|

| As the world races to power the artificial intelligence revolution, one thing has become unmistakably clear: America doesn’t have enough electricity.

|

| Data centers the size of football fields are springing up across the country, consuming more power than some entire cities. Electric vehicles, heat pumps and factories are pushing demand to record highs.

|

| Yet the North American Electric Reliability Corporation now warns that over half the continent faces serious energy shortfalls within just a few years.

|

| That’s why the White House has declared a National Energy Emergency — and why a single commodity, long ignored, is suddenly back at the center of America’s energy policy: uranium.

|

| It’s also why the next big winner in junior mining could be an exciting new uranium play — Homeland Uranium (HLU.V; HLUCF.OTC) — that has uncovered a large, U.S. uranium resource that had been lost for over four decades.

|

| Homeland’s story is extraordinary in its own right...but it’s even more so because it’s coming while uranium is experiencing an epic resurgence.

|

|

| Click image to enlarge

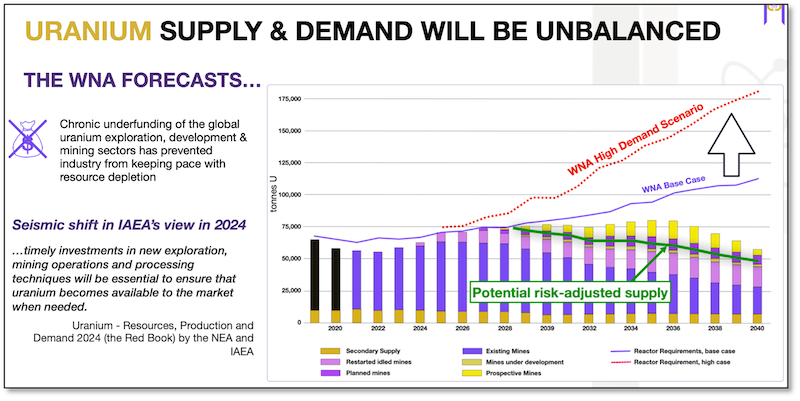

The supply-demand imbalance in uranium is about to go into overdrive — making U.S. supplies that much more needed, just as Homeland proves up its large historical resource.

|

| The Fuel Behind America’s Comeback

|

| After a 45-year pause in new nuclear plant construction, the U.S. is now fast-tracking next-generation reactors — small, modular and safer than ever before.

President Trump pledged to “approve new power plants and new reactors on day one,” and Congress has already followed through with the Atomic Energy Advancement Act, streamlining reactor approvals and incentivizing uranium production.

At the same time, the Department of Energy is building a strategic uranium reserve — and offering to purchase American-mined uranium for it.

|

| Yet here’s the problem: U.S. uranium production has collapsed 98% since 2000. We now import nearly all our uranium from abroad — much of it from unstable or unfriendly regimes like Russia, Kazakhstan and Niger.

|

| That’s why a quiet discovery in the high desert of northwestern Colorado could soon become a vital part of America’s domestic uranium revival.

|

|

| Click image to enlarge

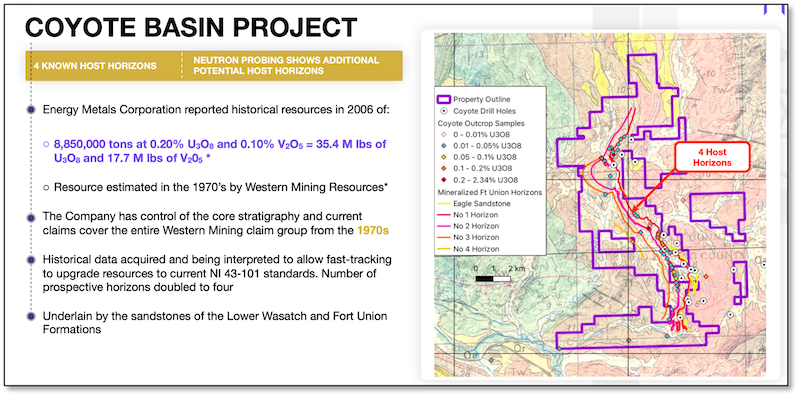

Homeland’s Coyote Basin project boasts not only large historical uranium resources, but clear potential for new discoveries at depth and along four identified host horizons.

|

| A Large Uranium Find, Lost to History

|

| In 1979, an exploration company called Western Mining drilled into what appeared to be a significant uranium deposit — in Colorado’s Coyote Basin.

Then came the Three Mile Island incident. Nuclear power fell out of political favor overnight. Prices collapsed...and Western Mining walked away.

The Coyote Basin claims sat idle for decades.

Fast forward to 2024. A small team at Shift Rare Metals was combing through old SEC filings when they stumbled across a September 2006 quarterly filing by Energy Metals Corp that reported Western Mining’s 1978-79 uranium discovery at Coyote Basin.

|

| Energy Metals attributed this historical resource from work completed by Western Mining Resources*, a previous operator of the property from detailing a 1978-79 exploration program that consisted of surface sampling, coring, drill hole chip sampling and gamma logging of 24 widely spaced holes.

|

| What they found was remarkable: a documented, 35-million-pound historical resource* still unclaimed.

|

| This historical resource estimate was documented in a private internal report titled, Western Mining, Executive Summary, Coyote Basin Uranium District, Rio Blanco and Moffat Counties, State of Colorado, January, 1980. Homeland Uranium is not treating this historical information as current mineral resources and the reader is cautioned not to rely on it. Homeland has not completed the work necessary to independently verify the classification of these historical resource estimates nor can comment on the validity of any data outlined in the historical reports and is not treating the mineral resource estimates as conforming to the requirements of National Instrument 43-101. The Coyote Basin Project and any future NI 43-101 resource estimates will require considerable further evaluation, which the Company’s management intends to carry out in due course.

|

| They quickly moved to stake the ground.

And then — recognizing that they would need to drill that historical resource to confirm it and bring it up to modern reporting standards — they introduced the project to Roger Lemaitre, a 30-year industry veteran with one of the best track records of building uranium resources in the business.

Lemaitre immediately saw the tremendous potential of this major uranium “re-discovery.”

|

| Enter Homeland Uranium

...The U.S. Uranium Play

|

| Lemaitre took the helm and renamed the company “Homeland Uranium” — reflecting both its U.S. focus and its role in re-establishing domestic supply.

|

| Lemaitre’s track record speaks volumes. As CEO of UEX Corporation, he doubled uranium resources from 75 million to 150 million pounds and grew the company’s market cap from $75 million to $310 million before it was acquired by Uranium Energy Corp.

He also spent 11 years at Cameco — the world’s leading uranium producer — running global exploration and making multiple discoveries.

|

| In short, Lemaitre knows how to turn uranium in the ground into shareholder value.

And with Homeland Uranium, he’s working to do it again — this time, in America’s own backyard.

|

| Two Projects With Significant Potential

|

| Homeland’s flagship Coyote Basin Project is big — spanning over 14,000 acres in northwestern Colorado.

The upside potential of the project is obvious, as the original Western Mining work defined that 35-million-pound historical resource to a depth of just 250 feet — exceptionally shallow by modern standards.

|

| Better yet, the company now possesses the complete historical exploration dataset — worth millions in time and expense — allowing Homeland to rapidly move to verify and expand those results under today’s NI 43-101 standards.

|

| The property also benefits from infrastructure that most junior miners can only dream of: no less than three licensed uranium mills lie within 300 miles, minimizing both transportation costs and permitting hurdles.

But the story doesn’t end there.

|

|

| Click image to enlarge

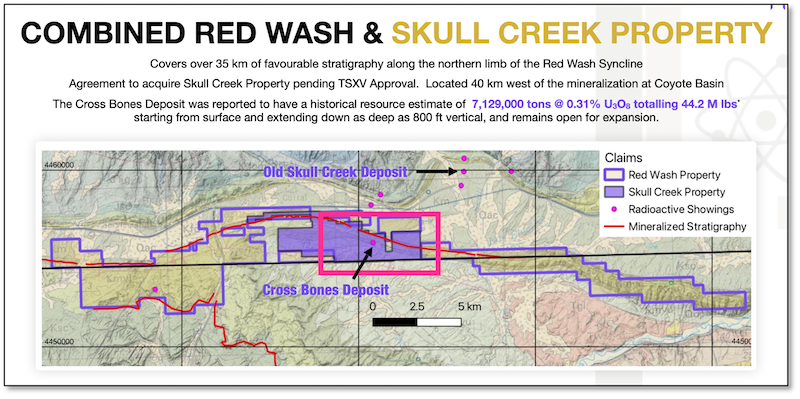

With the acquisition of two combined properties encompassing the Cross Bones uranium deposit, Homeland has two properties with significant historical resource. The next step is drilling to confirm these large uranium resources according to current standards.

|

| In mid-2025, Homeland acquired a second potentially significant asset — the Cross Bones Project, a 1,489-acre property just 20 miles away, hosting a 44-million-pound historical resource.

|

| This historical resource was also reported in Energy Metals’ September 30, 2006 SEC quarterly financial report filings, and was attributed to be sourced from work completed by previous operators of the property and outlined in the report Geological Reconnaissance Report on Lignite Properties in Moffat County, Colorado, Geological Services, Moab, Utah, 1956. Homeland has not completed the work necessary to independently verify the classification of these historical resource estimates nor can comment on the validity of any data outlined in the historical reports and is not treating the mineral resource estimates as conforming to the requirements of National Instrument 43-101. The Cross Bones Project and any future NI 43-101 resource estimates will require considerable further evaluation, which the Company’s management intends to carry out in due course.

|

| Each project’s historical estimate, once verified, could become a valuable contribution to domestic uranium supply.

|

| Timing Is Everything...

|

| Uranium prices have more than doubled — up 141% in just four years — as demand outpaces supply.

And according to the World Nuclear Association, global demand is set to rise another 28% by 2030, driven by more than 70 reactors under construction worldwide and over 300 more planned or proposed.

Even tech giants are stepping up:

|

| • Microsoft has inked a deal to buy nuclear power from the re-opened Three Mile Island reactor.

• Google and Amazon are investing directly in small modular reactor developers.

• Meta is sourcing nuclear power for its AI data centers.

|

| It’s no longer a question of if nuclear power is back — it’s how fast uranium producers can meet demand.

...And that’s exactly where Homeland Uranium could shine.

|

| America Desperately Needs A Domestic Supply

|

| Right now, more than 90% of U.S. uranium comes from abroad. With geopolitical tensions rising and import bans already in place against Russia, securing a homegrown source of uranium has become a matter of national security.

That’s why the federal government is actively supporting U.S.-based uranium producers — fast-tracking permits, offering financing under the Defense Production Act and purchasing directly for the national reserve.

Homeland Uranium’s assets — both in mining-friendly Colorado — could become pivotal as the U.S. rebuilds its nuclear fuel chain from the ground up.

|

| Experienced Leadership, Grounded Execution

|

| In an industry where management is everything, Homeland stands out for its experience and discipline.

Beyond CEO Roger Lemaitre’s deep industry credentials, the team includes geologists and engineers who have worked on some of North America’s most successful uranium projects.

|

| Their mandate is simple: confirm, expand, and upgrade the historical resources — and do it quickly.

|

| Fieldwork is already under way to verify the existing drill data and plan new exploration across untested areas of the Coyote Basin and Cross Bones properties.

If early confirmation meets expectations, Homeland could emerge as one of the most significant new uranium stories in the United States — and one of the few with large-scale, near-surface tonnage ready for modern development.

|

| The Bottom Line

|

| Homeland Uranium (OTCQB: HLUCF; TSXV: HLU) offers a rare combination:

|

| • Large-scale, U.S.-based uranium resources in a friendly jurisdiction

• A well funded, experienced management team with global discovery success

• Proven infrastructure and access to nearby processing mills

• Exposure to a surging uranium price and a long-term national supply mandate

|

| Homeland Uranium is a fresh, new story — and one that relatively few investors know of yet. But as the company validates and expands its historic resource base, that could change quickly.

|

| Uranium’s bull market is only beginning — and Homeland could be positioned right at its epicenter.

|

| As America races to secure domestic uranium supply, this small company’s timing couldn’t be better.

And that’s why some analysts believe that Homeland Uranium one of the most compelling early-stage opportunities in the market today.

|

| CLICK HERE

To Learn More About Homeland Uranium

|