Volcker was a Treasury animal for decades – he joined the Fed in 1952! – before rising to the top (and I mean top, standing 6’8”) of the Fed in 1979. Powell is a political appointee – an attorney and investment banker before his Fed gig.

|  | | Source: St. Louis Federal Reserve Bank (FRED.com)

| | Voters Cared More About Debts in 1994 and 2010…But Not So Much in 2022

| | Many 2023 speakers in New Orleans amplified on this debt story, but before I go there, let me recall the big story at the 1993 New Orleans Investment conference.

That year marked the debut of “Bankruptcy 1995,” a book by Harry Figgie, which earmarked the rising deficits under George Bush, Sr., which arguably cost him the 1992 election – losing not just to Bill Clinton but to that third party gadfly Ross Perot and his “debt clock” lectures. Fed Chairman Alan Greenspan then shocked Wall Street with the first of his six rate increases in February, 1994, followed by the Mexican peso crisis and the Orange County debt default, followed by the Republican Revolution, which turned the House over to Republicans for the first time in 40 years, and by a wide margin, eventually resulting in four balanced budgets, 1998-2001.

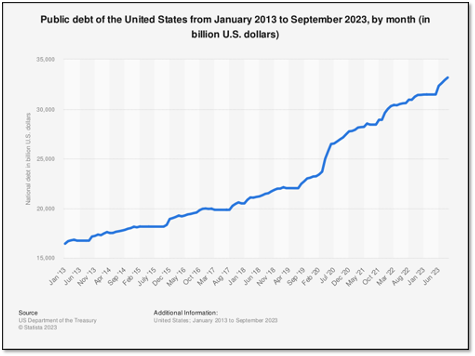

As a result, the public debt of $4 trillion in 1994 was cut to $3.3 trillion in 2001, so all of that scare mongering by Perot, Figgie and our New Orleans crowd worked, for a while. It worked again in 2010 with the Tea Party, but now the debt is 10 times larger, $33 trillion, and nobody seems to care.

The biggest gain in national debt has come since 2008, with the debt growing from 35% of GDP in 2007 to nearly 130% now, with this year’s GDP of $26 trillion overlaid by a national debt of $33.5 trillion.

|  | | Nationaldebtrelief.com (numbers after 2020 are projected, but too low; they turned out much worse)

| | In light of our near-130% debt to GDP ratio, Jim Iuorio mentioned a study by Hirschman Capital which showed that between 1800 and 2020, 98% of all nations whose sovereign debt exceeded 130% of their GDP defaulted on their debt, usually via sustained high inflation, but also through outright default. This study covered 53 countries, and Japan is the lone exception, so far, so we have a high bar to overcome.

In his New Orleans speech, Iuorio also said that the rapid interest rate increases in the last year felt like “economic sabotage,” since so many families and businesses were accustomed to low rates. Those who locked in low rates did so, long ago, and that put them into frozen positions. Homeowners can’t now easily move, since they can’t afford higher mortgages, and businesses are locked into long-term leases.

Summarizing some other 2023 New Orleans speakers, Adrian Day said the Treasury was clueless if not criminal by scheduling most U.S. debt on the short maturity end of the spectrum instead of emulating Austria and other nations by issuing 100-year bonds when rates were near zero. He said our current federal government maturities are warped to the short end. Corporate debt maturities are also scheduled to mature from 2025 to

2028. In the Economy Panel, Adrian added that it is almost irrelevant whether or not the Fed schedules one more rate increase – since 12 of 19 voting members on the “dot plot” survey predict one more rate hike. What is more troublesome is the “higher for longer” mantra that will cause pain in the economy, and rising deficits when they could have ameliorated such an outcome in advance.

Many other speakers touched on the urgency of deficit reduction. George Gammon (and others) said it’s not just a Fed problem, and not even primarily a Fed problem. It’s a government deficit-funding problem. Few in Congress address the deficit, and not enough voters care, either. These debt comparisons, below, provided by Gammon, available at FRED.com, tell us that the 2022 voters didn’t care to mount a revolt.

| | | | Source: St. Louis Federal Reserve Bank (FRED.com)

|  |  |  | | Currently, the betting is that the Fed’s first fed funds rate cut will come next June, but that’s way too far in the future. With the cost of interest on the federal debt soon

to top $1 trillion, they can at least lower the vigorish on our debt service by ratcheting down the cost of feeding the beast and, in the process, help heal those several sectors of U.S. economy recently crippled by higher interest rates. The Fed cannot force Congress and the White House to cut spending, but they can at least provide some alternative leadership.

| | | Editor’s Note: Gary Alexander has been senior editor of Louis Navellier's MARKETMAIL since 2009. He also writes his own weekly column, Growth Mail. MARKETMAIL opens with a Market Overview by Louis Navellier and includes four other weekly letters, on Income, Growth, Global Markets and Sectors. Free delivery of these weekly letters is available at https://navellier.com/market-mail/

| | CLICK HERE

For Immediate Access To

The New Orleans 2023

Video Recordings

| | | | | © Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |